Decoding The Triangle Sample: A Complete Information For Merchants

By admin / June 22, 2024 / No Comments / 2025

Decoding the Triangle Sample: A Complete Information for Merchants

Associated Articles: Decoding the Triangle Sample: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Triangle Sample: A Complete Information for Merchants. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Triangle Sample: A Complete Information for Merchants

Triangle patterns, a ubiquitous characteristic in technical evaluation, symbolize durations of consolidation inside a prevailing development. Not like different chart patterns that usually sign a decisive directional transfer, triangles are characterised by converging trendlines, hinting at a interval of indecision earlier than a possible breakout. Understanding the nuances of triangle patterns – their formation, sorts, and implications – is essential for merchants searching for to capitalize on their inherent volatility and directional bias.

This complete information delves into the intricacies of triangle patterns, exploring their varied types, offering sensible identification methods, and providing methods for efficient buying and selling round these formations.

Understanding Triangle Sample Formation

Triangle patterns are characterised by the convergence of two trendlines: a assist line connecting a collection of swing lows and a resistance line connecting a collection of swing highs. These strains steadily converge, making a triangular form on the worth chart. The sample’s formation displays a interval of indecision available in the market, the place consumers and sellers are locked in a comparatively balanced wrestle. This equilibrium finally breaks, resulting in a decisive transfer in a single course or the opposite.

The length of a triangle sample can differ considerably, starting from a couple of days to a number of months, relying on the timeframe and the underlying asset’s volatility. Longer-duration triangles usually signify a extra substantial worth motion post-breakout.

Forms of Triangle Patterns

Triangle patterns are broadly categorized into three primary sorts: symmetrical triangles, ascending triangles, and descending triangles. Every kind reveals distinct traits and buying and selling implications:

1. Symmetrical Triangles:

Symmetrical triangles are the commonest kind. They’re characterised by almost equal slopes for each the resistance and assist trendlines. The value motion oscillates throughout the converging strains, with every successive excessive barely decrease than the earlier one and every successive low barely greater than the earlier one. This sample represents a interval of indecision, with neither consumers nor sellers gaining a transparent higher hand.

- Identification: Search for a collection of decrease highs and better lows converging in the direction of a central level. The trendlines must be roughly symmetrical.

- Breakout: Breakouts from symmetrical triangles can happen in both course. The value usually breaks out with a major transfer within the course of the prevailing development previous to the triangle formation. A breakout above the resistance line suggests a bullish continuation, whereas a breakdown beneath the assist line suggests a bearish continuation.

- Goal Value: The standard goal worth for a symmetrical triangle breakout is calculated by measuring the utmost worth vary throughout the triangle and projecting that distance past the breakout level.

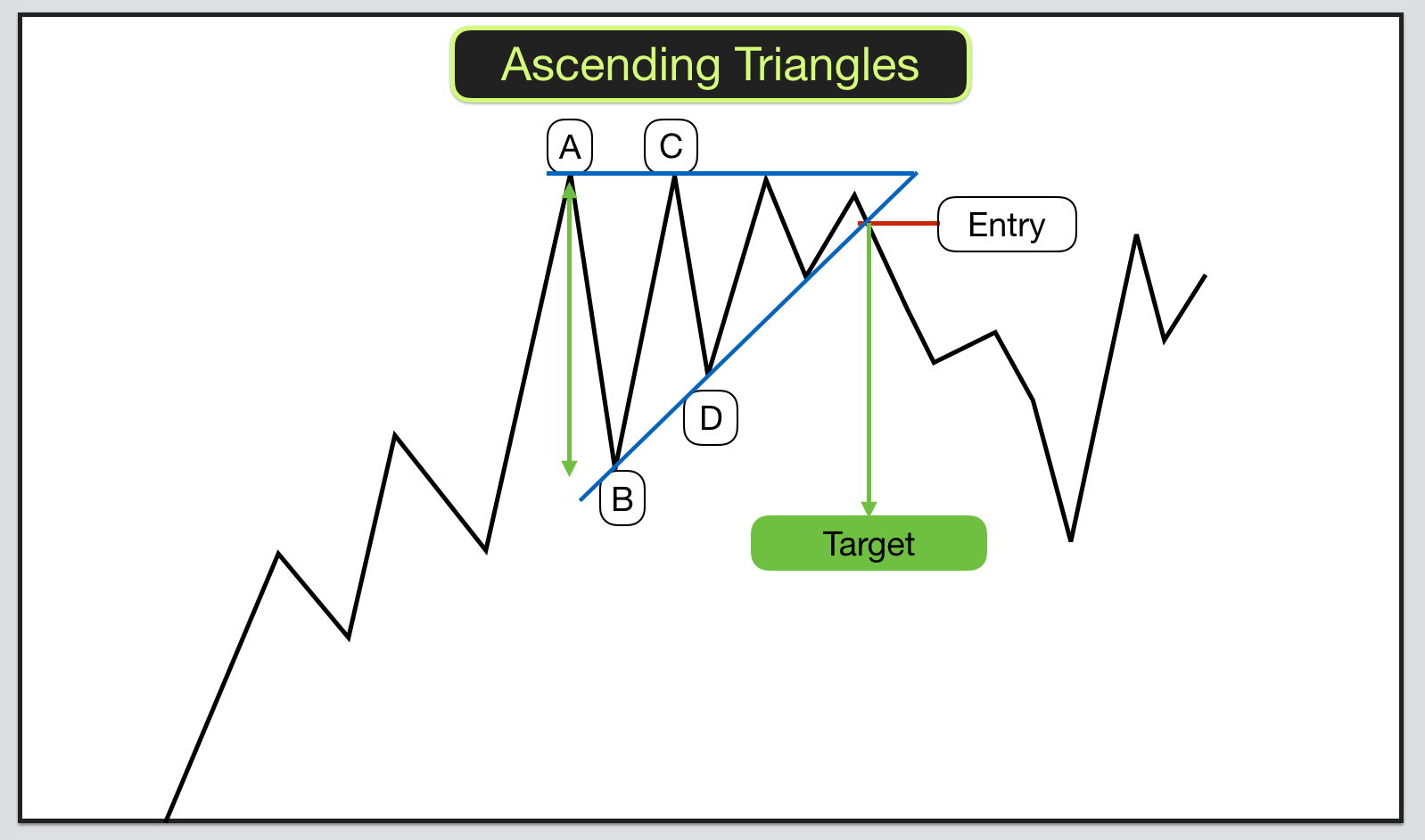

2. Ascending Triangles:

Ascending triangles are bullish patterns characterised by a flat, horizontal resistance line and an upward-sloping assist line. The value motion exhibits greater lows, suggesting growing shopping for strain, whereas the resistance line stays comparatively constant, indicating vendor resistance. This sample suggests a bullish continuation, with the eventual breakout occurring above the resistance line.

- Identification: Search for a flat or barely downward-sloping resistance line and a clearly upward-sloping assist line. The highs are roughly equal, whereas the lows are progressively greater.

- Breakout: Breakouts usually happen above the resistance line, signaling a continuation of the uptrend. The breakout is usually accompanied by elevated quantity.

- Goal Value: Much like symmetrical triangles, the goal worth may be estimated by measuring the vertical distance between the very best excessive and the bottom low throughout the triangle and projecting that distance from the breakout level.

3. Descending Triangles:

Descending triangles are bearish patterns characterised by a flat or barely upward-sloping assist line and a downward-sloping resistance line. The value motion exhibits decrease highs, suggesting waning shopping for strain, whereas the assist line stays comparatively constant, indicating purchaser assist. This sample suggests a bearish continuation, with the eventual breakout occurring beneath the assist line.

- Identification: Search for a flat or barely upward-sloping assist line and a clearly downward-sloping resistance line. The lows are roughly equal, whereas the highs are progressively decrease.

- Breakout: Breakouts usually happen beneath the assist line, signaling a continuation of the downtrend. The breakout is usually accompanied by elevated quantity.

- Goal Value: The goal worth may be estimated by measuring the vertical distance between the very best excessive and the bottom low throughout the triangle and projecting that distance from the breakout level.

Quantity Evaluation in Triangle Patterns

Quantity evaluation performs a vital position in confirming the validity and potential of a triangle sample. Usually, quantity tends to lower through the formation of the triangle, reflecting the indecision available in the market. Nonetheless, a major improve in quantity accompanying the breakout confirms the sample’s validity and suggests a robust directional transfer. Low quantity breakouts, then again, might point out a false breakout and must be handled with warning.

False Breakouts and Threat Administration

Triangle patterns are inclined to false breakouts, the place the worth briefly breaks by way of one of many trendlines however fails to maintain the transfer. These false breakouts can lure merchants who enter positions based mostly solely on the preliminary breakout. Due to this fact, it is essential to make use of danger administration methods, corresponding to stop-loss orders, to restrict potential losses. Merchants ought to watch for affirmation of the breakout earlier than getting into a place, corresponding to a robust candlestick sample or elevated quantity.

Buying and selling Methods for Triangle Patterns

A number of buying and selling methods may be employed when buying and selling round triangle patterns:

-

Breakout Buying and selling: This includes getting into an extended place upon a breakout above the resistance line in an ascending or symmetrical triangle, or a brief place upon a breakout beneath the assist line in a descending or symmetrical triangle. A stop-loss order must be positioned beneath the assist line for lengthy positions and above the resistance line for brief positions.

-

Pullback Buying and selling: This includes ready for a pullback to the damaged trendline after the preliminary breakout. This technique presents a decrease entry level with a tighter stop-loss, however it additionally will increase the chance of lacking the preliminary transfer.

-

Affirmation Buying and selling: This technique includes ready for affirmation of the breakout, corresponding to elevated quantity or a robust candlestick sample, earlier than getting into a place. This reduces the chance of false breakouts however may additionally lead to a barely greater entry worth.

Conclusion:

Triangle patterns are worthwhile instruments for technical analysts searching for to establish potential turning factors and directional strikes available in the market. By understanding the various kinds of triangles, their formation traits, and the related quantity dynamics, merchants can considerably enhance their capacity to establish high-probability buying and selling alternatives. Nonetheless, it is essential to do not forget that no sample is foolproof, and danger administration methods are important to mitigate potential losses. Combining triangle sample evaluation with different technical indicators and basic evaluation can additional improve buying and selling choices and enhance general buying and selling efficiency. Steady studying and expertise are key to mastering the artwork of buying and selling round these dynamic chart patterns.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Triangle Sample: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!