Decoding The XAU/USD Foreign exchange Chart: A Complete Information

By admin / September 11, 2024 / No Comments / 2025

Decoding the XAU/USD Foreign exchange Chart: A Complete Information

Associated Articles: Decoding the XAU/USD Foreign exchange Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the XAU/USD Foreign exchange Chart: A Complete Information. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the XAU/USD Foreign exchange Chart: A Complete Information

The XAU/USD, or Gold/US Greenback, foreign exchange pair is a extremely fashionable and actively traded instrument within the international alternate market. Its worth displays the worth of gold (XAU) when it comes to the US greenback (USD). Understanding the nuances of its chart is essential for any dealer, from novice to professional, aiming to navigate this dynamic market. This text will delve deep into analyzing the XAU/USD chart, exploring numerous technical indicators, worth motion patterns, and basic elements that affect its motion.

Understanding the Fundamentals: What Drives Gold Costs?

Earlier than diving into chart evaluation, it is important to know the basic elements influencing the XAU/USD worth. Gold’s worth is primarily pushed by its position as a safe-haven asset, inflation hedging, and industrial demand.

-

Secure-Haven Asset: Throughout occasions of financial uncertainty, geopolitical instability, or market volatility, traders flock to gold as a secure haven, driving its worth upwards. Occasions like wars, recessions, or foreign money crises usually result in a surge in gold demand.

-

Inflation Hedge: Gold is commonly thought of an inflation hedge. When inflation rises, the buying energy of fiat currencies decreases, main traders to hunt refuge in gold, whose worth tends to understand throughout inflationary durations. Central financial institution insurance policies, notably rate of interest hikes, considerably affect inflation expectations and subsequently, gold costs.

-

US Greenback Energy: The XAU/USD is inversely correlated with the US greenback. A stronger greenback makes gold costlier for holders of different currencies, thus lowering demand and placing downward stress on the gold worth. Conversely, a weaker greenback boosts gold’s attractiveness, driving its worth larger.

-

Curiosity Charges: Greater rates of interest typically enhance the chance value of holding non-yielding property like gold. Traders would possibly favor higher-yielding investments, resulting in diminished gold demand and decrease costs. Conversely, decrease rates of interest could make gold extra interesting.

-

Jewellery and Industrial Demand: Whereas much less impactful than the aforementioned elements, the demand for gold in jewellery and industrial purposes additionally influences its worth. Modifications in world financial development and client spending can have an effect on this demand.

-

Provide and Demand: The general provide of gold, influenced by mining manufacturing and recycling, additionally performs a task. A scarcity of provide relative to demand can push costs upwards.

Technical Evaluation of the XAU/USD Chart: Instruments and Strategies

Technical evaluation focuses on deciphering worth charts and utilizing numerous indicators to foretell future worth actions. A number of instruments are generally used to research the XAU/USD chart:

-

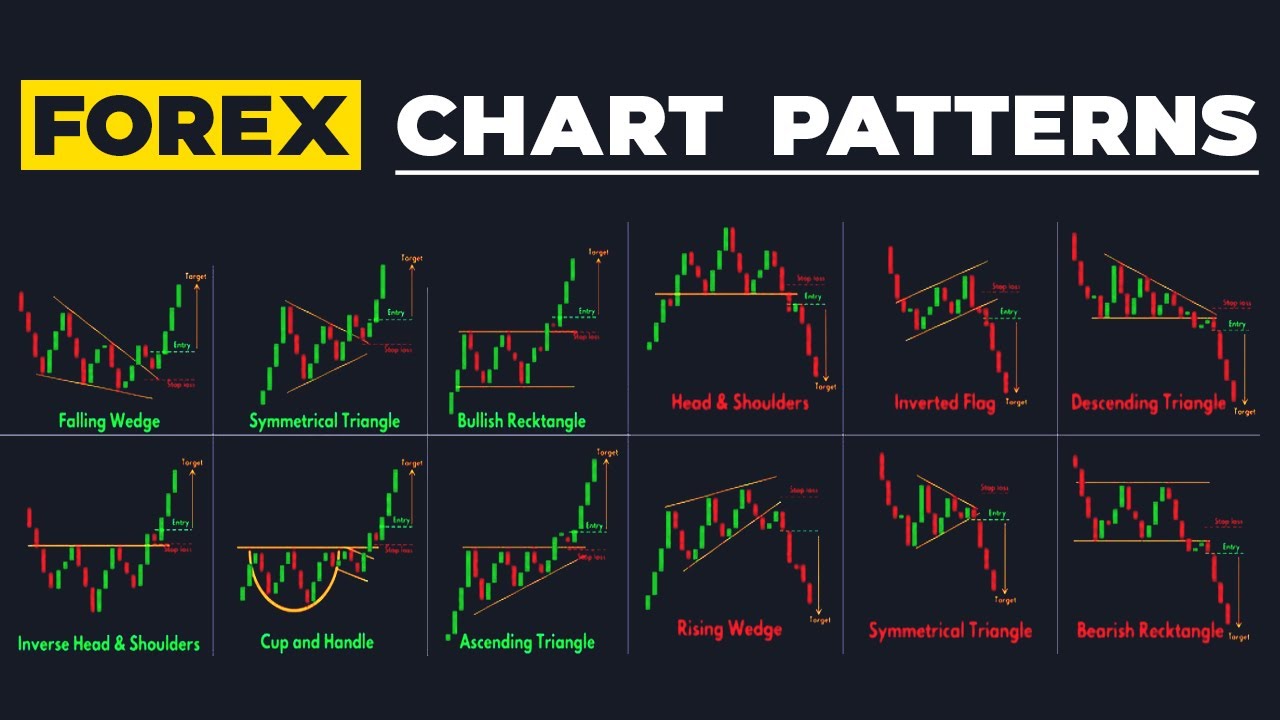

Candlestick Patterns: Candlestick patterns reveal details about the market’s sentiment and potential worth reversals or continuations. Recognizing patterns like bullish engulfing patterns, bearish engulfing patterns, hammer, hanging man, and capturing stars can present priceless insights.

-

Shifting Averages: Shifting averages, akin to easy transferring averages (SMA) and exponential transferring averages (EMA), clean out worth fluctuations and determine traits. Crossovers between totally different transferring averages can sign potential purchase or promote alerts. Generally used transferring averages embrace the 50-day, 100-day, and 200-day transferring averages.

-

Relative Energy Index (RSI): The RSI is a momentum oscillator that measures the velocity and alter of worth actions. Readings above 70 are typically thought of overbought, whereas readings under 30 are thought of oversold. These ranges can sign potential reversals.

-

MACD (Shifting Common Convergence Divergence): The MACD is one other momentum indicator that compares two transferring averages to determine adjustments in momentum. MACD crossovers and divergences can present priceless buying and selling alerts.

-

Fibonacci Retracements and Extensions: Fibonacci retracements and extensions are primarily based on the Fibonacci sequence and are used to determine potential assist and resistance ranges. These ranges can be utilized to put stop-loss orders and take-profit orders.

-

Help and Resistance Ranges: Help ranges symbolize worth factors the place the worth is prone to discover patrons and bounce again, whereas resistance ranges symbolize worth factors the place the worth is prone to discover sellers and reverse. Figuring out these ranges is essential for figuring out potential entry and exit factors.

-

Trendlines: Trendlines are drawn to attach a collection of upper lows (uptrend) or decrease highs (downtrend). Breaks of trendlines can sign vital shifts available in the market’s path.

Decoding the Chart: Placing it All Collectively

Analyzing the XAU/USD chart requires combining basic evaluation with technical evaluation. For instance, if the US greenback is weakening resulting from a dovish financial coverage stance from the Federal Reserve, and the chart reveals a bullish candlestick sample with optimistic RSI and MACD readings, it’d recommend a robust purchase sign. Nonetheless, it is essential to think about the general market context and potential geopolitical dangers.

Danger Administration and Buying and selling Methods

Buying and selling the XAU/USD, like another monetary instrument, includes vital danger. Implementing a strong danger administration technique is essential. This consists of:

-

Place Sizing: By no means danger greater than a small share of your buying and selling capital on a single commerce.

-

Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses.

-

Take-Revenue Orders: Use take-profit orders to safe earnings when the worth reaches a predetermined goal.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout totally different property to mitigate danger.

Totally different Buying and selling Methods:

Varied buying and selling methods may be employed when buying and selling the XAU/USD:

-

Swing Buying and selling: Swing merchants maintain positions for a number of days or even weeks, aiming to seize vital worth swings.

-

Day Buying and selling: Day merchants open and shut positions throughout the similar buying and selling day.

-

Scalping: Scalpers purpose to revenue from small worth actions, holding positions for only some seconds or minutes.

-

Development Following: Development followers determine and experience established traits, aiming to revenue from constant worth actions in a selected path.

Conclusion:

The XAU/USD chart is a posh and dynamic entity influenced by a mess of things. Profitable buying and selling requires an intensive understanding of each basic and technical evaluation, coupled with a sound danger administration technique. By diligently finding out the chart, using numerous technical indicators, and staying knowledgeable about macroeconomic occasions, merchants can enhance their probabilities of making knowledgeable choices and navigating the intricacies of the gold market. Do not forget that previous efficiency is just not indicative of future outcomes, and all buying and selling includes danger. It is essential to conduct thorough analysis and take into account in search of recommendation from a certified monetary advisor earlier than participating in foreign currency trading.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the XAU/USD Foreign exchange Chart: A Complete Information. We respect your consideration to our article. See you in our subsequent article!