Decoding The QQQ Interactive Inventory Chart: A Complete Information For Buyers

By admin / October 1, 2024 / No Comments / 2025

Decoding the QQQ Interactive Inventory Chart: A Complete Information for Buyers

Associated Articles: Decoding the QQQ Interactive Inventory Chart: A Complete Information for Buyers

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the QQQ Interactive Inventory Chart: A Complete Information for Buyers. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the QQQ Interactive Inventory Chart: A Complete Information for Buyers

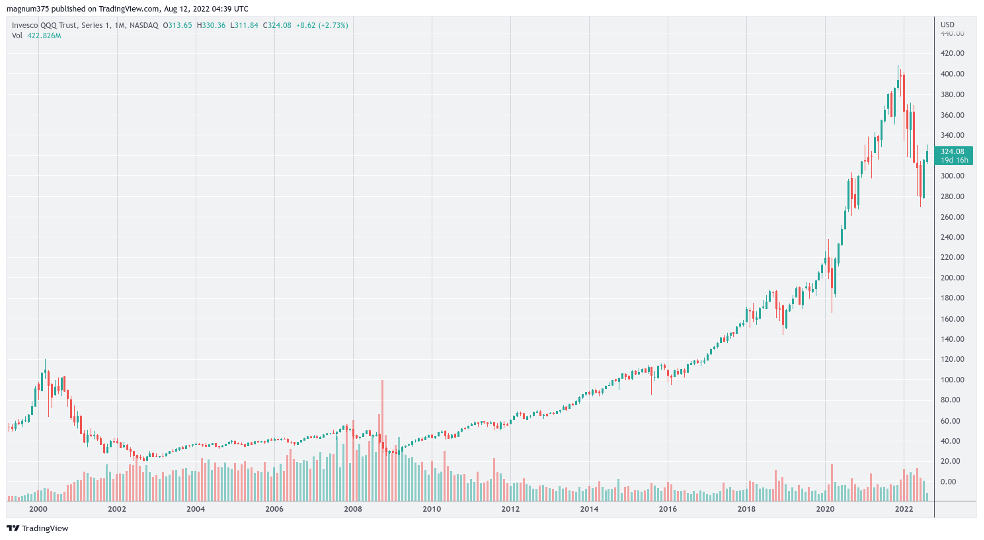

The Invesco QQQ Belief (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index contains 100 of the biggest non-financial firms listed on the Nasdaq Inventory Market, making QQQ a well-liked alternative for traders looking for publicity to the expertise sector and broader development shares. Understanding the nuances of its interactive inventory chart is essential for efficient funding selections. This text delves deep into decoding QQQ’s interactive chart, protecting numerous facets from fundamental candlestick patterns to superior technical indicators and their implications.

I. The Fundamentals: Understanding the Parts of a QQQ Interactive Chart

Most interactive inventory charts supply the same fundamental construction, offering a visible illustration of QQQ’s value actions over time. Key elements embody:

- Value Axis (Y-axis): This vertical axis represents the value of QQQ, sometimes starting from the bottom to the best value inside the chosen timeframe.

- Time Axis (X-axis): This horizontal axis represents the time interval, starting from seconds (intraday charts) to years (long-term charts). The timeframe may be adjusted by the consumer.

- Candlesticks/Bars: These signify the value motion for a particular time interval (e.g., 1 day, 1 week, 1 month). Every candlestick/bar sometimes exhibits the open, excessive, low, and shutting costs.

- Open: The value in the beginning of the interval.

- Excessive: The very best value reached in the course of the interval.

- Low: The bottom value reached in the course of the interval.

- Shut: The value on the finish of the interval.

- Quantity: Typically displayed as a separate graph beneath the value chart, quantity signifies the variety of shares traded throughout every interval. Excessive quantity typically accompanies important value actions.

- Timeframes: Interactive charts enable customers to modify between numerous timeframes, from intraday (minutes, hours) to every day, weekly, month-to-month, and yearly views. Selecting the suitable timeframe is essential for various analytical functions.

II. Decoding Candlestick Patterns:

Candlestick patterns supply useful insights into market sentiment and potential future value actions. Some widespread patterns seen on QQQ’s interactive chart embody:

- Bullish Candlesticks: These counsel potential upward value motion. Examples embody:

- Hammer: A small physique with an extended decrease shadow, suggesting a reversal from a downtrend.

- Morning Star: A 3-candlestick sample the place a small physique is sandwiched between two bigger candlesticks, signaling a possible bullish reversal.

- Engulfing Sample (Bullish): A bigger bullish candlestick utterly engulfs a previous bearish candlestick, suggesting a shift in momentum.

- Bearish Candlesticks: These counsel potential downward value motion. Examples embody:

- Hanging Man: A small physique with an extended decrease shadow, suggesting a possible reversal from an uptrend.

- Night Star: A 3-candlestick sample much like the morning star however suggesting a bearish reversal.

- Engulfing Sample (Bearish): A bigger bearish candlestick utterly engulfs a previous bullish candlestick, suggesting a shift in momentum.

- Doji: A candlestick with nearly no physique, indicating indecision out there. It typically indicators a possible reversal or continuation.

It is essential to do not forget that candlestick patterns are handiest when thought-about along side different technical indicators and basic evaluation.

III. Using Technical Indicators:

Interactive charts enable customers to overlay numerous technical indicators to reinforce their evaluation. Some generally used indicators embody:

- Transferring Averages (MA): These clean out value fluctuations and assist establish traits. Generally used MAs embody the 50-day and 200-day transferring averages. A bullish crossover happens when a shorter-term MA crosses above a longer-term MA, suggesting a possible uptrend. A bearish crossover is the other.

- Relative Energy Index (RSI): This momentum indicator measures the magnitude of current value adjustments to guage overbought (above 70) and oversold (beneath 30) situations. These ranges can sign potential reversals.

- MACD (Transferring Common Convergence Divergence): This trend-following momentum indicator identifies adjustments within the energy, path, momentum, and length of a development. Crossovers of the MACD line and sign line can point out potential purchase or promote indicators.

- Bollinger Bands: These depict value volatility by plotting customary deviations round a transferring common. Value actions outdoors the bands can counsel overbought or oversold situations or potential breakouts.

- Fibonacci Retracement: This software identifies potential help and resistance ranges based mostly on Fibonacci ratios. These ranges may also help predict value reversals or continuation.

The choice and interpretation of technical indicators rely upon the investor’s buying and selling type and threat tolerance. Combining a number of indicators can present a extra complete evaluation.

IV. Superior Chart Options:

Many interactive QQQ charts supply superior options to reinforce the analytical course of:

- Drawing Instruments: These enable customers to attract development strains, help/resistance ranges, Fibonacci retracements, and different graphical components immediately onto the chart.

- Customizable Indicators: Customers can typically add their most well-liked technical indicators and customise their parameters.

- Backtesting: Some platforms enable customers to backtest their buying and selling methods utilizing historic QQQ knowledge. This helps consider the effectiveness of various approaches earlier than making use of them to reside buying and selling.

- Alert System: Many platforms supply an alert system that notifies customers when particular value ranges or technical indicator situations are met. This may be essential for well timed buying and selling selections.

- A number of Chart Views: Some platforms enable for the simultaneous viewing of a number of charts, enabling comparability of QQQ’s efficiency towards different property or indices.

V. Integrating Basic Evaluation:

Whereas technical evaluation utilizing the interactive chart is effective, it is important to think about basic evaluation as effectively. This entails inspecting the underlying monetary well being and prospects of the businesses inside the Nasdaq-100 index. Components to think about embody:

- Earnings reviews: Analyzing the monetary efficiency of the constituent firms helps assess their future development potential.

- Trade traits: Understanding the general traits inside the expertise sector offers context for QQQ’s value actions.

- Financial indicators: Macroeconomic elements like rates of interest, inflation, and GDP development can considerably impression the efficiency of development shares like these in QQQ.

By combining each technical and basic evaluation, traders can develop a extra complete understanding of QQQ’s value actions and make knowledgeable funding selections.

VI. Threat Administration and Disclaimer:

Investing in QQQ, or any asset, entails inherent threat. The knowledge supplied on this article is for academic functions solely and shouldn’t be thought-about monetary recommendation. It is essential to conduct your personal thorough analysis and seek the advice of with a professional monetary advisor earlier than making any funding selections. Previous efficiency shouldn’t be indicative of future outcomes. All the time handle your threat appropriately and by no means make investments greater than you may afford to lose.

The interactive QQQ inventory chart is a robust software for traders. By mastering its options and integrating technical and basic evaluation, traders can acquire useful insights into market traits and enhance their funding decision-making course of. Nonetheless, do not forget that no software ensures success, and cautious threat administration is paramount.

Closure

Thus, we hope this text has supplied useful insights into Decoding the QQQ Interactive Inventory Chart: A Complete Information for Buyers. We thanks for taking the time to learn this text. See you in our subsequent article!