Decoding The YTL Company Share Worth: A Complete Chart Evaluation

By admin / June 30, 2024 / No Comments / 2025

Decoding the YTL Company Share Worth: A Complete Chart Evaluation

Associated Articles: Decoding the YTL Company Share Worth: A Complete Chart Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the YTL Company Share Worth: A Complete Chart Evaluation. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the YTL Company Share Worth: A Complete Chart Evaluation

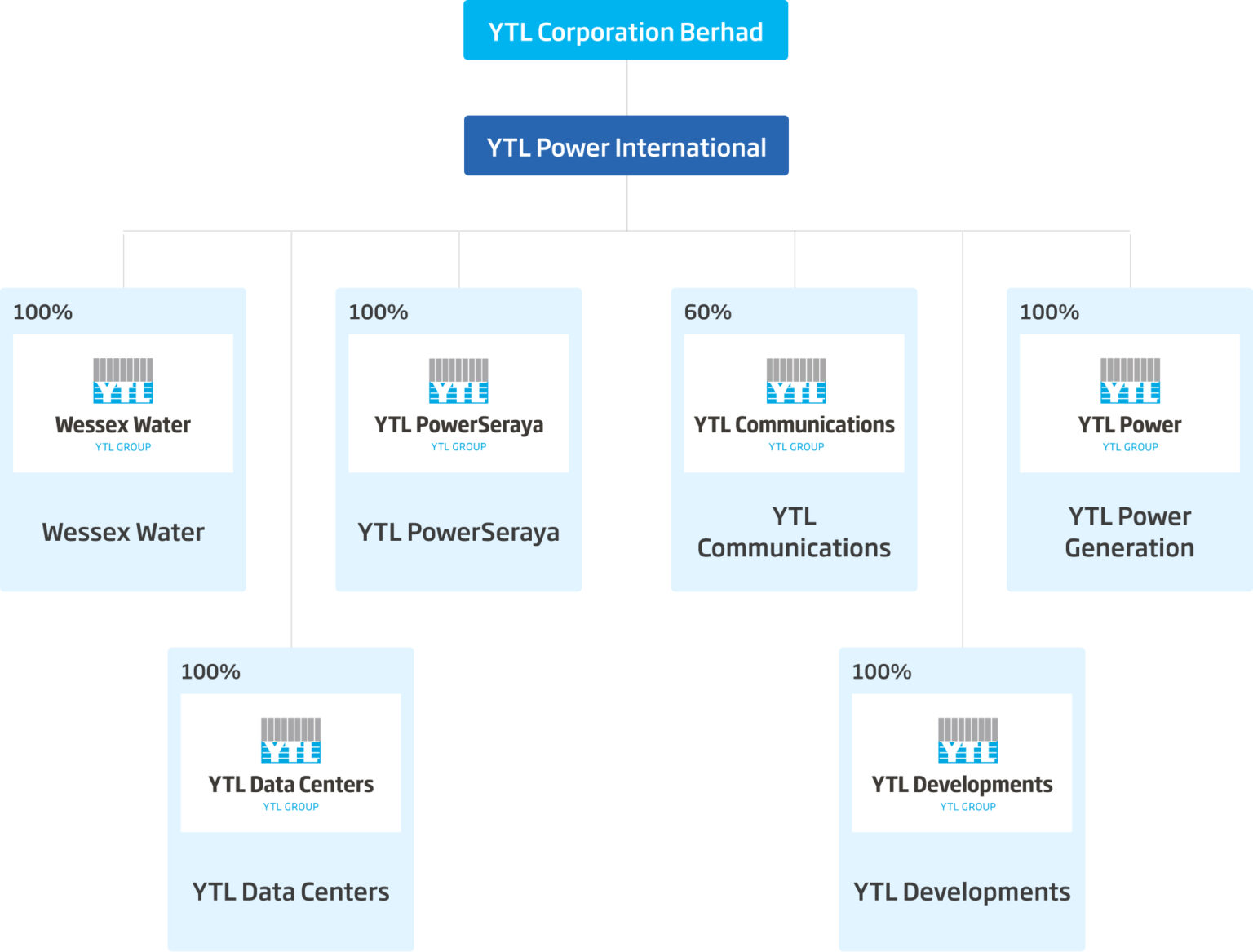

YTL Company Berhad (YTL), a Malaysian multinational conglomerate, boasts a various portfolio spanning vitality, development, property improvement, and cement manufacturing. Understanding its share worth trajectory requires a nuanced evaluation of its monetary efficiency, market sentiment, and broader macroeconomic components. This text delves deep into the YTL share worth commerce chart, analyzing historic traits, figuring out key assist and resistance ranges, and exploring potential future actions. We are going to make the most of technical evaluation strategies to interpret the chart and provide insights, however it’s essential to do not forget that this evaluation will not be monetary recommendation. Particular person buyers ought to conduct their very own thorough analysis earlier than making any funding choices.

Historic Efficiency: A Fowl’s Eye View

Analyzing the YTL share worth chart over the previous decade reveals a fancy sample of development, consolidation, and durations of volatility. To successfully interpret this, we have to take into account varied timeframes:

-

Lengthy-Time period Pattern (10+ years): A protracted-term chart will illustrate YTL’s general efficiency. Search for important highs and lows, figuring out potential main assist and resistance zones. These zones usually characterize psychological boundaries for merchants and buyers, doubtlessly influencing future worth actions. The long-term pattern would possibly reveal a basic upward, downward, or sideways motion, providing perception into the corporate’s long-term well being and investor confidence.

-

Medium-Time period Pattern (1-3 years): This timeframe helps determine intermediate traits and potential reversals. Observing the medium-term pattern permits us to evaluate the effectiveness of YTL’s strategic initiatives and their influence on investor sentiment. Figuring out patterns like head and shoulders, double tops/bottoms, or flags can present clues about potential future worth actions.

-

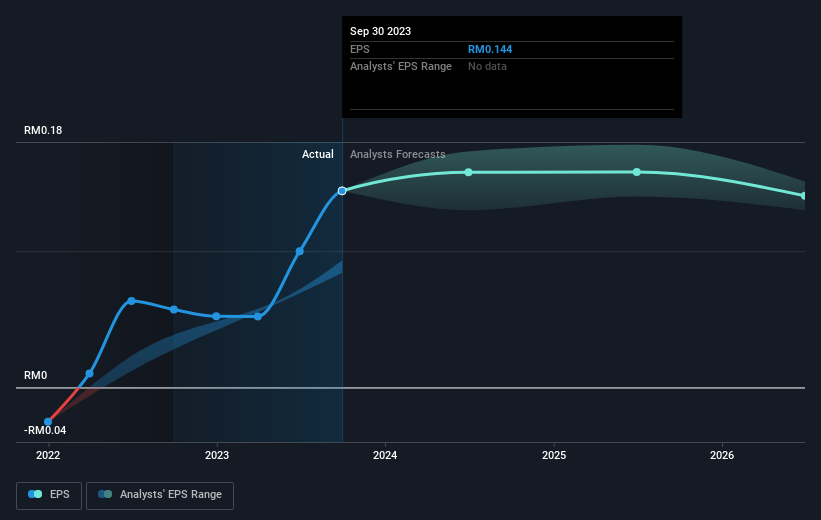

Brief-Time period Pattern (weeks/months): The short-term chart supplies insights into current market exercise and the rapid worth course. This timeframe is closely influenced by each day market fluctuations and information occasions. Analyzing short-term traits utilizing indicators like transferring averages, RSI (Relative Power Index), and MACD (Transferring Common Convergence Divergence) will help determine potential entry and exit factors for merchants.

Key Assist and Resistance Ranges:

Assist ranges characterize worth factors the place shopping for strain is anticipated to outweigh promoting strain, stopping additional worth declines. Resistance ranges, conversely, are worth factors the place promoting strain is anticipated to outweigh shopping for strain, hindering additional worth will increase. Figuring out these ranges on the YTL share worth chart is essential for each long-term buyers and short-term merchants. Previous assist and resistance ranges usually act as future ranges, providing potential entry and exit indicators.

These ranges could be recognized visually on the chart by observing earlier worth reversals and consolidations. Moreover, technical indicators like Fibonacci retracements and pivot factors will help pinpoint potential assist and resistance areas with extra precision.

Technical Indicators: Deciphering the Alerts

Technical evaluation employs varied indicators to gauge momentum, pattern energy, and potential reversals. Making use of these indicators to the YTL share worth chart can improve our understanding of the underlying dynamics:

-

Transferring Averages: Easy Transferring Averages (SMA) and Exponential Transferring Averages (EMA) clean out worth fluctuations, highlighting the underlying pattern. Crossovers between totally different transferring averages (e.g., a 50-day SMA crossing above a 200-day SMA) can sign potential pattern modifications.

-

Relative Power Index (RSI): The RSI measures the magnitude of current worth modifications to guage overbought or oversold circumstances. Readings above 70 usually recommend an overbought market, doubtlessly indicating a worth correction, whereas readings under 30 recommend an oversold market, doubtlessly signaling a worth rebound.

-

Transferring Common Convergence Divergence (MACD): The MACD identifies modifications in momentum by evaluating two transferring averages. MACD crossovers and divergences between the MACD line and the sign line can present insights into potential pattern modifications.

-

Quantity Evaluation: Analyzing buying and selling quantity alongside worth actions is essential. Excessive quantity throughout worth will increase confirms the energy of the uptrend, whereas excessive quantity throughout worth decreases confirms the energy of the downtrend. Low quantity throughout worth actions usually suggests weak momentum and potential reversals.

Basic Evaluation: The Underlying Story

Whereas technical evaluation focuses on chart patterns and indicators, basic evaluation examines the underlying monetary well being and prospects of YTL Company. Elements to contemplate embody:

-

Monetary Efficiency: Assessment YTL’s monetary statements, together with income development, profitability, debt ranges, and money move. Robust monetary efficiency usually interprets into constructive investor sentiment and better share costs.

-

Trade Traits: Analyze the general efficiency of the vitality, development, property, and cement sectors in Malaysia and globally. Favorable business traits can positively affect YTL’s efficiency.

-

Administration High quality: Assess the competence and expertise of YTL’s administration crew. Robust management can contribute considerably to the corporate’s success.

-

Aggressive Panorama: Consider YTL’s aggressive place inside its varied sectors. A robust aggressive benefit can result in sustained development and better profitability.

-

Geopolitical Elements: Think about the influence of macroeconomic components, reminiscent of rates of interest, inflation, and authorities insurance policies, on YTL’s operations and profitability.

Decoding the Chart: A Case Research

We could say a situation the place the YTL share worth chart reveals a long-term upward pattern, however the short-term pattern is at the moment downward. The RSI is under 30, indicating an oversold situation. The MACD is displaying a bullish divergence, suggesting a possible reversal. Moreover, the worth has reached a robust historic assist stage.

On this situation, a long-term investor would possibly view this as a possible shopping for alternative, given the long-term upward pattern and the oversold situation. A brief-term dealer may additionally take into account a protracted place, anticipating a worth rebound primarily based on the technical indicators and assist stage. Nonetheless, it is essential to contemplate the general market sentiment and potential dangers earlier than making any funding choices.

Conclusion: Navigating the YTL Share Worth Panorama

Analyzing the YTL share worth commerce chart requires a holistic method, combining technical and basic evaluation. Whereas technical evaluation can present worthwhile insights into potential worth actions, it is important to grasp the underlying fundamentals driving the corporate’s efficiency. Keep in mind that previous efficiency will not be indicative of future outcomes, and all investments carry danger. Thorough analysis, diversification, and a well-defined funding technique are essential for navigating the complexities of the YTL share worth and attaining your funding objectives. This text serves as an academic instrument and shouldn’t be construed as monetary recommendation. Seek the advice of with a certified monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the YTL Company Share Worth: A Complete Chart Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!