Decoding The USD/VND Trade Fee Chart: A Deep Dive Into Vietnam’s Foreign money

By admin / October 1, 2024 / No Comments / 2025

Decoding the USD/VND Trade Fee Chart: A Deep Dive into Vietnam’s Foreign money

Associated Articles: Decoding the USD/VND Trade Fee Chart: A Deep Dive into Vietnam’s Foreign money

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the USD/VND Trade Fee Chart: A Deep Dive into Vietnam’s Foreign money. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the USD/VND Trade Fee Chart: A Deep Dive into Vietnam’s Foreign money

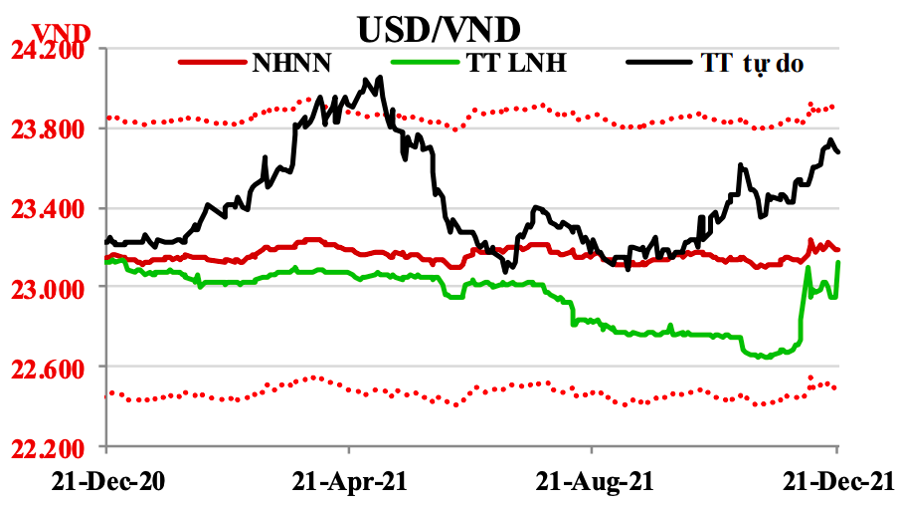

The USD/VND change price, representing the worth of the US greenback in opposition to the Vietnamese đồng (VND), is a vital indicator of Vietnam’s financial well being and its world standing. Understanding the fluctuations depicted within the USD/VND change price chart requires analyzing a posh interaction of home and worldwide components. This text delves into the intricacies of this chart, exploring its historic tendencies, influencing components, and implications for companies, buyers, and on a regular basis Vietnamese residents.

Historic Context: A Managed Float

The Vietnamese đồng has undergone vital adjustments since its inception. Initially pegged to the US greenback, Vietnam transitioned to a managed floating change price regime in 1991, permitting for extra flexibility whereas sustaining a level of presidency management. This strategy aimed to stability the advantages of a market-driven change price with the necessity for macroeconomic stability. The chart reveals a historical past of gradual depreciation of the VND in opposition to the USD, punctuated by intervals of relative stability and sharp fluctuations. These fluctuations aren’t random; they mirror the dynamic interaction of assorted financial and political forces.

Key Elements Influencing the USD/VND Trade Fee

A number of key components contribute to the actions noticed on the USD/VND change price chart:

-

US Financial Coverage: The Federal Reserve’s actions considerably affect the USD’s worth globally. Rate of interest hikes within the US typically strengthen the greenback, resulting in the next USD/VND price (which means extra VND are wanted to purchase one USD). Conversely, rate of interest cuts weaken the greenback, probably inflicting the USD/VND price to fall. The chart typically exhibits a correlation between US rate of interest adjustments and subsequent actions within the USD/VND change price.

-

Vietnamese Financial Coverage: The State Financial institution of Vietnam (SBV), the nation’s central financial institution, performs a vital function in managing the change price. The SBV intervenes within the international change market by means of shopping for and promoting USD to affect the VND’s worth. These interventions are sometimes aimed toward sustaining stability and stopping extreme volatility. The chart might present intervals of SBV intervention, marked by a brief slowing or reversal of the prevailing development.

-

World Financial Situations: World financial shocks, equivalent to recessions or monetary crises, can considerably affect the USD/VND change price. In periods of worldwide uncertainty, buyers typically flock to safe-haven belongings just like the US greenback, growing its demand and strengthening it in opposition to the VND. The chart typically displays these world occasions with intervals of sharp appreciation of the USD in opposition to the VND.

-

Vietnam’s Financial Efficiency: Vietnam’s financial development price, inflation, and present account stability are essential home components influencing the change price. Sturdy financial development usually helps the VND, whereas excessive inflation and a big present account deficit can weaken it. The chart typically showcases a constructive correlation between Vietnam’s financial efficiency and the energy of its foreign money. Sturdy export efficiency, for instance, typically boosts the VND.

-

International Direct Funding (FDI): Inflows of FDI into Vietnam strengthen the demand for VND, contributing to its appreciation. Conversely, decreased FDI can put downward strain on the VND. The chart may mirror intervals of elevated FDI with a corresponding strengthening of the VND.

-

Political and Geopolitical Elements: Political stability and worldwide relations play a major function. Geopolitical uncertainties can result in capital flight, weakening the VND. Main political occasions in Vietnam or globally also can affect investor sentiment and subsequently affect the change price. The chart may present momentary dips or spikes associated to vital political developments.

-

Hypothesis and Market Sentiment: Market sentiment and speculative buying and selling can considerably affect the USD/VND change price. Rumors, forecasts, and expectations about future financial circumstances can drive short-term fluctuations, even within the absence of basic adjustments. The chart may present intervals of excessive volatility pushed purely by speculative exercise.

Decoding the USD/VND Trade Fee Chart: Sensible Implications

Understanding the USD/VND change price chart is essential for numerous stakeholders:

-

Importers and Exporters: Fluctuations within the change price straight affect the profitability of import and export companies. A stronger USD makes imports costlier and exports cheaper for Vietnamese companies, whereas a weaker USD has the alternative impact. Companies must fastidiously monitor the chart and use hedging methods to mitigate change price dangers.

-

Traders: The change price is a key issue for buyers contemplating investments in Vietnam. A secure and predictable change price reduces funding danger, attracting extra international capital. Traders analyze the chart to evaluate potential dangers and returns related to investments in Vietnamese belongings.

-

Vacationers: The change price straight impacts the price of journey for vacationers visiting Vietnam. A stronger USD makes journey to Vietnam costlier for US vacationers, whereas a weaker USD has the alternative impact. Vacationers typically monitor the chart to find out the optimum time to change foreign money.

-

Vietnamese Residents: The change price impacts the buying energy of Vietnamese residents, notably these with international foreign money earnings or money owed. A stronger USD will increase the price of imported items, whereas a weaker USD can result in larger inflation.

Predicting Future Actions: A Complicated Activity

Predicting future actions within the USD/VND change price is a difficult job. Whereas analyzing historic tendencies and understanding the influencing components gives precious insights, quite a few unpredictable occasions can considerably affect the change price. Refined econometric fashions and forecasting strategies are sometimes employed, however even these strategies have limitations.

Conclusion:

The USD/VND change price chart is a dynamic reflection of Vietnam’s financial efficiency and its integration into the worldwide economic system. Understanding the components that affect the change price is essential for companies, buyers, and policymakers. Whereas predicting future actions with certainty is not possible, a radical evaluation of historic tendencies and present financial circumstances will help stakeholders make knowledgeable selections and handle the dangers related to change price fluctuations. Steady monitoring of the chart, coupled with a complete understanding of the underlying financial and political forces, is important for navigating the complexities of Vietnam’s foreign money market.

Closure

Thus, we hope this text has offered precious insights into Decoding the USD/VND Trade Fee Chart: A Deep Dive into Vietnam’s Foreign money. We recognize your consideration to our article. See you in our subsequent article!