Decoding The Nasdaq 100 Futures Stay Chart: A Complete Information

By admin / November 9, 2024 / No Comments / 2025

Decoding the Nasdaq 100 Futures Stay Chart: A Complete Information

Associated Articles: Decoding the Nasdaq 100 Futures Stay Chart: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Nasdaq 100 Futures Stay Chart: A Complete Information. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Nasdaq 100 Futures Stay Chart: A Complete Information

The Nasdaq 100, a technology-heavy index encompassing 100 of the most important non-financial firms listed on the Nasdaq Inventory Market, is a bellwether for the worldwide tech sector and a major driver of total market sentiment. Understanding its value actions is essential for traders and merchants alike. Accessing this info in real-time by way of a Nasdaq 100 futures stay chart presents unparalleled perception, enabling knowledgeable decision-making. This text delves into the intricacies of decoding these charts, highlighting key indicators and methods for efficient evaluation.

Understanding Nasdaq 100 Futures Contracts:

Earlier than diving into chart interpretation, it is important to understand the character of Nasdaq 100 futures contracts. These contracts symbolize an settlement to purchase or promote the index at a predetermined value on a future date. They provide a number of benefits over instantly investing within the underlying index:

- Leverage: Futures contracts permit merchants to manage a bigger place with a smaller preliminary funding, magnifying each potential earnings and losses.

- Hedging: Buyers can use futures contracts to hedge in opposition to potential losses of their present Nasdaq 100 inventory holdings.

- Quick Promoting: Futures contracts facilitate brief promoting, enabling merchants to revenue from anticipated value declines.

- 24/5 Buying and selling: In contrast to the underlying shares, which commerce solely throughout common market hours, Nasdaq 100 futures are traded across the clock, 5 days every week, providing higher flexibility.

Navigating the Nasdaq 100 Futures Stay Chart:

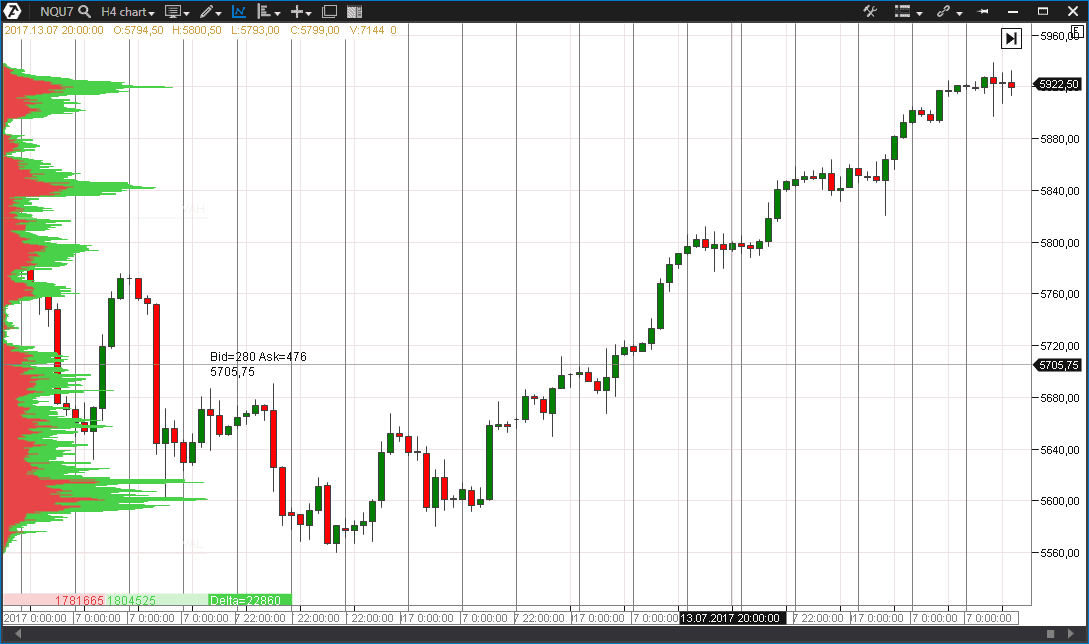

A typical Nasdaq 100 futures stay chart shows the worth of the contract over time, normally offered as a candlestick or line chart. A number of key parts are essential for interpretation:

- Worth Axis (Y-axis): This axis represents the worth of the futures contract, usually displayed in factors (e.g., 1 level = $100).

- Time Axis (X-axis): This axis represents the time interval coated by the chart, starting from intraday to long-term views. Frequent timeframes embody 1-minute, 5-minute, 15-minute, hourly, day by day, weekly, and month-to-month charts.

- Candlesticks/Traces: Candlesticks visually symbolize value actions over a particular time interval. The physique of the candlestick reveals the opening and shutting costs, whereas the wicks (shadows) point out the excessive and low costs. Line charts merely join the closing costs of every interval.

- Quantity: Quantity indicators present the variety of contracts traded throughout every interval. Excessive quantity typically accompanies important value actions, suggesting robust conviction behind the worth motion.

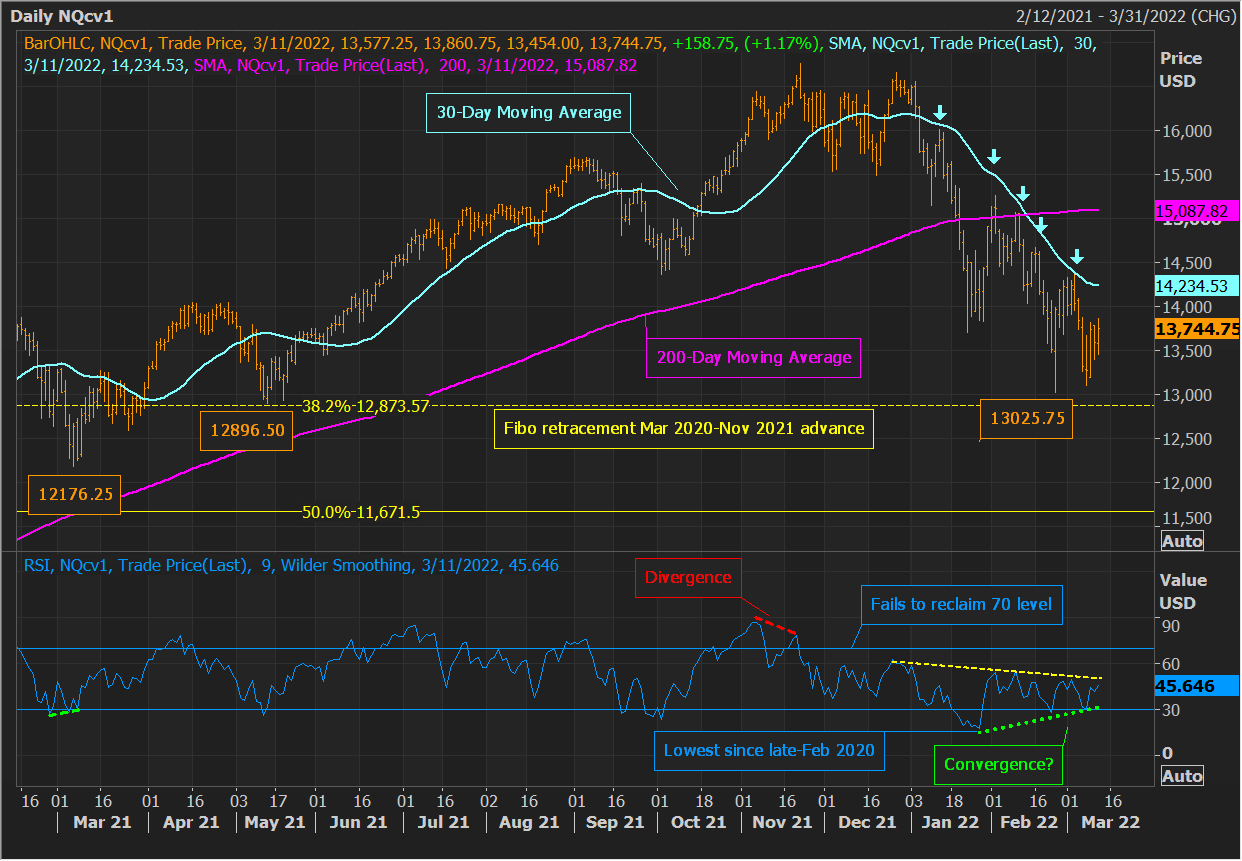

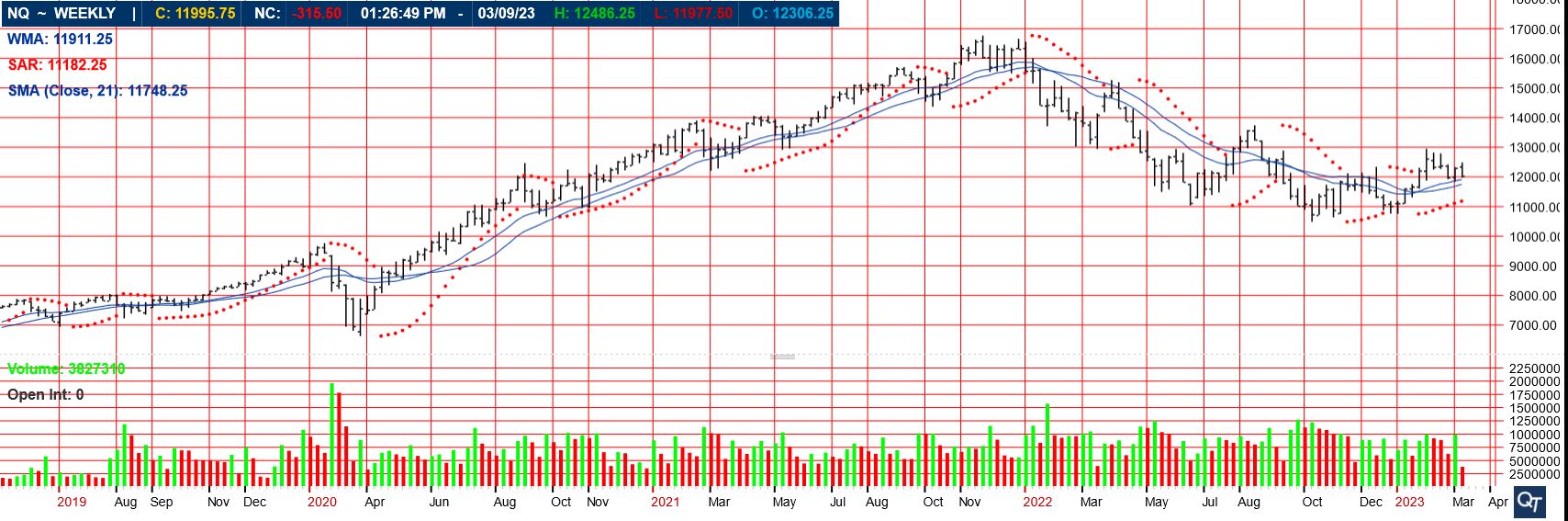

- Shifting Averages: Shifting averages easy out value fluctuations, revealing underlying traits. Generally used shifting averages embody easy shifting averages (SMA) and exponential shifting averages (EMA). The 50-day and 200-day shifting averages are significantly important for figuring out long-term traits.

- Technical Indicators: A plethora of technical indicators will be overlaid on the chart to supply further insights. These embody relative energy index (RSI), shifting common convergence divergence (MACD), Bollinger Bands, stochastic oscillators, and lots of extra. Every indicator presents a novel perspective on market momentum, overbought/oversold circumstances, and potential pattern reversals.

Decoding Worth Motion and Developments:

Analyzing the Nasdaq 100 futures stay chart includes figuring out value patterns and traits. Key elements to contemplate embody:

- Development Identification: Is the worth trending upwards (bullish), downwards (bearish), or sideways (consolidating)? Shifting averages may help determine the dominant pattern.

- Help and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt by way of. Help ranges symbolize potential shopping for alternatives, whereas resistance ranges point out potential promoting alternatives.

- Breakouts: A breakout happens when the worth decisively breaks by way of a help or resistance stage, typically signaling a continuation of the prevailing pattern or a possible pattern reversal.

- Chart Patterns: Numerous chart patterns, reminiscent of head and shoulders, double tops/bottoms, triangles, and flags, can present insights into potential future value actions. Recognizing these patterns requires apply and expertise.

- Quantity Affirmation: Excessive quantity accompanying breakouts or important value actions strengthens the sign, indicating robust conviction behind the worth motion. Conversely, low quantity breakouts could also be much less dependable.

Utilizing Technical Indicators:

Technical indicators can improve chart evaluation by offering further alerts and confirming potential buying and selling alternatives. Nevertheless, it is essential to do not forget that no indicator is ideal, and they need to be used along side value motion evaluation:

- RSI (Relative Power Index): Measures the magnitude of latest value adjustments to judge overbought (above 70) and oversold (under 30) circumstances. Divergences between the RSI and value motion will also be important.

- MACD (Shifting Common Convergence Divergence): Identifies adjustments in momentum by evaluating two shifting averages. Crossovers of the MACD strains can sign potential pattern adjustments.

- Bollinger Bands: Plot customary deviations round a shifting common, highlighting value volatility. Worth touches or breakouts from the bands can recommend potential reversals or continuations.

- Stochastic Oscillator: Measures the momentum of value adjustments, additionally indicating overbought and oversold circumstances.

Threat Administration and Buying and selling Methods:

Buying and selling Nasdaq 100 futures includes important danger. Implementing efficient danger administration methods is essential:

- Place Sizing: Decide the suitable place dimension based mostly in your danger tolerance and account stability. By no means danger greater than a small share of your capital on any single commerce.

- Cease-Loss Orders: Place stop-loss orders to restrict potential losses if the market strikes in opposition to you. These orders robotically promote your place when the worth reaches a predetermined stage.

- Take-Revenue Orders: Use take-profit orders to lock in earnings when your goal value is reached.

- Diversification: Do not put all of your eggs in a single basket. Diversify your buying and selling throughout completely different property and methods to scale back danger.

Conclusion:

The Nasdaq 100 futures stay chart gives a dynamic window into the world of know-how investing. By understanding the chart’s parts, decoding value motion, using technical indicators, and implementing sound danger administration methods, merchants can navigate this complicated market with higher confidence. Nevertheless, it is essential to do not forget that buying and selling includes inherent danger, and no technique ensures success. Steady studying, apply, and adaptation are important for long-term success in buying and selling Nasdaq 100 futures. All the time conduct thorough analysis and take into account looking for skilled recommendation earlier than making any funding choices.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Nasdaq 100 Futures Stay Chart: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!