Decoding The Nifty 50 Chart Stay: A Free And Complete Information

By admin / October 21, 2024 / No Comments / 2025

Decoding the Nifty 50 Chart Stay: A Free and Complete Information

Associated Articles: Decoding the Nifty 50 Chart Stay: A Free and Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Nifty 50 Chart Stay: A Free and Complete Information. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Nifty 50 Chart Stay: A Free and Complete Information

The Nifty 50 index, a benchmark for Indian equities, is a vital indicator for traders and merchants alike. Understanding its stay chart is paramount for making knowledgeable selections. This text supplies a complete information to accessing free Nifty 50 chart knowledge, deciphering its parts, and leveraging its insights for profitable buying and selling and funding methods.

Accessing Free Nifty 50 Chart Information:

The web provides a wealth of assets for accessing free, real-time Nifty 50 charts. A number of web sites and platforms present this service, every with its personal strengths and weaknesses. Selecting the best platform will depend on your particular wants and technical experience.

1. Monetary Information Web sites: Respected monetary information web sites corresponding to Google Finance, Yahoo Finance, and Moneycontrol provide free, interactive Nifty 50 charts. These platforms typically present fundamental charting instruments, together with candlestick charts, line charts, and numerous technical indicators. Whereas they could not provide the superior options of devoted charting platforms, their simplicity and accessibility make them splendid for inexperienced persons. Nevertheless, remember that the info may be barely delayed in comparison with skilled platforms.

2. Brokerage Platforms: Many on-line brokerage corporations present free entry to real-time Nifty 50 charts to their shoppers, even with out an lively buying and selling account. It is a important benefit, as these platforms usually combine charting instruments with order placement functionalities, streamlining the buying and selling course of. Nevertheless, the provision of those options varies vastly relying on the brokerage.

3. Devoted Charting Web sites: A number of web sites specialise in offering free charting instruments and monetary knowledge. These platforms usually provide a wider vary of indicators, drawing instruments, and customization choices in comparison with basic monetary information websites. Whereas some could provide restricted free options, upgrading to a paid subscription usually unlocks superior functionalities. Analysis fastidiously to discover a platform that balances your wants with its free choices.

4. Cellular Apps: Quite a few cell purposes present free entry to real-time Nifty 50 charts. These apps are handy for on-the-go monitoring and evaluation. Nevertheless, the options and knowledge accuracy could range relying on the app. At all times verify person opinions and scores earlier than downloading any app.

Understanding the Elements of the Nifty 50 Chart:

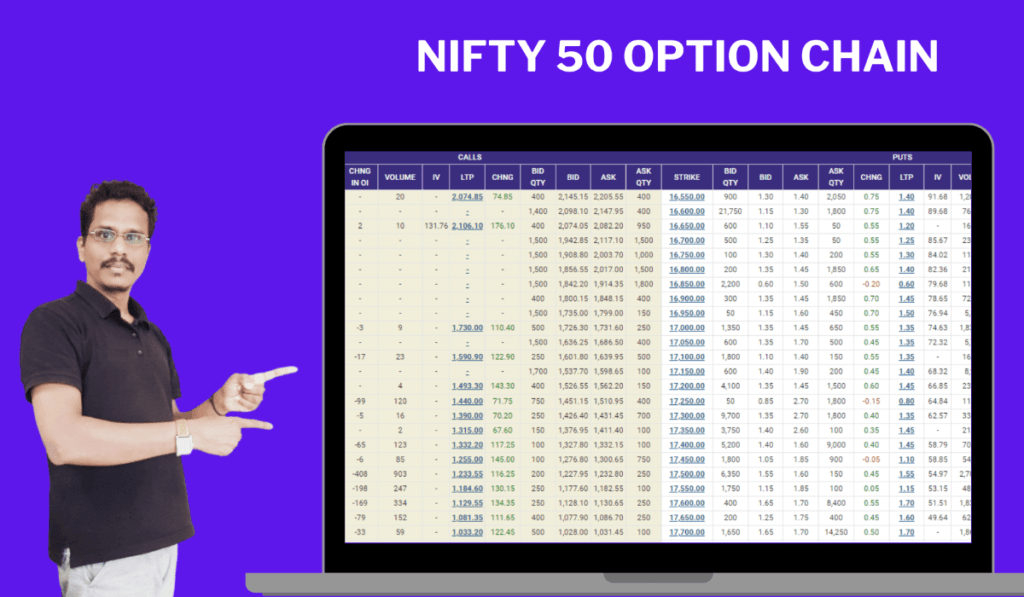

A typical Nifty 50 chart shows a number of key parts:

-

Value Axis (Y-axis): This axis represents the value of the Nifty 50 index at totally different deadlines. The dimensions will be adjusted to give attention to particular worth ranges.

-

Time Axis (X-axis): This axis represents the time interval coated by the chart. The time scale will be adjusted from intraday (minutes, hours) to each day, weekly, month-to-month, and even yearly intervals.

-

Candlestick Chart/Line Chart: The most typical chart varieties are candlestick charts and line charts. Candlestick charts visually characterize the opening, closing, excessive, and low costs for a particular time interval. Line charts merely join the closing costs over time.

-

Quantity: Many charts show buying and selling quantity alongside the value. Quantity signifies the variety of shares traded throughout a particular interval. Excessive quantity usually signifies robust worth actions, whereas low quantity would possibly recommend weaker developments.

-

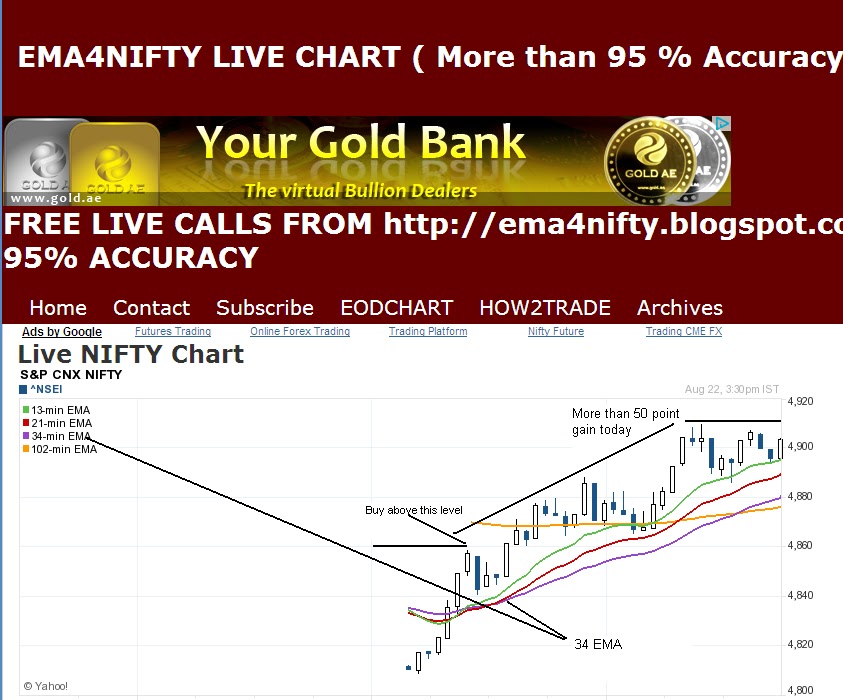

Technical Indicators: These are mathematical calculations utilized to cost and quantity knowledge to establish developments, assist ranges, resistance ranges, and potential reversal factors. Frequent indicators embody Transferring Averages (MA), Relative Energy Index (RSI), MACD, Bollinger Bands, and Stochastic Oscillator. Understanding these indicators is essential for technical evaluation.

-

Help and Resistance Ranges: These are worth ranges the place the value has traditionally struggled to interrupt by way of. Help ranges characterize worth flooring, whereas resistance ranges characterize worth ceilings. Figuring out these ranges may help predict potential worth actions.

-

Trendlines: These are traces drawn to attach important worth highs or lows, illustrating the general route of the value motion. Uptrend traces join rising lows, whereas downtrend traces join falling highs.

Leveraging the Nifty 50 Chart for Buying and selling and Funding Methods:

The Nifty 50 chart can be utilized to implement numerous buying and selling and funding methods:

1. Technical Evaluation: This strategy makes use of chart patterns, indicators, and worth motion to foretell future worth actions. Merchants use technical evaluation to establish entry and exit factors for trades, aiming to capitalize on short-term worth fluctuations.

2. Elementary Evaluation: Whereas the chart itself would not immediately present elementary knowledge, it may be used together with elementary evaluation. Elementary evaluation examines an organization’s monetary well being, administration, and trade place to evaluate its long-term worth. By evaluating the chart efficiency with elementary indicators, traders can establish undervalued or overvalued shares throughout the Nifty 50.

3. Swing Buying and selling: This technique goals to revenue from worth swings over a number of days or even weeks. Merchants use the chart to establish potential entry and exit factors primarily based on assist and resistance ranges, trendlines, and technical indicators.

4. Day Buying and selling: This entails shopping for and promoting property throughout the similar buying and selling day. Day merchants closely depend on real-time chart knowledge and technical evaluation to establish short-term worth actions. This technique requires important experience and danger administration abilities.

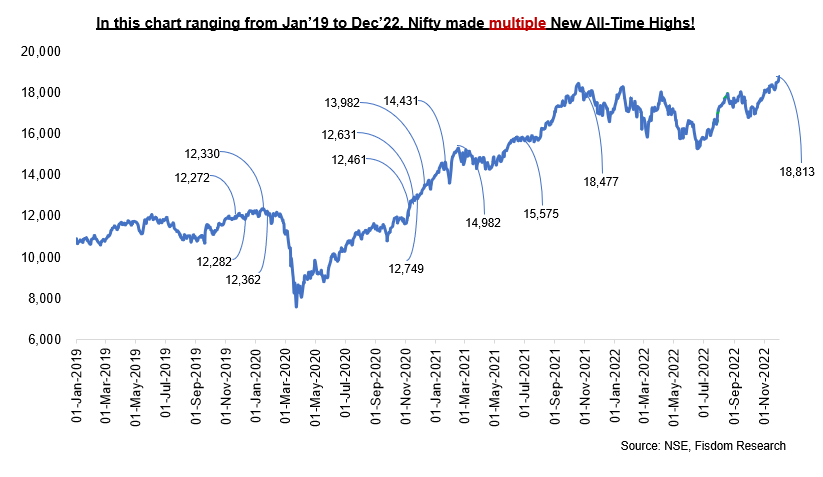

5. Lengthy-Time period Investing: Traders use the chart to observe the long-term efficiency of the Nifty 50 and establish potential shopping for alternatives throughout market corrections or dips. Lengthy-term traders are much less involved with short-term fluctuations and give attention to the general development potential of the index.

Threat Administration:

Whatever the chosen technique, danger administration is essential when utilizing the Nifty 50 chart for buying and selling or investing. By no means make investments greater than you may afford to lose. Diversification can be important to mitigate danger. Think about using stop-loss orders to restrict potential losses and take income at predetermined ranges.

Conclusion:

The Nifty 50 chart, readily accessible by way of numerous free assets, supplies invaluable insights into the Indian fairness market. By understanding its parts, leveraging its knowledge successfully, and using sound danger administration methods, traders and merchants can improve their decision-making course of and probably obtain their monetary objectives. Nevertheless, keep in mind that charting alone is just not a assure of success. Steady studying, thorough analysis, and a disciplined strategy are important for navigating the complexities of the market. At all times seek the advice of with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Nifty 50 Chart Stay: A Free and Complete Information. We recognize your consideration to our article. See you in our subsequent article!