Decoding The Tick Chart: A Dealer’s Information To Extremely-Excessive-Frequency Information

By admin / August 17, 2024 / No Comments / 2025

Decoding the Tick Chart: A Dealer’s Information to Extremely-Excessive-Frequency Information

Associated Articles: Decoding the Tick Chart: A Dealer’s Information to Extremely-Excessive-Frequency Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Tick Chart: A Dealer’s Information to Extremely-Excessive-Frequency Information. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Tick Chart: A Dealer’s Information to Extremely-Excessive-Frequency Information

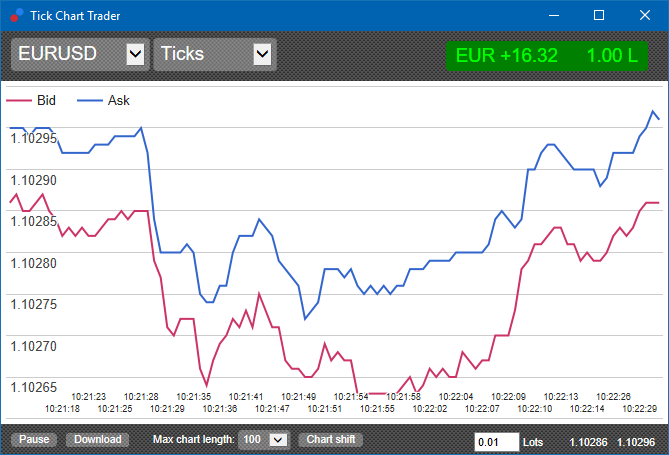

Within the fast-paced world of monetary buying and selling, entry to real-time information is paramount. Whereas candlestick charts and bar charts present a helpful overview of value motion over particular time intervals, they inherently easy out the granular particulars of market exercise. That is the place tick charts emerge as a strong device, providing an unparalleled stage of granularity by plotting every particular person value change – or "tick" – as a knowledge level. Understanding tick charts requires a shift in perspective, shifting away from the smoothed illustration of value actions in direction of a uncooked, unfiltered view of market dynamics.

This text delves deep into the world of tick charts, exploring their performance, benefits, disadvantages, and sensible purposes in varied buying and selling methods. We’ll look at how they differ from different chart sorts, the particular data they reveal, and the technical indicators that may be successfully employed alongside them.

What’s a Tick Chart?

A tick chart is a kind of value chart that plots every particular person value change (tick) as a knowledge level. Not like bar charts or candlestick charts, which mixture value information over particular time intervals (e.g., 1-minute, 5-minute, or day by day bars), tick charts focus solely on the variety of ticks. A "tick" represents a change within the bid or ask value of an asset. For instance, if the worth of a inventory strikes from $10.00 to $10.01, that constitutes one tick. If it strikes from $10.00 to $10.02, that counts as two ticks. Subsequently, the x-axis of a tick chart represents the cumulative variety of ticks, whereas the y-axis represents the worth.

This basic distinction results in a number of key traits:

- Excessive Granularity: Tick charts seize each single value motion, offering essentially the most detailed illustration of value motion out there. That is significantly invaluable in extremely liquid markets the place value fluctuations are frequent.

- Time-Impartial: Not like time-based charts, the horizontal axis of a tick chart just isn’t tied to a selected time interval. The chart’s development is set solely by the variety of value modifications, making it perfect for analyzing market dynamics unbiased of time constraints.

- Volatility-Delicate: The spacing between information factors on a tick chart straight displays market volatility. Intervals of excessive volatility will lead to intently spaced information factors, whereas intervals of low volatility will present wider spacing.

- Appropriate for Excessive-Frequency Buying and selling: The ultra-high-frequency nature of tick information makes these charts exceptionally helpful for high-frequency buying and selling (HFT) methods that depend on capturing minute value fluctuations for revenue.

Benefits of Utilizing Tick Charts:

- Early Detection of Tendencies: The excessive granularity of tick charts permits merchants to establish rising traits sooner than with different chart sorts. Refined shifts in value motion, usually masked in time-based charts, turn out to be readily obvious.

- Improved Order Entry: By observing the move of ticks, merchants can higher time their entries and exits, probably enhancing commerce execution and minimizing slippage.

- Enhanced Threat Administration: The detailed view of value fluctuations helps in assessing market volatility and adjusting place sizing accordingly, main to higher danger administration.

- Identification of Assist and Resistance Ranges: Tick charts can reveal refined assist and resistance ranges that could be missed on coarser timeframes. These ranges can be utilized to set stop-loss and take-profit orders.

- Evaluation of Order Circulate: Skilled merchants can use tick charts to research order move, inferring the intentions of different market contributors based mostly on the sample of ticks.

- Backtesting Methods: Tick information gives a wealthy dataset for backtesting buying and selling methods, permitting for a extra correct analysis of their efficiency.

Disadvantages of Utilizing Tick Charts:

- Data Overload: The sheer quantity of knowledge in a tick chart may be overwhelming, particularly for novices. It requires vital expertise and self-discipline to interpret the knowledge successfully.

- Noise: Tick charts are vulnerable to noise, reflecting random value fluctuations that won’t characterize vital market traits. Filtering methods could also be obligatory to scale back the influence of noise.

- Computational Calls for: Processing and visualizing giant volumes of tick information requires vital computational sources. Actual-time tick chart evaluation could require highly effective {hardware} and environment friendly software program.

- Not Appropriate for All Markets: Tick charts are simplest in extremely liquid markets with frequent value modifications. In much less liquid markets, the rare ticks could not present ample data.

- Studying Curve: Mastering the interpretation of tick charts requires appreciable apply and a deep understanding of market dynamics.

Technical Indicators for Tick Charts:

Whereas tick charts themselves present a uncooked view of value motion, combining them with applicable technical indicators can improve their analytical energy. Some indicators significantly well-suited for tick chart evaluation embody:

- Quantity-based indicators: Whereas conventional quantity just isn’t straight relevant, tick quantity (variety of ticks) can be utilized to gauge market exercise and establish intervals of excessive volatility.

- Shifting Averages: Quick-moving averages may also help easy out among the noise in tick charts and establish short-term traits. Nonetheless, utilizing very gradual shifting averages would possibly defeat the aim of utilizing a tick chart.

- Market Profile: This device, usually used along side quantity profile, may also help establish areas of worth and potential value reversals.

- Order Circulate Indicators: These indicators try and quantify the course and depth of order move based mostly on tick information, offering insights into market sentiment.

- Tick-based Volatility Indicators: Indicators like common true vary (ATR) may be tailored to make use of tick information to measure volatility.

Sensible Purposes of Tick Charts:

- Scalping: Tick charts are ideally fitted to scalping methods, which intention to revenue from small value actions over brief intervals. The excessive granularity permits scalpers to establish and capitalize on fleeting alternatives.

- Excessive-Frequency Buying and selling (HFT): HFT algorithms closely depend on tick information to execute trades at extraordinarily excessive speeds, benefiting from minuscule value discrepancies.

- Algorithmic Buying and selling: Tick information kinds the premise for a lot of algorithmic buying and selling methods, offering the uncooked enter for complicated buying and selling algorithms.

- Market Microstructure Evaluation: Researchers and lecturers use tick information to check market microstructure, gaining insights into the mechanics of market operations.

Conclusion:

Tick charts provide a singular perspective on market dynamics, offering an unparalleled stage of granularity that’s invaluable for sure buying and selling types. Nonetheless, their complexity and the potential for data overload require a cautious and regarded method. Profitable utilization of tick charts necessitates a robust understanding of market mechanics, a disciplined buying and selling plan, and the flexibility to filter out noise and give attention to significant value motion. Whereas not appropriate for all merchants or all market situations, for individuals who are keen to speculate the effort and time, tick charts can present a big edge in navigating the complexities of the monetary markets. The secret is to mix the uncooked energy of tick information with applicable technical evaluation and a well-defined buying and selling technique to unlock their full potential. Do not forget that buying and selling with tick charts entails vital danger, and thorough backtesting and danger administration are essential earlier than deploying any technique based mostly on this information.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Tick Chart: A Dealer’s Information to Extremely-Excessive-Frequency Information. We respect your consideration to our article. See you in our subsequent article!