Decoding The W Chart Sample: Figuring out Potential Targets And Managing Danger

By admin / October 20, 2024 / No Comments / 2025

Decoding the W Chart Sample: Figuring out Potential Targets and Managing Danger

Associated Articles: Decoding the W Chart Sample: Figuring out Potential Targets and Managing Danger

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the W Chart Sample: Figuring out Potential Targets and Managing Danger. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the W Chart Sample: Figuring out Potential Targets and Managing Danger

The W chart sample, a visually hanging reversal formation, usually indicators a possible shift in market sentiment from bearish to bullish. Whereas its look is comparatively simple, precisely predicting its goal worth requires a nuanced understanding of its traits, the underlying asset’s dynamics, and sound threat administration methods. This text delves deep into the W sample, exploring its formation, identification, goal worth calculation strategies, limitations, and essential threat issues.

Understanding the W Chart Sample Formation

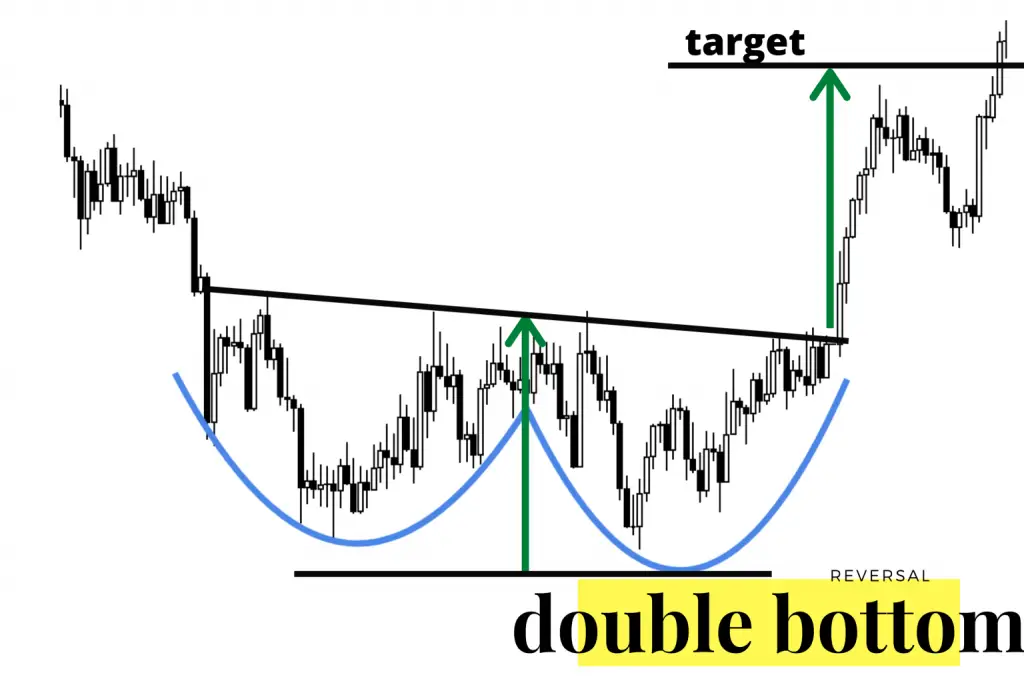

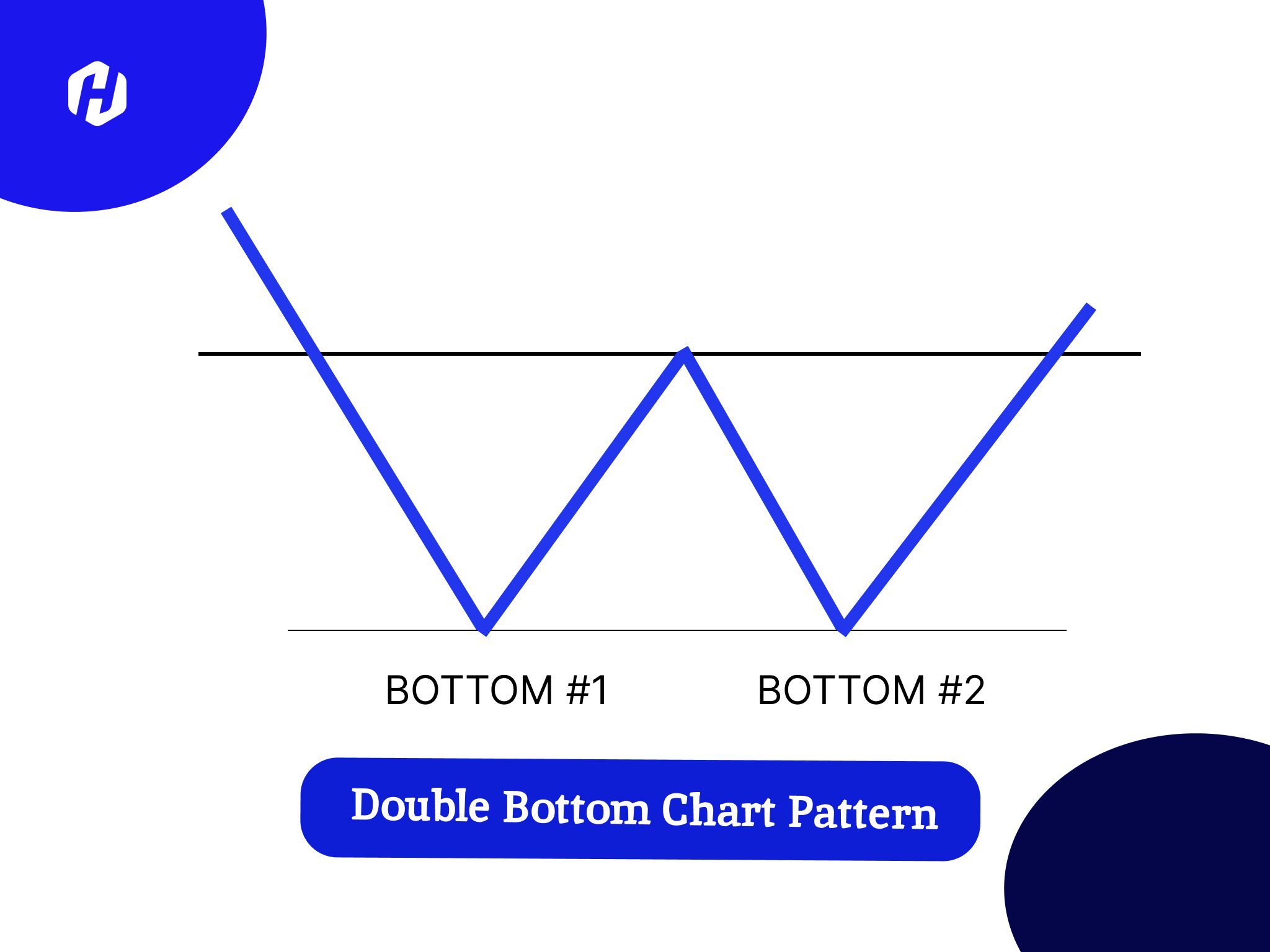

The W sample, often known as a double backside, is a bearish-to-bullish reversal sample. It is characterised by two distinct troughs (lows) related by a rebound (rally) that creates the "W" form. The sample signifies a possible exhaustion of promoting stress. Patrons step in on the second trough, pushing the value greater, indicating a possible shift in market momentum.

Key parts of a sound W sample embrace:

-

Two distinct troughs: These symbolize durations of serious promoting stress. Ideally, these troughs must be comparatively shut in worth, indicating a assist stage. A big divergence between the troughs weakens the sample’s predictive energy.

-

A rebound (rally): The value should get better considerably from the second trough, exceeding the value of the preliminary trough’s rebound excessive. This rally confirms the potential reversal.

-

Neckline: The neckline is a horizontal or barely sloping trendline connecting the highs between the 2 troughs. A decisive break above the neckline confirms the sample’s completion and indicators a possible worth improve.

-

Quantity: Quantity performs a vital position in confirming the sample’s validity. Usually, quantity must be greater throughout the preliminary drop, average throughout the rebound, and improve considerably upon the neckline breakout. Lowering quantity throughout the rebound can sign weak spot.

Strategies for Figuring out the W Sample Goal Value

A number of strategies exist for projecting the potential worth goal of a W sample. These strategies should not foolproof and must be used together with different technical indicators and elementary evaluation:

1. Measuring the Depth of the Sample:

That is the commonest technique. The space between the neckline and the bottom level of the second trough (the deepest level of the "W") is measured. This distance is then projected upwards from the neckline breakout level. This projection supplies a possible goal worth.

- Calculation: Goal Value = Neckline Breakout Value + (Neckline Value – Second Trough Value)

This technique assumes that the value motion after the breakout will mirror the value motion earlier than the breakout.

2. Fibonacci Retracement and Extension:

Fibonacci retracement ranges may also help determine potential assist and resistance ranges throughout the W sample. After the neckline breakout, Fibonacci extensions can be utilized to venture potential goal costs primarily based on the sample’s depth. Frequent extension ranges embrace 127.2%, 161.8%, and 261.8%.

- Calculation: This includes making use of the Fibonacci extension instrument to your complete W sample, utilizing the bottom level of the second trough as level 1, the neckline breakout as level 2, after which projecting potential targets primarily based on the chosen extension stage.

3. Utilizing Different Technical Indicators:

Combining the W sample with different technical indicators, akin to shifting averages (e.g., 20-day, 50-day, 200-day), RSI (Relative Energy Index), MACD (Transferring Common Convergence Divergence), and Bollinger Bands, can improve the accuracy of goal worth predictions. These indicators can affirm the energy of the bullish momentum and assist determine potential areas of assist and resistance.

Limitations of W Sample Goal Value Predictions:

It is essential to acknowledge that the W sample, like every other technical sample, just isn’t a assure of future worth actions. A number of elements can affect the accuracy of goal worth predictions:

-

Market Circumstances: Broader market tendencies and financial elements can considerably impression the sample’s effectiveness. A robust bearish market pattern would possibly override the bullish sign from the W sample.

-

Sample Validity: The accuracy of the goal worth relies upon closely on the sample’s validity. Imperfect W patterns with poorly outlined troughs or necklines can result in inaccurate predictions.

-

Quantity Affirmation: Lack of adequate quantity affirmation throughout the breakout can point out weak bullish momentum, doubtlessly resulting in a failed breakout and an inaccurate goal worth.

-

False Breakouts: The value would possibly break above the neckline solely to reverse course shortly after, leading to a false sign and an inaccurate goal.

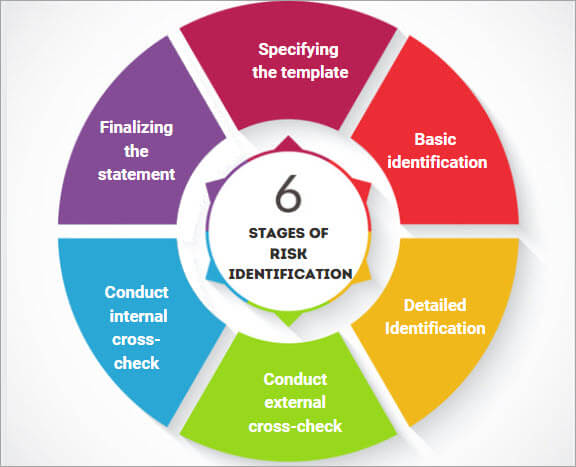

Danger Administration Methods for Buying and selling the W Sample:

Buying and selling the W sample includes inherent threat. Efficient threat administration methods are essential to guard capital and maximize potential earnings:

-

Cease-Loss Orders: Place a stop-loss order beneath the neckline to restrict potential losses if the breakout fails. The stop-loss order must be positioned at a stage that minimizes potential losses whereas permitting for some worth fluctuation.

-

Place Sizing: By no means threat extra capital than you possibly can afford to lose. Place sizing must be rigorously decided primarily based in your threat tolerance and the potential reward-to-risk ratio.

-

Trailing Cease-Loss: As soon as the value breaks above the neckline and strikes in your favor, think about using a trailing stop-loss order to guard earnings. This order will transfer your stop-loss order upwards as the value will increase, locking in earnings whereas minimizing potential losses.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout completely different property to scale back general threat.

-

Elementary Evaluation: Mix technical evaluation (the W sample) with elementary evaluation to realize a extra complete understanding of the underlying asset’s worth and potential for future progress.

Conclusion:

The W chart sample affords a useful instrument for figuring out potential bullish reversals. Nevertheless, precisely predicting its goal worth requires a radical understanding of its formation, varied calculation strategies, and limitations. Combining technical evaluation with elementary evaluation and implementing sound threat administration methods is essential for profitable buying and selling primarily based on the W sample. Do not forget that no technical indicator or sample ensures success, and prudent threat administration is paramount in any buying and selling endeavor. At all times conduct thorough analysis and take into account searching for recommendation from a professional monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered useful insights into Decoding the W Chart Sample: Figuring out Potential Targets and Managing Danger. We hope you discover this text informative and useful. See you in our subsequent article!