Decoding The Nifty 50 PE Ratio Chart: A Complete Information For Traders

By admin / August 5, 2024 / No Comments / 2025

Decoding the Nifty 50 PE Ratio Chart: A Complete Information for Traders

Associated Articles: Decoding the Nifty 50 PE Ratio Chart: A Complete Information for Traders

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Nifty 50 PE Ratio Chart: A Complete Information for Traders. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Nifty 50 PE Ratio Chart: A Complete Information for Traders

The Nifty 50 index, representing India’s 50 largest and most liquid corporations, is a benchmark for the Indian inventory market. Understanding its Value-to-Earnings (PE) ratio is essential for traders looking for to gauge market valuations and make knowledgeable selections. This text delves deep into the Nifty 50 PE ratio chart, exploring its historic developments, interpretations, limitations, and implications for funding methods.

Understanding the Nifty 50 PE Ratio

The PE ratio is a valuation metric that compares an organization’s (or on this case, an index’s) inventory value to its earnings per share (EPS). The next PE ratio suggests traders are keen to pay extra for every rupee of earnings, doubtlessly indicating larger development expectations or a extra optimistic market sentiment. Conversely, a decrease PE ratio would possibly sign undervaluation or considerations about future earnings. For the Nifty 50, the PE ratio is calculated by dividing the index’s whole market capitalization by the mixture earnings of its constituent corporations.

Decoding the Nifty 50 PE Ratio Chart: Historic Developments and Cycles

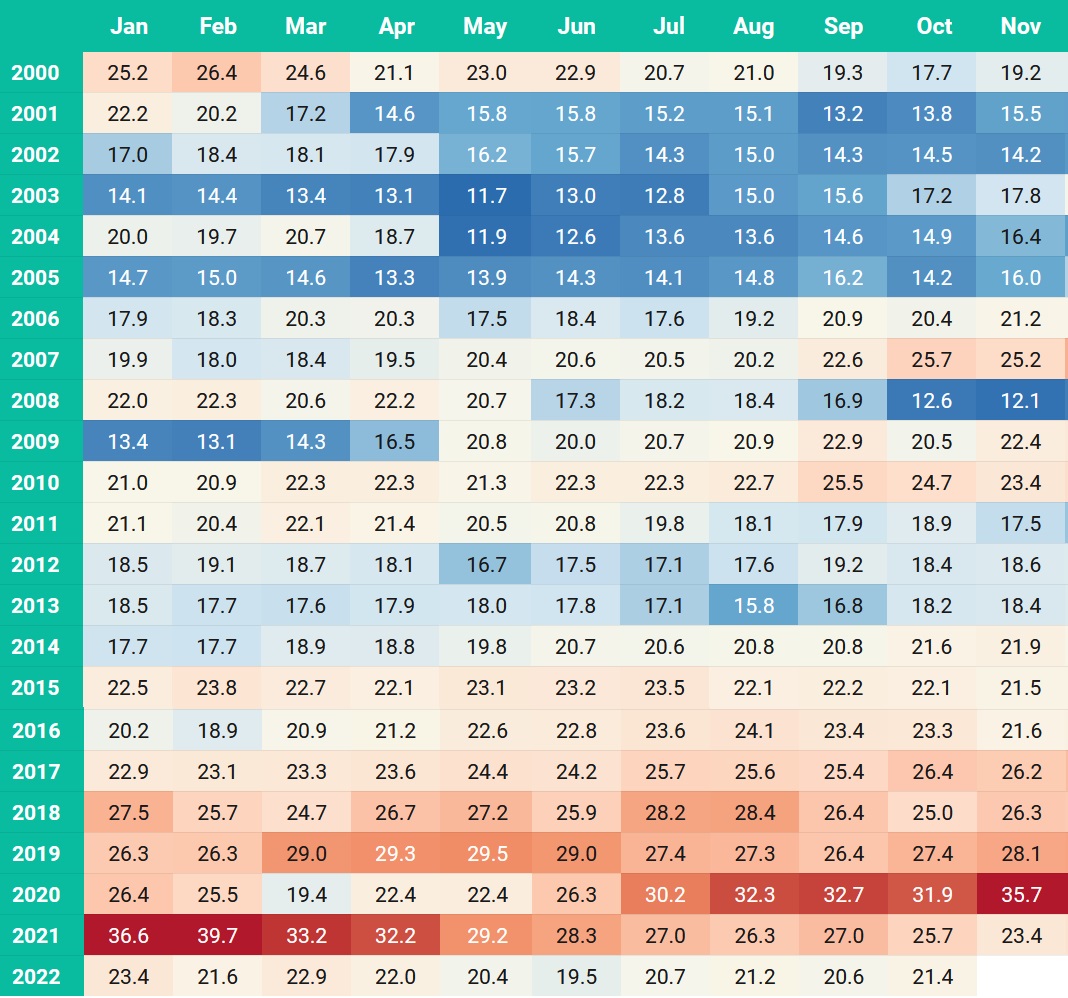

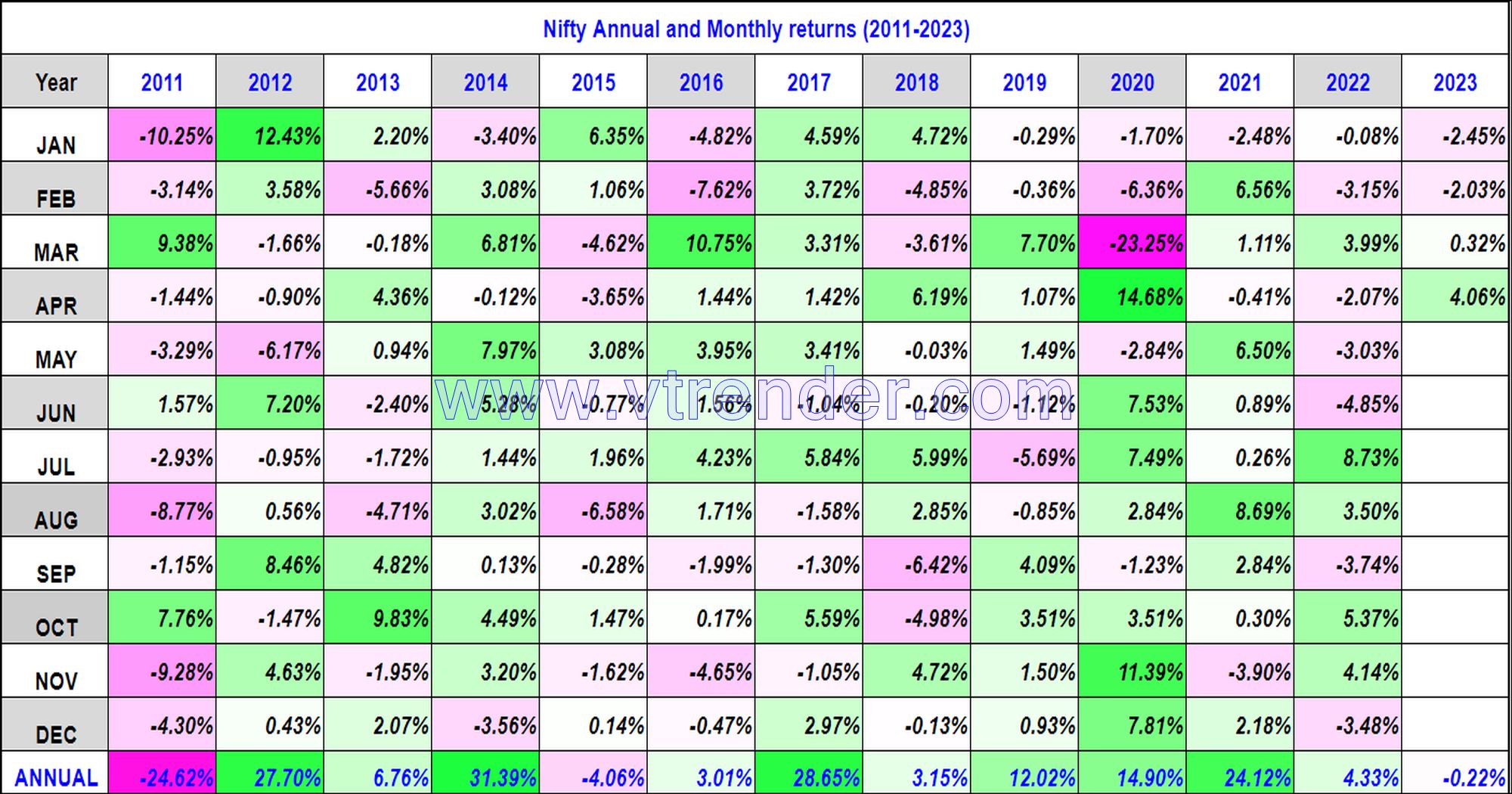

Analyzing the historic Nifty 50 PE ratio chart reveals cyclical patterns reflecting the ebb and movement of market sentiment and financial circumstances. The chart usually reveals intervals of excessive valuations (excessive PE ratios) adopted by intervals of low valuations (low PE ratios).

-

Bull Markets and Excessive PE Ratios: Throughout bull markets characterised by robust financial development, excessive investor confidence, and rising company earnings, the Nifty 50 PE ratio tends to climb. Traders are keen to pay a premium for future earnings development, driving up inventory costs and pushing the PE ratio larger. These intervals typically see PE ratios exceeding their historic averages, generally considerably. The 2007-08 bull market and the current rally witnessed exceptionally excessive PE multiples.

-

Bear Markets and Low PE Ratios: Conversely, bear markets, typically triggered by financial downturns, geopolitical uncertainties, or investor pessimism, normally witness a decline within the Nifty 50 PE ratio. Falling inventory costs and doubtlessly declining earnings result in decrease valuations. These intervals supply alternatives for long-term traders to purchase at comparatively decrease costs, but additionally carry larger danger. The 2008 international monetary disaster and the COVID-19 market crash are prime examples of intervals with considerably depressed PE ratios.

-

The Position of Curiosity Charges: Rates of interest play a big function in shaping the Nifty 50 PE ratio. Decrease rates of interest typically stimulate financial exercise and encourage funding in equities, doubtlessly pushing up the PE ratio. Increased rates of interest, however, could make bonds extra enticing, diverting funding away from equities and doubtlessly decreasing the PE ratio.

-

Affect of World Occasions: World occasions, corresponding to wars, pandemics, or main financial shifts in different international locations, can considerably affect the Nifty 50 PE ratio. These occasions typically create uncertainty available in the market, resulting in fluctuations in investor sentiment and consequently impacting valuations.

Utilizing the Nifty 50 PE Ratio for Funding Choices:

Whereas the Nifty 50 PE ratio is a priceless device, it is essential to keep away from utilizing it in isolation. Contemplate these factors:

-

PE Ratio as a Relative Indicator: The Nifty 50 PE ratio is most helpful when in comparison with its historic common and to the PE ratios of different markets. A excessive PE ratio in comparison with its historic common would possibly counsel overvaluation, whereas a low PE ratio would possibly counsel undervaluation. Nonetheless, this comparability needs to be contextualized with the prevailing financial and market circumstances.

-

Lengthy-Time period Perspective: The Nifty 50 PE ratio needs to be analyzed over the long run relatively than specializing in short-term fluctuations. Brief-term actions will be influenced by market noise and hypothesis, making it tough to attract significant conclusions.

-

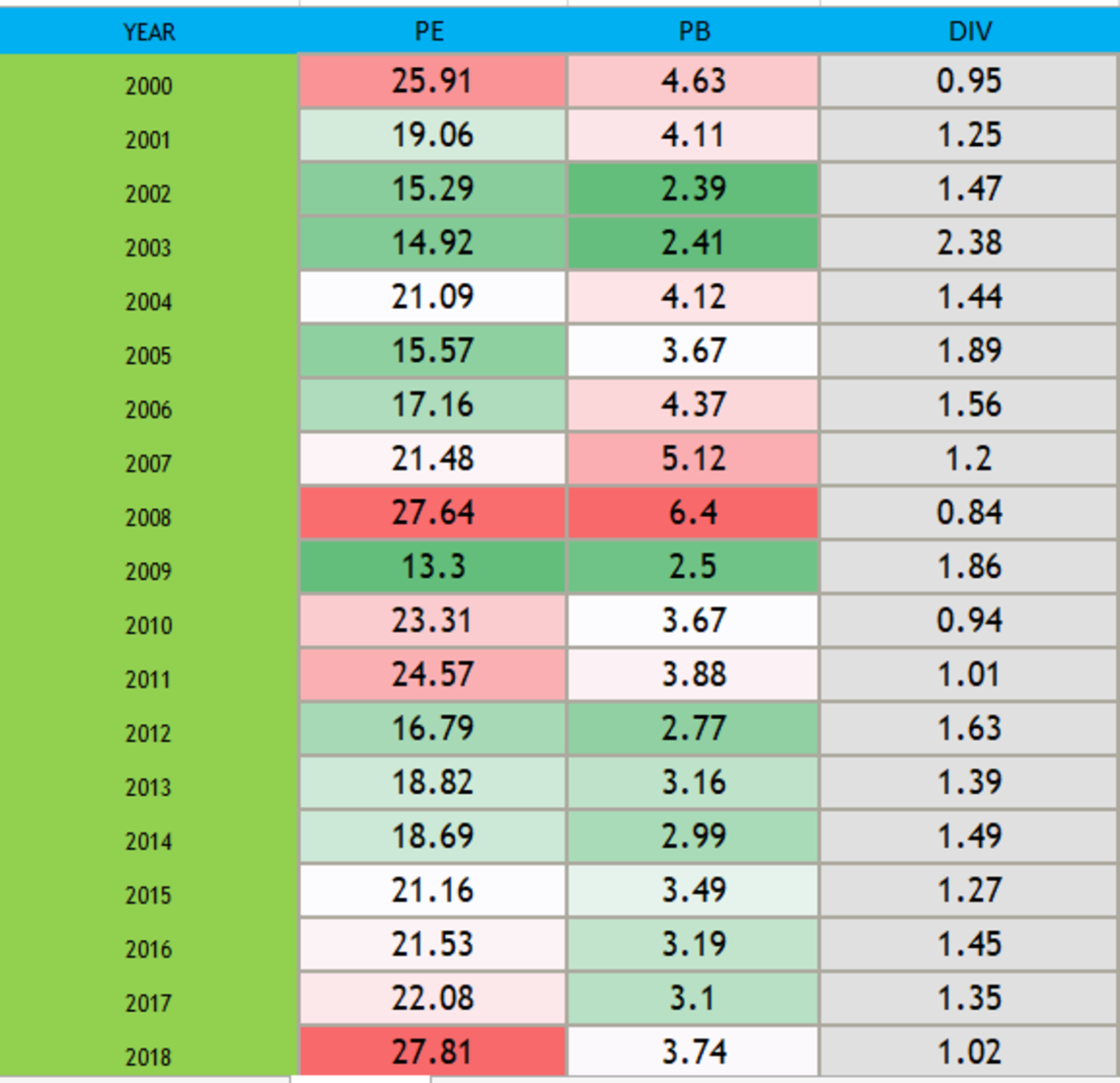

Contemplating Different Valuation Metrics: Relying solely on the PE ratio will be deceptive. It is essential to think about different valuation metrics, corresponding to Value-to-Guide (PB) ratio, Value-to-Gross sales (PS) ratio, and dividend yield, to get a extra complete image of market valuation.

-

Understanding Earnings High quality: The standard of earnings is equally essential. A excessive PE ratio primarily based on artificially inflated earnings is much less significant than a decrease PE ratio primarily based on constantly robust earnings.

-

Sectoral Evaluation: The Nifty 50 includes various sectors. Analyzing the PE ratios of particular person sectors throughout the index can present priceless insights into sector-specific valuations and funding alternatives.

Limitations of the Nifty 50 PE Ratio:

Regardless of its usefulness, the Nifty 50 PE ratio has limitations:

-

Accounting Practices: Completely different corporations could use completely different accounting practices, doubtlessly affecting the accuracy of EPS calculations and thus the PE ratio.

-

Future Earnings Uncertainty: The PE ratio depends on previous and current earnings to foretell future earnings, which is inherently unsure. Sudden financial shocks or company-specific occasions can considerably affect future earnings.

-

Market Sentiment: Market sentiment performs a considerable function in figuring out inventory costs and, consequently, the PE ratio. Irrational exuberance or panic promoting can result in PE ratios that deviate considerably from basic valuations.

-

Index Composition Modifications: Modifications within the composition of the Nifty 50 index can have an effect on its total PE ratio. The inclusion or exclusion of corporations can affect the mixture earnings and market capitalization, resulting in shifts within the PE ratio.

Conclusion:

The Nifty 50 PE ratio chart is a robust device for assessing market valuations and informing funding selections. Nonetheless, it needs to be used cautiously and at the side of different valuation metrics and an intensive understanding of the broader financial and market context. Traders ought to keep away from relying solely on the PE ratio for making funding selections and as an alternative combine it right into a broader funding technique that considers danger tolerance, funding horizon, and different related elements. A protracted-term perspective, mixed with a complete evaluation of assorted valuation metrics and market circumstances, is essential for making knowledgeable and profitable funding selections within the Indian inventory market. Usually monitoring the Nifty 50 PE ratio chart, together with different related information, may also help traders navigate the complexities of the market and doubtlessly capitalize on each bull and bear market alternatives.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the Nifty 50 PE Ratio Chart: A Complete Information for Traders. We thanks for taking the time to learn this text. See you in our subsequent article!