Decoding The Silver Worth USD In the present day: A Complete Chart Evaluation

By admin / June 25, 2024 / No Comments / 2025

Decoding the Silver Worth USD In the present day: A Complete Chart Evaluation

Associated Articles: Decoding the Silver Worth USD In the present day: A Complete Chart Evaluation

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Silver Worth USD In the present day: A Complete Chart Evaluation. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Silver Worth USD In the present day: A Complete Chart Evaluation

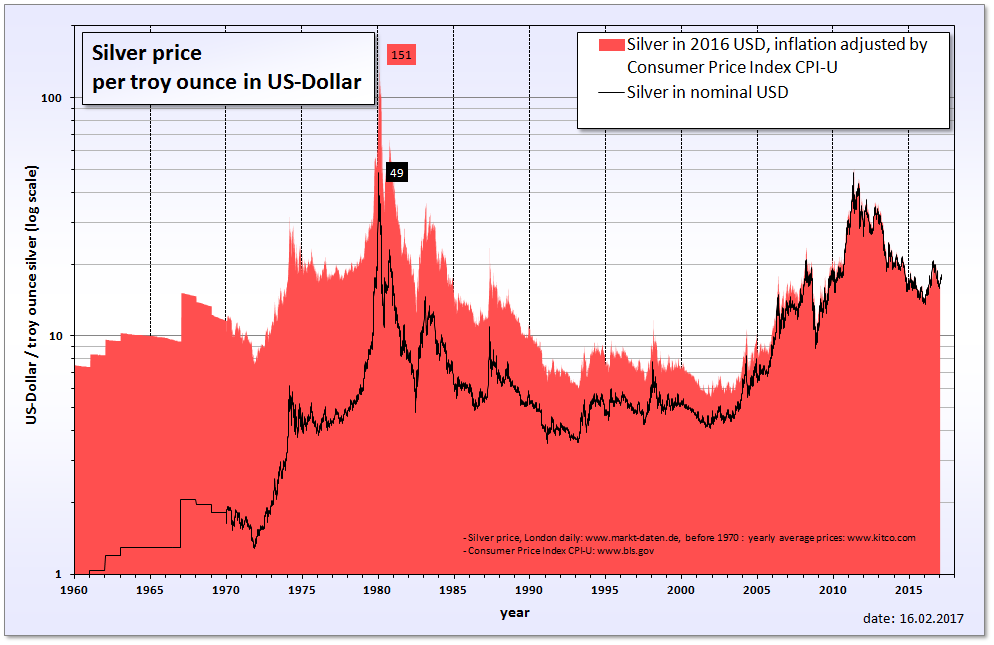

Silver, a lustrous treasured metallic with a historical past as wealthy as its sheen, has captivated traders and industrial customers for millennia. Its worth, inextricably linked to world financial circumstances, industrial demand, and investor sentiment, fluctuates continually. Understanding the present silver worth in USD, as depicted on a every day chart, requires a multifaceted method that considers each short-term market dynamics and long-term developments. This text delves into the intricacies of deciphering the silver worth USD in the present day chart, inspecting its key drivers, technical indicators, and potential implications for traders.

The Silver Worth USD In the present day: A Snapshot

Earlier than diving into the evaluation, it is essential to acknowledge that the silver worth is dynamic. Any particular worth talked about here’s a snapshot in time and can inevitably change. To acquire essentially the most up-to-date info, one ought to seek the advice of a reside, respected monetary information supply comparable to these supplied by main monetary information shops or specialised commodity buying and selling platforms. These platforms usually show an interactive chart exhibiting the silver worth in USD (typically represented as XAG/USD), together with historic information, technical indicators, and buying and selling quantity.

Key Drivers Influencing the Silver Worth

A number of elements converge to form the every day worth actions of silver:

-

Industrial Demand: Silver’s industrial functions are intensive, starting from electronics and photo voltaic panels to medical units and catalysts. Robust world industrial development usually interprets to elevated silver demand, pushing costs increased. Conversely, financial slowdowns or technological shifts can cut back demand and exert downward strain on costs. Monitoring manufacturing PMI (Buying Managers’ Index) and industrial manufacturing information from key economies is essential for assessing this issue.

-

Funding Demand: Silver is a well-liked funding asset, thought of each a treasured metallic and an industrial metallic. Investor sentiment, pushed by elements like inflation expectations, geopolitical uncertainty, and the general market temper, considerably impacts silver costs. Elevated investor curiosity, typically mirrored in ETF (Change-Traded Fund) inflows and futures market exercise, tends to spice up costs. Conversely, risk-off sentiment can result in promoting strain.

-

US Greenback Power: The silver worth is often quoted in US {dollars}. A strengthening US greenback usually places downward strain on silver costs, because it turns into costlier for holders of different currencies to buy silver. Conversely, a weakening greenback can enhance silver costs. Monitoring the US Greenback Index (DXY) is crucial for understanding this dynamic.

-

Inflation Expectations: Silver is usually seen as a hedge towards inflation. When inflation fears rise, traders are likely to flock to treasured metals like silver as a retailer of worth, driving up costs. Conversely, if inflation expectations subside, the demand for silver as an inflation hedge could lower. Monitoring inflation indices just like the Client Worth Index (CPI) and Producer Worth Index (PPI) is essential on this context.

-

Geopolitical Elements: World political instability, wars, and commerce tensions can affect silver costs. Uncertainty typically leads traders to hunt secure haven belongings, together with silver, boosting demand and costs. Conversely, durations of relative geopolitical calm can result in decreased demand.

-

Provide and Demand Dynamics: The general provide and demand steadiness for silver performs an important position in worth dedication. Mining manufacturing, recycling charges, and stock ranges all contribute to the availability facet. Adjustments in these elements can considerably impression costs.

Decoding the Silver Worth USD In the present day Chart: Technical Evaluation

Technical evaluation makes use of historic worth information and chart patterns to foretell future worth actions. A number of key indicators are ceaselessly employed when analyzing the silver worth USD in the present day chart:

-

Shifting Averages: These are calculated by averaging the worth over a selected interval (e.g., 50-day, 200-day transferring common). Crossovers between transferring averages can sign potential development adjustments. A bullish crossover happens when a shorter-term transferring common crosses above a longer-term transferring common, suggesting a possible worth enhance. A bearish crossover signifies the alternative.

-

Relative Power Index (RSI): This indicator measures the magnitude of latest worth adjustments to guage overbought or oversold circumstances. An RSI above 70 usually suggests an overbought market, indicating potential for a worth correction. An RSI under 30 suggests an oversold market, doubtlessly signaling a worth rebound.

-

MACD (Shifting Common Convergence Divergence): This indicator identifies adjustments in momentum by evaluating two transferring averages. A bullish MACD crossover (when the MACD line crosses above the sign line) suggests growing momentum, whereas a bearish crossover suggests lowering momentum.

-

Help and Resistance Ranges: These are worth ranges the place the worth has traditionally struggled to interrupt by way of. Help ranges symbolize worth flooring, whereas resistance ranges symbolize worth ceilings. Breaks above resistance ranges are sometimes thought of bullish alerts, whereas breaks under help ranges are bearish.

-

Chart Patterns: Numerous chart patterns, comparable to head and shoulders, double tops/bottoms, and triangles, can present insights into potential worth actions. These patterns require expertise and cautious interpretation.

Lengthy-Time period Tendencies and Outlook

Analyzing the long-term development of silver costs requires contemplating the broader financial context, technological developments, and geopolitical panorama. Elements just like the growing adoption of renewable power applied sciences (which use vital quantities of silver) and the potential for inflation may drive long-term demand for silver. Nevertheless, financial slowdowns or technological breakthroughs that cut back silver’s use in sure industries may exert downward strain.

Dangers and Issues

Investing in silver, like some other asset, carries inherent dangers. Worth volatility could be vital, and traders must be ready for potential losses. Moreover, geopolitical occasions, surprising adjustments in industrial demand, and shifts in investor sentiment can all impression silver costs unpredictably. Diversification is essential to mitigate danger.

Conclusion

Analyzing the silver worth USD in the present day chart requires a complete method that considers varied financial, industrial, and geopolitical elements, together with technical indicators. Whereas short-term worth fluctuations could be influenced by market sentiment and hypothesis, long-term developments are formed by broader financial forces and technological developments. By fastidiously inspecting these elements and using acceptable danger administration methods, traders can navigate the complexities of the silver market and make knowledgeable choices. Keep in mind to all the time seek the advice of with a certified monetary advisor earlier than making any funding choices. The data supplied on this article is for instructional functions solely and shouldn’t be thought of monetary recommendation.

-638089277926702721.png)

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Silver Worth USD In the present day: A Complete Chart Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!