Decoding The QQQ ETF Inventory Chart: A Complete Information For Traders

By admin / October 30, 2024 / No Comments / 2025

Decoding the QQQ ETF Inventory Chart: A Complete Information for Traders

Associated Articles: Decoding the QQQ ETF Inventory Chart: A Complete Information for Traders

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the QQQ ETF Inventory Chart: A Complete Information for Traders. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the QQQ ETF Inventory Chart: A Complete Information for Traders

The Invesco QQQ Belief (QQQ) is a broadly fashionable exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index contains 100 of the most important non-financial corporations listed on the Nasdaq Inventory Market, representing a big slice of the expertise sector and a broader illustration of the US progress financial system. Understanding the QQQ ETF inventory chart is essential for buyers trying to navigate this dynamic sector and doubtlessly revenue from its progress. This text delves into the intricacies of decoding the QQQ chart, contemplating numerous technical indicators, basic evaluation, and danger administration methods.

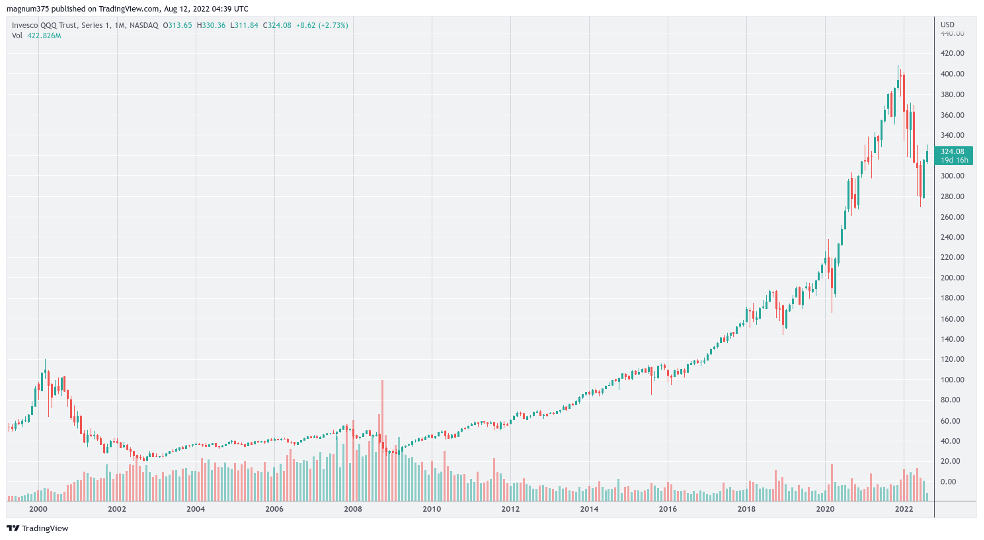

Understanding the Fundamentals of the QQQ Chart:

Earlier than diving into superior evaluation, it is important to know the basic elements of a QQQ inventory chart. Most charting platforms show:

- Value: The vertical axis usually represents the value of QQQ, reflecting its worth at completely different closing dates.

- Time: The horizontal axis shows the time interval, starting from intraday (minutes, hours) to years.

- Candlesticks/Bars: These visible representations depict the opening, closing, excessive, and low costs for a particular interval (e.g., every day, weekly). A inexperienced candlestick usually signifies a closing value larger than the opening value (upward motion), whereas a pink candlestick signifies the other (downward motion).

- Quantity: Typically displayed under the value chart, quantity signifies the variety of shares traded throughout a particular interval. Excessive quantity usually accompanies important value actions, suggesting robust conviction out there.

Technical Evaluation of the QQQ Chart:

Technical evaluation focuses on figuring out patterns and traits in value actions to foretell future value motion. A number of key indicators are generally used to interpret the QQQ chart:

-

Shifting Averages: These are traces that easy out value fluctuations, revealing underlying traits. Well-liked transferring averages embrace the 50-day and 200-day transferring averages. A bullish crossover happens when a shorter-term transferring common (e.g., 50-day) crosses above a longer-term transferring common (e.g., 200-day), suggesting a possible uptrend. The other is true for a bearish crossover.

-

Relative Power Index (RSI): This momentum indicator measures the velocity and alter of value actions. Readings above 70 typically counsel overbought circumstances (potential for a value correction), whereas readings under 30 point out oversold circumstances (potential for a value rebound).

-

MACD (Shifting Common Convergence Divergence): This indicator compares two transferring averages to determine momentum modifications. A bullish sign happens when the MACD line crosses above its sign line, whereas a bearish sign happens when it crosses under.

-

Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by means of. Help ranges characterize costs the place shopping for stress is predicted to outweigh promoting stress, whereas resistance ranges characterize the other. Breaks above resistance ranges usually sign bullish momentum, whereas breaks under assist ranges can point out bearish momentum.

-

Chart Patterns: Skilled merchants search for recurring chart patterns, akin to head and shoulders, double tops/bottoms, triangles, and flags, to anticipate potential value actions. These patterns present visible clues in regards to the market’s sentiment and potential future path.

Basic Evaluation and its Influence on the QQQ Chart:

Whereas technical evaluation focuses on value motion, basic evaluation examines the underlying financial elements influencing the QQQ’s efficiency. Key elements to think about embrace:

-

Financial Progress: Sturdy financial progress usually advantages expertise corporations, resulting in larger QQQ costs. Conversely, financial downturns can negatively influence the sector.

-

Curiosity Charges: Rising rates of interest can enhance borrowing prices for tech corporations, doubtlessly slowing down progress and impacting QQQ’s efficiency. Decrease rates of interest typically have the other impact.

-

Inflation: Excessive inflation can erode company income and scale back investor confidence, doubtlessly resulting in decrease QQQ costs.

-

Firm Earnings: The monetary efficiency of the person corporations throughout the Nasdaq-100 index immediately impacts the QQQ’s efficiency. Sturdy earnings studies typically result in larger QQQ costs, whereas weak earnings can result in declines.

-

Geopolitical Occasions: International occasions, akin to commerce wars or political instability, can considerably affect investor sentiment and influence the QQQ’s efficiency.

Threat Administration Methods When Investing in QQQ:

Investing in QQQ, like all funding, carries inherent dangers. Efficient danger administration is essential:

-

Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout completely different asset courses to scale back general danger.

-

Greenback-Price Averaging (DCA): Make investments a set sum of money at common intervals, whatever the value. This technique mitigates the danger of investing a big sum at a market peak.

-

Cease-Loss Orders: Set stop-loss orders to mechanically promote your QQQ shares if the value falls under a predetermined degree, limiting potential losses.

-

Place Sizing: Decide the suitable quantity of capital to allocate to QQQ primarily based in your danger tolerance and funding objectives. Keep away from over-leveraging your investments.

-

Common Monitoring: Preserve a detailed eye on the QQQ chart and the underlying financial elements influencing its efficiency. Be ready to regulate your funding technique primarily based on altering market circumstances.

Lengthy-Time period vs. Quick-Time period Investing in QQQ:

The QQQ ETF will be appropriate for each long-term and short-term funding methods.

-

Lengthy-Time period Investing: For long-term buyers, QQQ provides publicity to a various basket of main expertise corporations with robust progress potential. A buy-and-hold technique will be efficient, benefiting from long-term progress traits.

-

Quick-Time period Buying and selling: Quick-term merchants can use technical evaluation and chart patterns to determine potential short-term buying and selling alternatives. Nonetheless, this strategy requires extra lively monitoring and carries larger danger.

Conclusion:

Analyzing the QQQ ETF inventory chart requires a holistic strategy, combining technical evaluation, basic evaluation, and sound danger administration methods. Understanding value patterns, key indicators, and the underlying financial elements influencing the expertise sector is essential for making knowledgeable funding choices. Whereas QQQ provides publicity to a dynamic and doubtlessly profitable sector, it is important to keep in mind that all investments carry danger, and no funding technique ensures income. Thorough analysis, cautious planning, and a disciplined strategy are very important for profitable investing in QQQ or some other asset. Bear in mind to seek the advice of with a certified monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the QQQ ETF Inventory Chart: A Complete Information for Traders. We hope you discover this text informative and useful. See you in our subsequent article!