Decoding The One-Month Treasury Invoice Yield Chart: A Deep Dive Into Brief-Time period Curiosity Charges

By admin / August 16, 2024 / No Comments / 2025

Decoding the One-Month Treasury Invoice Yield Chart: A Deep Dive into Brief-Time period Curiosity Charges

Associated Articles: Decoding the One-Month Treasury Invoice Yield Chart: A Deep Dive into Brief-Time period Curiosity Charges

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the One-Month Treasury Invoice Yield Chart: A Deep Dive into Brief-Time period Curiosity Charges. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the One-Month Treasury Invoice Yield Chart: A Deep Dive into Brief-Time period Curiosity Charges

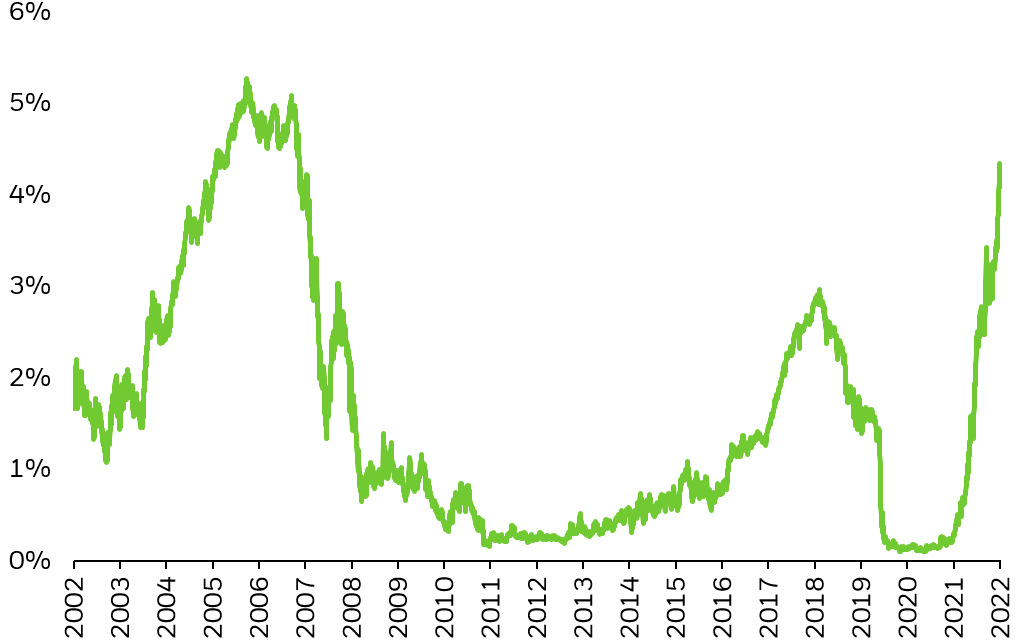

The one-month Treasury invoice (T-bill) yield chart, a seemingly easy graph depicting the return on the shortest-term U.S. authorities debt, provides a strong window into the complexities of the monetary markets. Understanding its nuances is essential for buyers, economists, and policymakers alike, offering insights into financial coverage, financial well being, and future rate of interest expectations. This text delves into the intricacies of the one-month T-bill yield chart, exploring its historic context, its relationship with different monetary indicators, and its implications for varied stakeholders.

Understanding the Fundamentals: What’s a One-Month T-Invoice?

Earlier than analyzing the yield chart, it is vital to understand the underlying instrument. A one-month T-bill is a short-term debt safety issued by the U.S. Treasury Division. It represents a promise by the federal government to repay the investor the principal quantity plus a small quantity of curiosity after a interval of 1 month. As a result of they’re backed by the complete religion and credit score of the U.S. authorities, T-bills are thought of just about risk-free investments, making them a benchmark for different short-term debt devices. The yield, expressed as a proportion, displays the return an investor receives for lending cash to the federal government for that month.

Deciphering the One-Month T-Invoice Yield Chart:

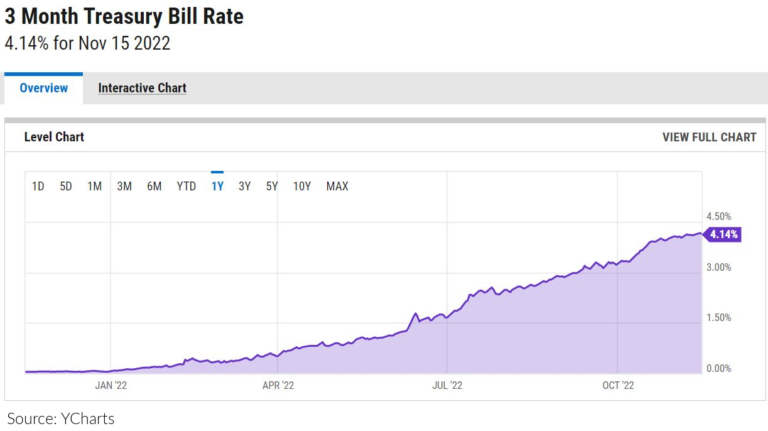

The chart usually shows the yield over time, normally plotted day by day or weekly. The x-axis represents the time interval, whereas the y-axis reveals the yield proportion. A rising yield signifies that buyers are demanding a better return for lending their cash, typically reflecting rising threat aversion or expectations of future charge hikes by the Federal Reserve. Conversely, a falling yield suggests decreased threat aversion or anticipation of decrease rates of interest.

Elements Influencing the One-Month T-Invoice Yield:

A number of components interaction to affect the yield on one-month T-bills, creating the fluctuations noticed within the chart. These embrace:

-

Federal Reserve Coverage: The Federal Reserve (the Fed) performs a pivotal position in setting short-term rates of interest. By means of its open market operations (shopping for and promoting authorities securities), the Fed influences the provision and demand for short-term debt, instantly impacting T-bill yields. When the Fed raises rates of interest (a tightening financial coverage), it usually results in increased T-bill yields, as buyers search increased returns on their investments. Conversely, reducing rates of interest (an easing financial coverage) normally ends in decrease T-bill yields.

-

Inflation Expectations: Inflation erodes the buying energy of cash. Traders demand increased yields to compensate for the anticipated loss in buying energy as a result of inflation. When inflation is predicted to rise, T-bill yields have a tendency to extend, reflecting buyers’ demand for a better return to offset the inflationary stress.

-

Financial Progress: Sturdy financial development can result in increased T-bill yields as companies and people borrow extra money, rising demand for credit score and driving up rates of interest. Conversely, a slowing economic system may end up in decrease yields as demand for credit score decreases.

-

International Financial Circumstances: International financial occasions, reminiscent of geopolitical instability or worldwide monetary crises, can considerably impression T-bill yields. During times of uncertainty, buyers typically flock to the security of U.S. Treasury securities, rising demand and doubtlessly pushing yields decrease, even when the Fed is just not actively intervening. Nonetheless, important international financial shocks may result in increased yields as buyers reassess threat.

-

Provide and Demand: The easy legal guidelines of provide and demand additionally play a big position. If the Treasury points a big quantity of T-bills, the elevated provide can put downward stress on yields. Conversely, sturdy demand for T-bills, maybe pushed by threat aversion, can push yields increased.

-

Market Sentiment: Investor sentiment and market psychology considerably affect T-bill yields. Durations of heightened uncertainty or pessimism can result in elevated demand for safe-haven belongings like T-bills, pushing yields down. Conversely, optimism and risk-taking conduct can result in increased yields as buyers search increased returns in riskier belongings.

The One-Month T-Invoice Yield Chart and Different Indicators:

The one-month T-bill yield chart would not exist in isolation. It is essential to investigate it at the side of different key financial and monetary indicators to achieve a complete understanding of market dynamics. These embrace:

-

The Federal Funds Fee: The goal charge set by the Federal Reserve for in a single day lending between banks. The Federal Funds Fee and the one-month T-bill yield are intently correlated, though the T-bill yield might exhibit some impartial actions as a result of provide and demand components.

-

Inflation Charges (CPI and PCE): Evaluating the T-bill yield to inflation charges (just like the Client Worth Index – CPI and Private Consumption Expenditures – PCE) helps decide the actual return on funding. A optimistic distinction signifies an actual return, whereas a unfavorable distinction suggests a lack of buying energy.

-

Yield Curve: Analyzing the yield curve, which plots the yields of Treasury securities with completely different maturities, supplies insights into future rate of interest expectations. An inverted yield curve (the place short-term yields are increased than long-term yields) is usually thought of a predictor of financial recession.

-

Inventory Market Indices: The connection between the one-month T-bill yield and inventory market indices just like the S&P 500 can reveal investor sentiment and threat urge for food. A rising T-bill yield, coupled with a falling inventory market, may recommend elevated threat aversion.

Implications for Completely different Stakeholders:

The one-month T-bill yield chart holds completely different implications for varied stakeholders:

-

Traders: The chart helps buyers make knowledgeable choices about their short-term funding methods. Low yields may immediate buyers to hunt increased returns in different asset courses, whereas excessive yields may make T-bills extra enticing.

-

Companies: Companies use the chart to evaluate borrowing prices and plan their capital expenditures. Greater yields enhance borrowing prices, doubtlessly slowing down funding and financial development.

-

Central Banks: Central banks intently monitor the chart to gauge the effectiveness of their financial insurance policies and to anticipate future financial developments.

-

Economists: Economists use the chart as a key enter of their financial fashions and forecasts, analyzing its actions in relation to different macroeconomic indicators.

Conclusion:

The one-month Treasury invoice yield chart, whereas seemingly easy, is a strong device for understanding the intricacies of short-term rates of interest and their affect on the broader economic system. By analyzing the chart at the side of different financial indicators and understanding the components that drive its fluctuations, buyers, companies, policymakers, and economists can achieve worthwhile insights into market dynamics and make knowledgeable choices. Commonly monitoring the chart and its relationship with different indicators is crucial for navigating the complexities of the monetary panorama. The chart supplies a vital snapshot of present market sentiment, future expectations, and the general well being of the economic system, making it an important useful resource for anybody concerned within the monetary world. Nonetheless, it is essential to do not forget that no single indicator supplies an entire image, and a holistic method, incorporating varied financial and monetary knowledge factors, is important for correct evaluation and knowledgeable decision-making.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the One-Month Treasury Invoice Yield Chart: A Deep Dive into Brief-Time period Curiosity Charges. We respect your consideration to our article. See you in our subsequent article!