Decoding The S&P 500 YTD Chart: A 2023 Deep Dive

By admin / June 10, 2024 / No Comments / 2025

Decoding the S&P 500 YTD Chart: A 2023 Deep Dive

Associated Articles: Decoding the S&P 500 YTD Chart: A 2023 Deep Dive

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the S&P 500 YTD Chart: A 2023 Deep Dive. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the S&P 500 YTD Chart: A 2023 Deep Dive

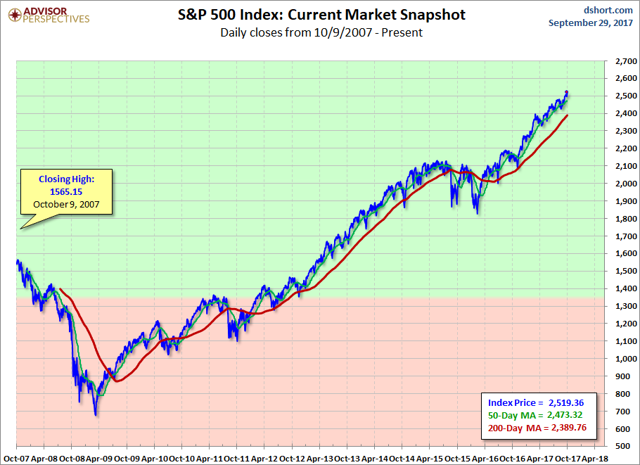

The S&P 500 index, a benchmark for the U.S. inventory market, gives a vital snapshot of the general financial well being and investor sentiment. Analyzing its year-to-date (YTD) efficiency affords precious insights into prevailing market tendencies, potential future instructions, and the affect of assorted macroeconomic elements. This text delves into the 2023 S&P 500 YTD chart, analyzing its fluctuations, underlying causes, and implications for buyers.

The 2023 Narrative: A Rollercoaster Journey

The 2023 S&P 500 YTD chart, not like earlier years, hasn’t introduced a simple narrative. As an alternative, it has been characterised by vital volatility, reflecting the advanced interaction of a number of financial forces. Whereas the exact figures will differ relying on the particular date of research, the overarching pattern has been one in every of preliminary development adopted by intervals of consolidation and, at instances, vital decline.

A number of elements have contributed to this rollercoaster:

-

Inflation and Curiosity Charge Hikes: The persistent inflation witnessed all through 2022 and into 2023 compelled the Federal Reserve (Fed) to aggressively increase rates of interest. These charge hikes, aimed toward cooling down the financial system and curbing inflation, immediately affect the inventory market. Greater rates of interest enhance borrowing prices for companies, doubtlessly slowing down financial development and lowering company earnings, thus placing downward stress on inventory costs. The uncertainty surrounding the Fed’s future actions has added to the market’s volatility. The YTD chart displays the market’s response to every rate of interest announcement, with constructive actions usually following indications of a possible pause or slowdown in charge hikes.

-

Geopolitical Uncertainty: The continued battle in Ukraine, together with escalating geopolitical tensions in different elements of the world, has created vital uncertainty within the international financial system. These occasions disrupt provide chains, affect vitality costs, and gasoline inflation, contributing to the volatility seen within the S&P 500 YTD chart. Intervals of heightened geopolitical danger usually correspond to dips within the index.

-

Company Earnings Experiences: The efficiency of particular person corporations inside the S&P 500 considerably impacts the general index. Sturdy earnings stories usually result in constructive market sentiment and upward motion, whereas disappointing outcomes can set off sell-offs. The YTD chart displays the cumulative impact of those quarterly earnings bulletins, with intervals of robust company efficiency coinciding with upward tendencies.

-

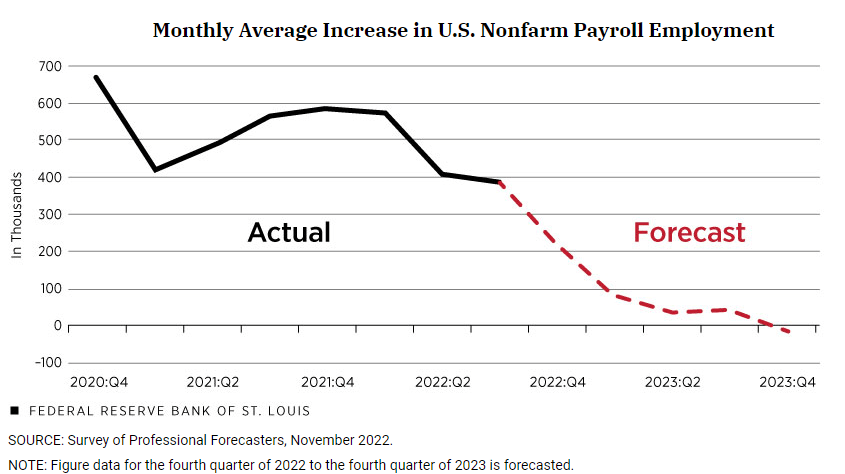

Recessionary Fears: All through 2023, issues a few potential recession have lingered. Financial indicators comparable to inflation charges, shopper confidence, and unemployment figures have been carefully monitored for indicators of an impending downturn. These fears have influenced investor conduct, resulting in intervals of danger aversion and sell-offs, mirrored within the dips noticed on the YTD chart.

-

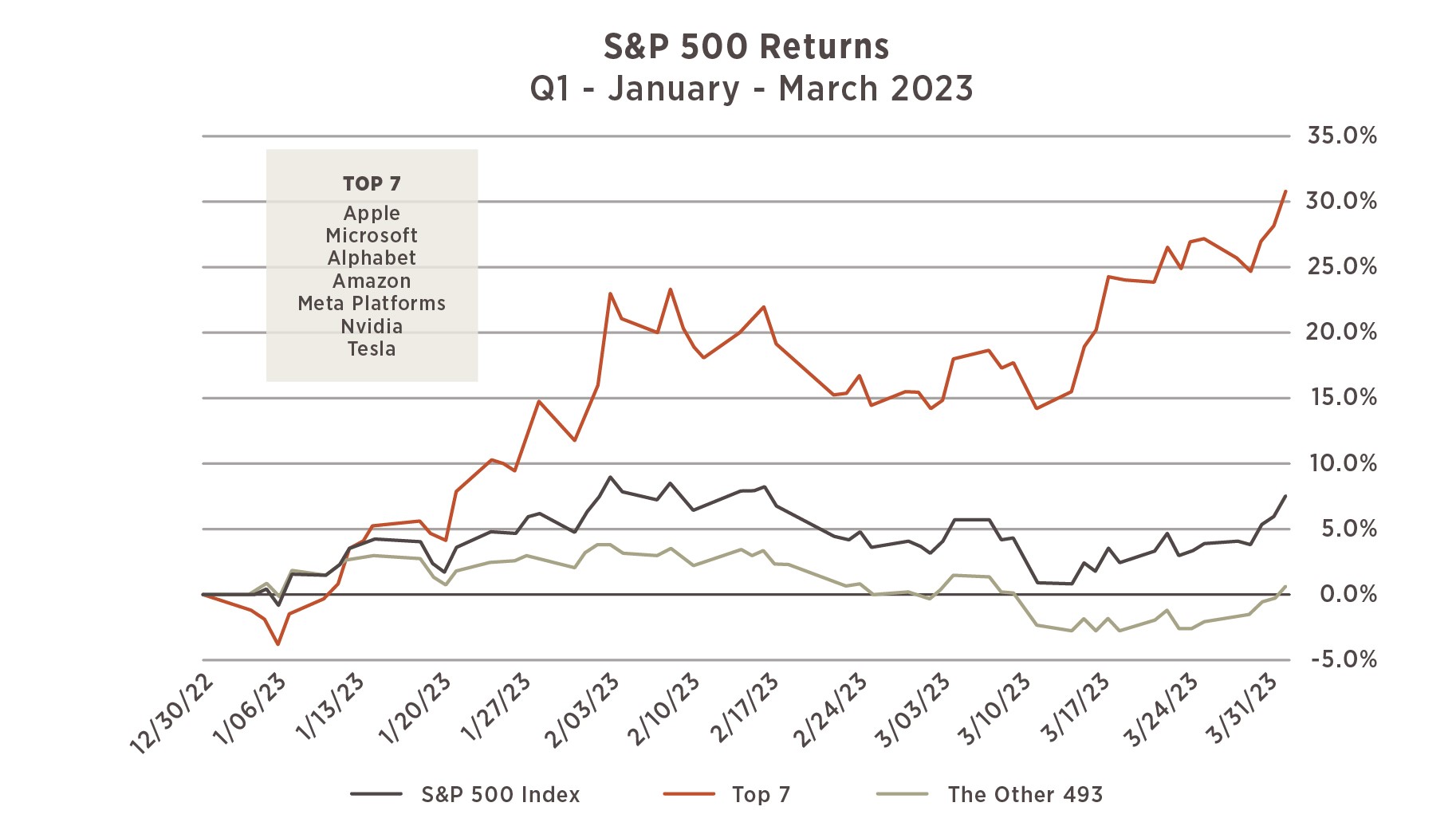

Technological Sector Efficiency: The know-how sector, a major factor of the S&P 500, has skilled its personal distinctive set of challenges and triumphs in 2023. Components comparable to AI developments, regulatory scrutiny, and altering shopper spending patterns have impacted the efficiency of tech giants, influencing the general index’s trajectory. The YTD chart reveals the affect of those tech-related occasions on the broader market.

Analyzing Key Turning Factors on the Chart:

An in depth evaluation of the 2023 S&P 500 YTD chart would contain figuring out key turning factors and correlating them with particular occasions or bulletins. For instance:

-

January/February Surge: An preliminary surge initially of the 12 months is perhaps attributed to hopes of a much less aggressive Fed and easing inflation issues.

-

March/April Correction: A subsequent correction may very well be linked to renewed inflation worries or disappointing financial information.

-

Summer season Rally: A summer season rally would possibly replicate constructive company earnings or a perceived softening of the Fed’s stance.

-

Autumn Volatility: Elevated volatility within the autumn may very well be pushed by geopolitical occasions, escalating rate of interest issues, or sudden financial information.

Every of those turning factors requires a deeper dive into the particular information and financial information launched round that point to completely perceive the causal relationship.

Implications for Traders:

The volatility depicted within the 2023 S&P 500 YTD chart highlights the significance of a well-diversified funding technique. Traders ought to keep away from making impulsive choices primarily based on short-term fluctuations and as an alternative concentrate on their long-term funding objectives. A sturdy portfolio ought to contemplate varied asset lessons and danger tolerances.

Moreover, staying knowledgeable about macroeconomic tendencies, geopolitical occasions, and company efficiency is essential for knowledgeable decision-making. Commonly reviewing the S&P 500 YTD chart at the side of different financial indicators might help buyers higher perceive the market’s dynamics and modify their funding methods accordingly.

Trying Forward:

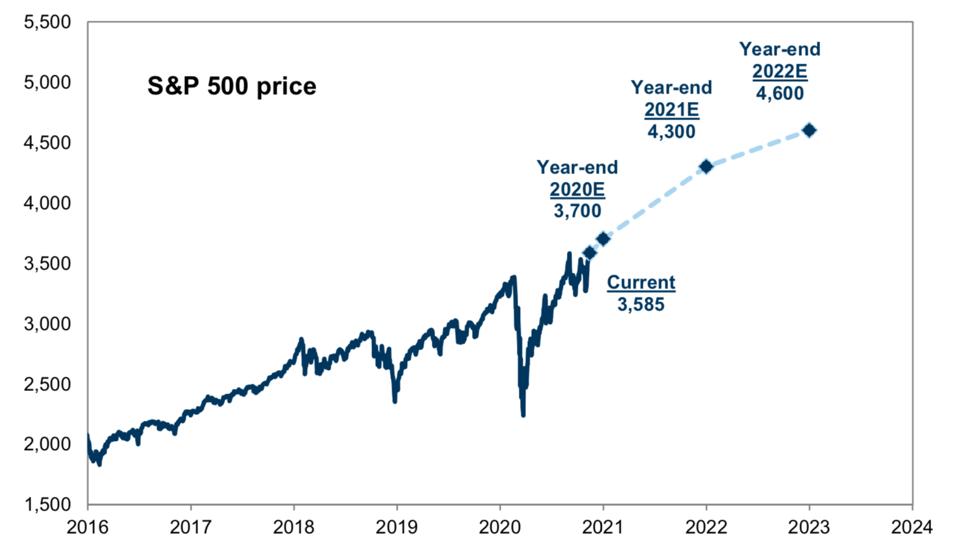

Predicting the longer term trajectory of the S&P 500 is inherently difficult. Nevertheless, analyzing the YTD chart alongside financial forecasts and professional opinions can provide some insights. Components to contemplate embody:

-

Inflation Trajectory: The trail of inflation will considerably affect the Fed’s future actions and, consequently, the inventory market.

-

Financial Development: The tempo of financial development will affect company earnings and investor sentiment.

-

Geopolitical Stability: Decreased geopolitical uncertainty would probably contribute to a extra secure market.

-

Curiosity Charge Expectations: Market expectations relating to future rate of interest adjustments will proceed to drive volatility.

Conclusion:

The 2023 S&P 500 YTD chart tells a narrative of resilience amidst uncertainty. The index’s fluctuations replicate the advanced interaction of assorted macroeconomic elements, highlighting the necessity for a cautious but knowledgeable method to funding. By fastidiously analyzing the chart at the side of different financial information and professional opinions, buyers can achieve a greater understanding of the market’s dynamics and make extra knowledgeable choices to navigate the ever-changing panorama of the inventory market. Bear in mind, the chart is a instrument, not a crystal ball. Constant monitoring, diversification, and a long-term perspective stay key to profitable investing. The journey depicted on the YTD chart is much from over, and understanding its nuances is essential for anybody navigating the complexities of the monetary markets.

Closure

Thus, we hope this text has offered precious insights into Decoding the S&P 500 YTD Chart: A 2023 Deep Dive. We thanks for taking the time to learn this text. See you in our subsequent article!