Decoding The Silver Greenback Worth Chart: A Complete Information

By admin / July 25, 2024 / No Comments / 2025

Decoding the Silver Greenback Worth Chart: A Complete Information

Associated Articles: Decoding the Silver Greenback Worth Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Silver Greenback Worth Chart: A Complete Information. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Silver Greenback Worth Chart: A Complete Information

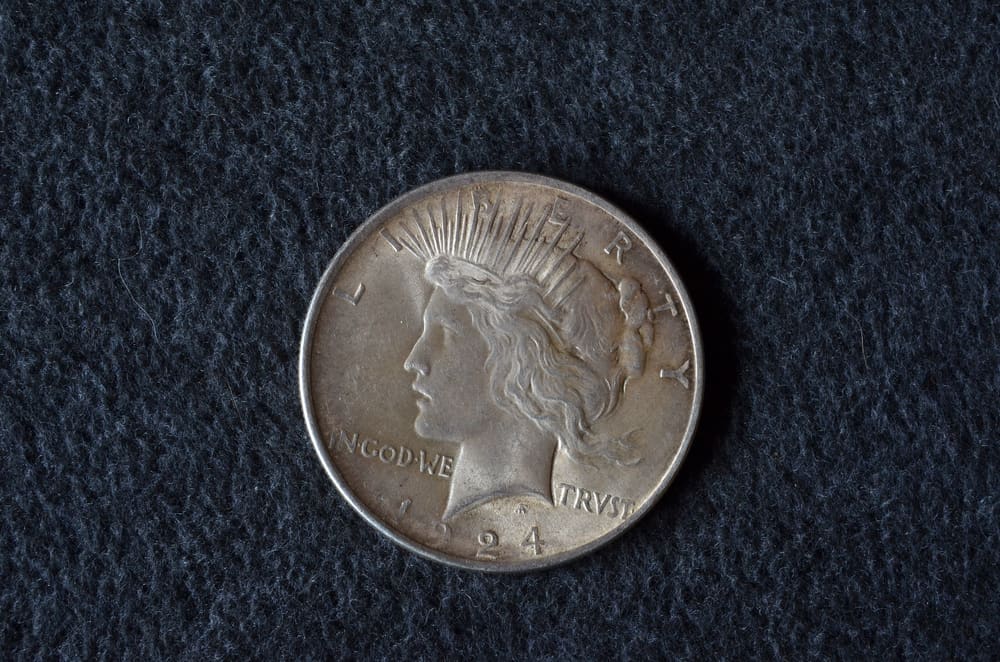

The attract of silver {dollars}, with their weighty presence and historic significance, extends past mere numismatic curiosity. For a lot of, they characterize an funding, a tangible asset that may maintain worth and even respect over time. Understanding the worth of a silver greenback, nevertheless, requires navigating a posh panorama of things that transcend merely checking the present silver value. This text serves as a complete information to decoding silver greenback worth charts and understanding the components that affect their value.

The Fundamentals: Extra Than Simply Silver Content material

Whereas the silver content material of a greenback is a major consider its worth, it is not the one one. A silver greenback’s value is decided by a confluence of things, together with:

-

Silver Content material: The quantity of pure silver contained inside the coin. This varies relying on the 12 months and mint of the coin. For instance, pre-1965 US silver {dollars} are 90% silver, whereas these minted after 1965 are sometimes clad or include no silver. This distinction drastically impacts worth.

-

Situation (Grade): The bodily situation of the coin, together with put on, scratches, and different imperfections. Skilled grading companies, similar to PCGS (Skilled Coin Grading Service) and NGC (Numismatic Warranty Company), assign numerical grades primarily based on strict requirements. A coin in near-perfect situation (e.g., MS65 or greater) will command a considerably greater value than a closely circulated coin (e.g., G4).

-

Rarity: The relative shortage of a selected coin. Sure dates and mints produced fewer cash than others, resulting in greater demand and consequently, greater costs. Error cash, these with distinctive minting errors, may also be exceptionally beneficial.

-

Demand: The general market demand for a particular coin. That is influenced by collector curiosity, funding traits, and financial situations. Excessive demand can drive costs up, even for cash that are not significantly uncommon.

-

Mint Mark: The mint mark signifies the place the coin was minted (e.g., "S" for San Francisco, "D" for Denver, "P" for Philadelphia). Sure mint marks are extra fascinating than others, impacting worth.

Decoding a Silver Greenback Worth Chart:

A typical silver greenback worth chart will current information in a tabular or graphical format. It could checklist cash by 12 months, mint mark, and grade, with corresponding values. Nonetheless, decoding these charts requires cautious consideration:

-

Understanding the Information Supply: The reliability of the chart relies upon solely on the supply. Respected sources, like respected numismatic web sites and public sale data, provide extra correct information than much less credible sources. Be cautious of charts that appear overly optimistic or lack transparency about their methodology.

-

Grade Consistency: Make sure the chart makes use of a constant grading scale. Completely different grading companies could have barely totally different requirements, resulting in discrepancies in worth. Stick with charts that clearly specify the grading service used (PCGS or NGC).

-

Date Specificity: Pay shut consideration to the precise 12 months and mint mark. A seemingly minor distinction in date can considerably impression worth. For instance, a 1909-S VDB Lincoln Cent is much extra beneficial than a typical 1909 Lincoln Cent attributable to its rarity. The identical precept applies to silver {dollars}.

-

Worth Fluctuation: Keep in mind that silver costs, and consequently silver greenback values, fluctuate continuously. A chart displays a snapshot in time and should not precisely replicate present market values. All the time cross-reference the chart with present market information from respected sources.

-

Premium Over Soften Worth: The worth of a silver greenback usually exceeds its soften worth (the worth of the silver contained inside the coin). This "numismatic premium" displays the coin’s collectibility, rarity, and situation. A chart ought to ideally point out this premium.

Elements Influencing Silver Greenback Worth Charts:

A number of exterior components affect the info introduced in silver greenback worth charts:

-

Silver Market Costs: The worth of silver itself is a serious driver of silver greenback values. When silver costs rise, so do the values of silver {dollars}, particularly these in decrease grades.

-

Financial Situations: Financial downturns can enhance demand for tangible property like silver {dollars}, driving up costs. Conversely, financial booms could shift investor focus elsewhere.

-

Collector Curiosity: Developments in numismatic gathering affect demand for particular silver {dollars}. Elevated curiosity in a selected 12 months or mint mark can result in value will increase.

-

Public sale Outcomes: Public sale outcomes present real-time information available on the market worth of silver {dollars}. Excessive public sale costs for sure cash can affect future valuations.

-

Availability: The variety of cash out there available on the market impacts their value. A restricted provide of a selected coin in excessive demand will drive up its value.

Constructing Your Personal Valuation:

Whereas counting on established charts is useful, creating your individual valuation can present a deeper understanding. This entails:

-

Figuring out the Coin: Decide the 12 months, mint mark, and sort of silver greenback.

-

Assessing the Situation: Fastidiously look at the coin for put on, scratches, and different imperfections. Think about using a magnification device for a extra correct evaluation. If uncertain, search skilled grading.

-

Researching Market Information: Seek the advice of a number of respected sources, together with on-line databases, public sale data, and seller tariffs.

-

Contemplating the Silver Worth: Issue within the present market value of silver to find out the soften worth.

-

Calculating the Numismatic Premium: Evaluate the market worth to the soften worth to find out the premium attributed to the coin’s collectibility and situation.

Conclusion:

Silver greenback worth charts are beneficial instruments for assessing the potential value of your cash. Nonetheless, they aren’t infallible. Understanding the components that affect silver greenback values, together with silver content material, situation, rarity, demand, and market situations, is essential for correct valuation. By fastidiously analyzing the info introduced in charts and conducting thorough analysis, you’ll be able to acquire a extra knowledgeable perspective on the true value of your silver {dollars} and make sound funding choices. Keep in mind to all the time seek the advice of a number of sources and think about skilled grading for correct evaluation, significantly for high-value cash. The world of numismatics is wealthy and nuanced; thorough analysis is your greatest ally in navigating its complexities.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the Silver Greenback Worth Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!