Decoding The Market: A Complete Information To Technical Evaluation Chart Patterns (PDF Downloadable)

By admin / June 29, 2024 / No Comments / 2025

Decoding the Market: A Complete Information to Technical Evaluation Chart Patterns (PDF Downloadable)

Associated Articles: Decoding the Market: A Complete Information to Technical Evaluation Chart Patterns (PDF Downloadable)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Market: A Complete Information to Technical Evaluation Chart Patterns (PDF Downloadable). Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Market: A Complete Information to Technical Evaluation Chart Patterns (PDF Downloadable)

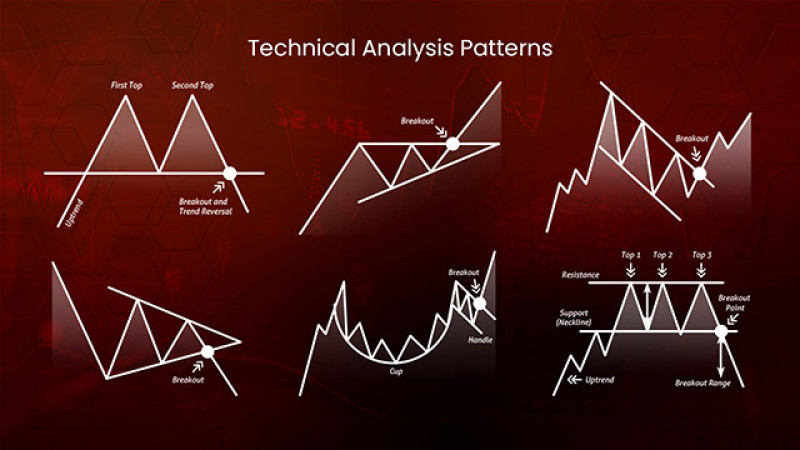

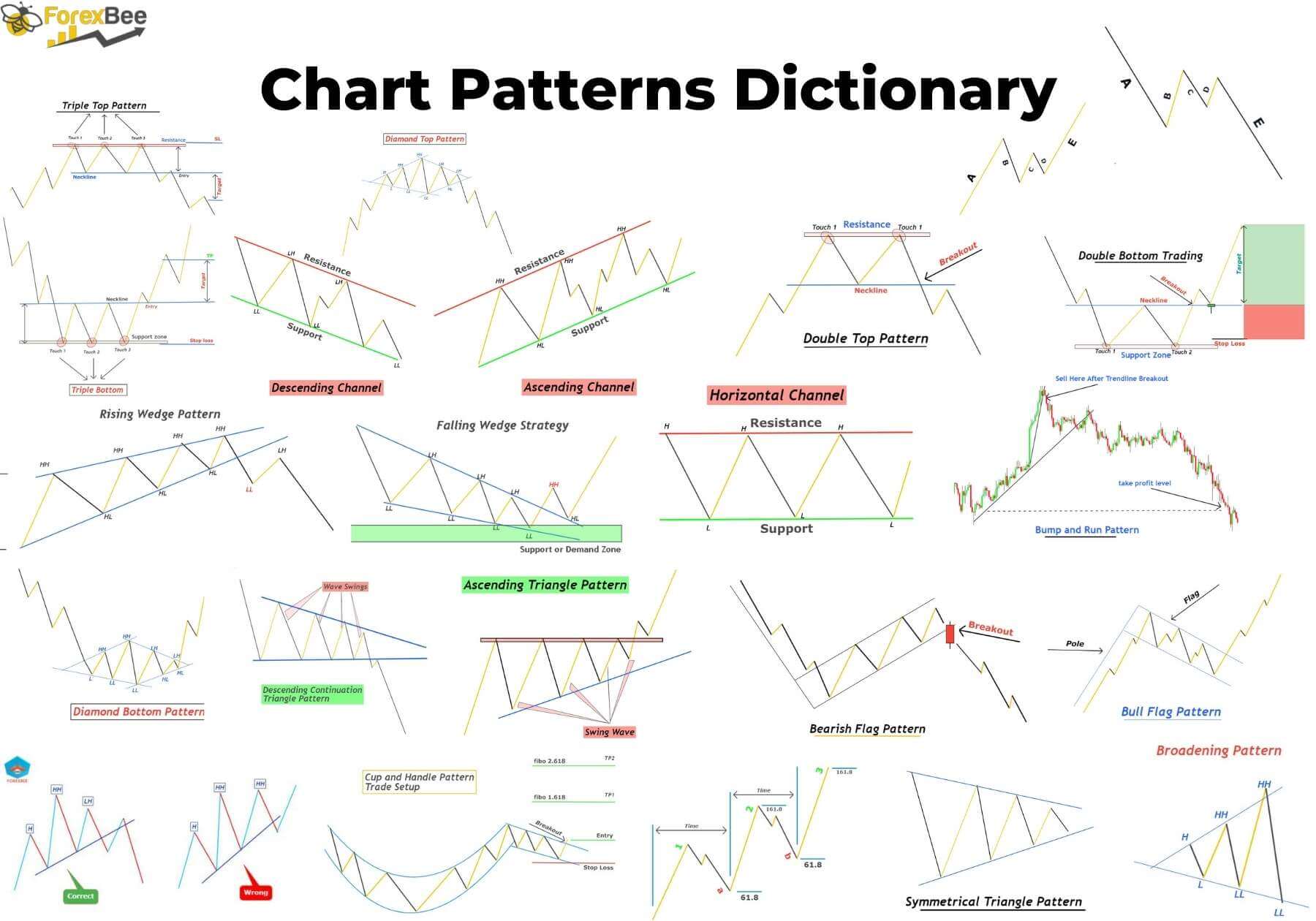

Technical evaluation, a cornerstone of buying and selling and investing, depends closely on deciphering value charts to foretell future market actions. An important facet of this includes recognizing and understanding chart patterns. These patterns, shaped by value motion and quantity, provide invaluable insights into potential development reversals, continuations, and buying and selling alternatives. This text offers a complete overview of widespread chart patterns, their identification, and their implications, culminating in a downloadable PDF useful resource to your reference.

What are Chart Patterns?

Chart patterns are visually identifiable formations on value charts that signify the collective conduct of market members. They are not foolproof predictors, however they supply possibilities and context for buying and selling choices. These patterns emerge from the interaction of provide and demand, reflecting shifts in investor sentiment and market momentum. Understanding these patterns permits merchants to anticipate potential value actions and handle danger extra successfully.

Categorizing Chart Patterns:

Chart patterns are broadly categorized into two fundamental teams:

- Continuation Patterns: These patterns recommend a brief pause in an present development earlier than the worth resumes its authentic path. They’re characterised by a interval of consolidation or sideways motion earlier than the breakout.

- Reversal Patterns: These patterns point out a possible change within the prevailing development. They sign a shift from an uptrend to a downtrend (or vice versa) and infrequently contain a major value correction.

Key Continuation Patterns:

-

Triangles: Triangles are characterised by converging trendlines, representing a interval of indecision between patrons and sellers. There are three fundamental sorts:

- Symmetrical Triangles: The higher and decrease trendlines converge equally, suggesting a interval of consolidation earlier than a breakout in both path. The breakout normally happens within the path of the previous development.

- Ascending Triangles: The higher trendline is horizontal, whereas the decrease trendline slopes upward. This sample is bullish, indicating patrons are steadily accumulating. A breakout above the higher trendline is anticipated.

- Descending Triangles: The higher trendline slopes downward, whereas the decrease trendline is horizontal. This sample is bearish, suggesting sellers are steadily gaining management. A breakout beneath the decrease trendline is anticipated.

-

Rectangles: Rectangles are characterised by two parallel horizontal trendlines, indicating a interval of sideways buying and selling. The value fluctuates inside an outlined vary earlier than breaking out in both path. Breakouts above the higher trendline are thought of bullish, whereas breakouts beneath the decrease trendline are bearish.

-

Flags and Pennants: These patterns are characterised by a brief interval of consolidation inside a channel, following a robust value transfer.

- Flags: The consolidation part kinds an oblong or barely slanted channel.

- Pennants: The consolidation part kinds a triangular form. Each patterns recommend a continuation of the previous development after the breakout.

-

Wedges: Wedges are characterised by converging trendlines, much like triangles, however with a extra pronounced slope. Ascending wedges are typically bearish, whereas descending wedges are typically bullish. The breakout typically happens in the other way of the wedge’s slope.

Key Reversal Patterns:

-

Head and Shoulders: It is a basic reversal sample consisting of three peaks (the left shoulder, the top, and the precise shoulder). The top is the best peak, and the shoulders are roughly equal in top. A neckline connects the troughs between the peaks. A break beneath the neckline confirms the bearish reversal.

-

Inverse Head and Shoulders: That is the mirror picture of the top and shoulders sample, indicating a bullish reversal. It consists of three troughs (the left shoulder, the top, and the precise shoulder), with the top being the bottom trough. A break above the neckline confirms the bullish reversal.

-

Double Tops and Double Bottoms: These patterns contain two successive peaks (double high) or troughs (double backside) at roughly the identical value stage. A break beneath the neckline of a double high confirms a bearish reversal, whereas a break above the neckline of a double backside confirms a bullish reversal.

-

Triple Tops and Triple Bottoms: Just like double tops and bottoms, however with three successive peaks or troughs. These patterns typically point out stronger reversal alerts.

-

Rounding Tops and Bottoms: These patterns are characterised by a gradual curving value motion, forming a rounded form. Rounding tops are bearish reversal patterns, whereas rounding bottoms are bullish reversal patterns. These patterns take longer to type than different reversal patterns.

Quantity Evaluation in Chart Patterns:

Quantity evaluation performs a vital position in confirming chart sample alerts. Elevated quantity throughout breakouts strengthens the sign, indicating robust conviction by market members. Conversely, low quantity breakouts could also be weak and unreliable. Analyzing quantity alongside value motion enhances the accuracy of sample interpretation.

Utilizing Chart Patterns Successfully:

- Affirmation: Do not rely solely on chart patterns. Affirm alerts utilizing different technical indicators, corresponding to transferring averages, RSI, or MACD.

- Danger Administration: All the time use stop-loss orders to restrict potential losses. Place stop-loss orders beneath the neckline for bearish patterns and above the neckline for bullish patterns.

- Goal Costs: Estimate potential value targets primarily based on the sample’s measurement and historic value actions.

- Context is Key: Contemplate the broader market context and the particular asset’s traits when deciphering chart patterns.

- Apply: Mastering chart sample recognition requires apply and expertise. Begin by analyzing historic charts and steadily transfer to dwell buying and selling.

Limitations of Chart Patterns:

- Subjectivity: Figuring out chart patterns will be subjective, resulting in differing interpretations.

- False Indicators: Chart patterns can typically produce false alerts, resulting in inaccurate predictions.

- Time Sensitivity: Chart patterns could take time to type and full, probably lacking short-term buying and selling alternatives.

- Market Manipulation: In some instances, chart patterns could also be intentionally created by market manipulators.

Conclusion:

Chart patterns are a invaluable device for technical analysts, offering insights into potential market actions. By understanding the varied forms of chart patterns, their implications, and the significance of quantity affirmation, merchants can enhance their decision-making course of and handle danger extra successfully. Nonetheless, it is essential to keep in mind that chart patterns are usually not foolproof predictors, and affirmation from different technical indicators is important. Constant apply and an intensive understanding of market dynamics are key to efficiently using chart patterns in buying and selling and investing.

(Downloadable PDF Hyperlink Right here) [This would be replaced with a link to a PDF file containing summarized information and visual representations of the chart patterns discussed in the article. The PDF would include diagrams of each pattern, key characteristics, and examples.]

This downloadable PDF will function a fast reference information, summarizing the important thing traits of every sample mentioned above, together with visible examples to help in identification. It is a invaluable useful resource for each rookies and skilled merchants trying to improve their technical evaluation abilities. Keep in mind to at all times apply accountable buying and selling and handle your danger successfully.

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Market: A Complete Information to Technical Evaluation Chart Patterns (PDF Downloadable). We respect your consideration to our article. See you in our subsequent article!