Mastering Nifty Financial institution Paper Buying and selling On TradingView: A Complete Information

By admin / August 23, 2024 / No Comments / 2025

Mastering Nifty Financial institution Paper Buying and selling on TradingView: A Complete Information

Associated Articles: Mastering Nifty Financial institution Paper Buying and selling on TradingView: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Mastering Nifty Financial institution Paper Buying and selling on TradingView: A Complete Information. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Mastering Nifty Financial institution Paper Buying and selling on TradingView: A Complete Information

The Nifty Financial institution index, a benchmark for India’s banking sector, affords thrilling buying and selling alternatives but in addition vital threat. Earlier than venturing into reside buying and selling, paper buying and selling on TradingView offers a useful coaching floor to hone your abilities, take a look at methods, and perceive market dynamics with out risking actual capital. This text delves into the intricacies of paper buying and selling the Nifty Financial institution index on TradingView, protecting every part from establishing your platform to creating efficient buying and selling methods.

Half 1: Organising your TradingView Paper Buying and selling Setting

TradingView’s intuitive interface and sturdy charting instruments make it a great platform for paper buying and selling. Here is tips on how to get began:

-

Account Creation: When you do not have already got one, create a free TradingView account. Whereas a paid subscription unlocks superior options, the free model is adequate for paper buying and selling.

-

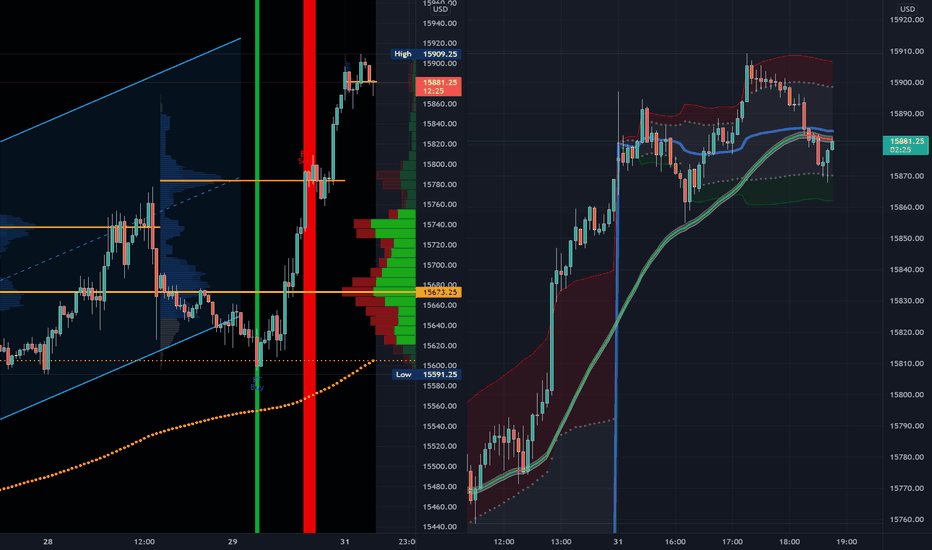

Selecting the Nifty Financial institution Chart: Navigate to the search bar and kind "NIFTY BANK". Choose the suitable index (often represented by a ticker like "BANKNIFTY"). You’ll be able to select varied chart sorts (candlestick, bar, line) relying in your choice.

-

Choosing the Timeframe: The timeframe you select relies on your buying and selling fashion. Scalpers may go for 1-minute or 5-minute charts, whereas swing merchants may choose every day or weekly charts. Experiment to search out what fits your strategy.

-

Including Indicators: TradingView affords an unlimited library of technical indicators. Start with a couple of elementary ones like transferring averages (SMA, EMA), Relative Power Index (RSI), MACD, and Bollinger Bands. Keep away from overloading your chart with too many indicators, as it might result in confusion. Concentrate on a couple of that resonate together with your technique.

-

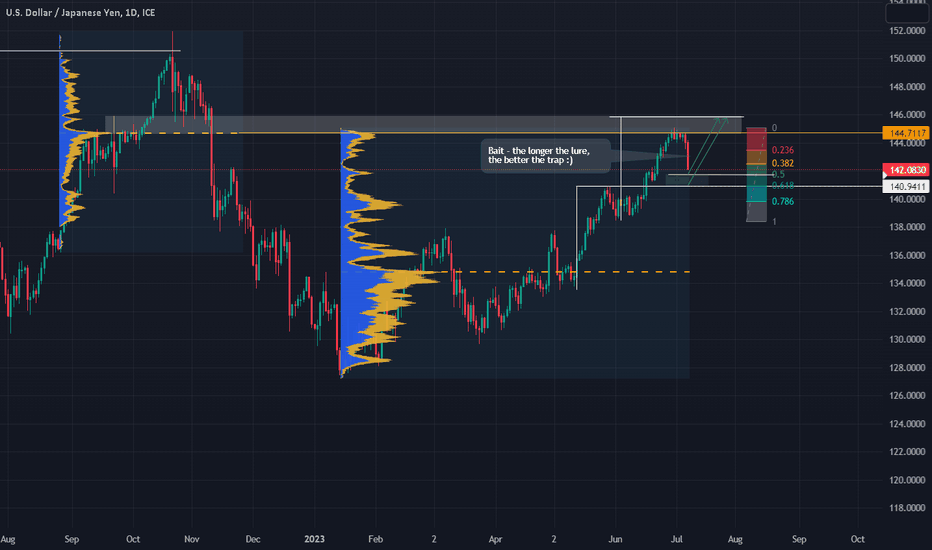

Drawing Instruments: Make the most of TradingView’s drawing instruments to determine assist and resistance ranges, trendlines, and chart patterns. Observe drawing Fibonacci retracements and extensions to determine potential reversal or continuation factors.

-

Paper Buying and selling Activation: TradingView’s paper buying and selling performance is seamlessly built-in. As soon as you have chosen your chart and indicators, you’ll be able to simulate trades straight throughout the platform. This often entails a button or choice throughout the chart interface. Make sure you perceive the method of putting purchase and promote orders, setting stop-loss and take-profit ranges.

Half 2: Growing a Nifty Financial institution Paper Buying and selling Technique

A well-defined buying and selling technique is essential for fulfillment in any market. Listed here are some key elements to contemplate:

-

Defining Your Buying and selling Type: Are you a day dealer, swing dealer, or place dealer? Your buying and selling fashion dictates your timeframe, threat tolerance, and the symptoms you employ.

-

Technical Evaluation: Mastering technical evaluation is paramount. Be taught to determine chart patterns (head and shoulders, double tops/bottoms, triangles), candlestick patterns (hammer, engulfing, doji), and assist and resistance ranges. Observe recognizing these patterns on the Nifty Financial institution chart.

-

Elementary Evaluation (Non-compulsory however Advisable): Whereas technical evaluation is the first focus for a lot of merchants, understanding the elemental components influencing the Nifty Financial institution index can present helpful context. This consists of monitoring rate of interest adjustments, financial knowledge releases, authorities insurance policies, and information associated to particular person banking shares throughout the index.

-

Threat Administration: That is arguably essentially the most essential side of buying and selling. By no means threat greater than a small proportion of your paper buying and selling capital on any single commerce. Set stop-loss orders to restrict potential losses. Decide your acceptable risk-reward ratio (e.g., 1:2, 1:3).

-

Backtesting: As soon as you have developed a method, backtest it utilizing historic knowledge. TradingView permits you to analyze previous efficiency to evaluate the effectiveness of your strategy. Nonetheless, keep in mind that previous efficiency shouldn’t be indicative of future outcomes.

-

Journaling: Preserve an in depth buying and selling journal. Report your trades, the rationale behind them, the outcomes, and any classes realized. This helps determine recurring errors and refine your technique over time.

Half 3: Particular Methods for Nifty Financial institution Paper Buying and selling on TradingView

Listed here are a couple of instance methods you’ll be able to take a look at on TradingView:

-

Transferring Common Crossover Technique: Use two transferring averages (e.g., a 50-day SMA and a 200-day SMA). Purchase when the shorter-term MA crosses above the longer-term MA (bullish sign) and promote when the shorter-term MA crosses beneath the longer-term MA (bearish sign).

-

RSI Divergence Technique: Search for divergences between the worth motion and the RSI. A bullish divergence happens when the worth makes decrease lows, however the RSI makes increased lows. This means a possible value reversal to the upside. A bearish divergence is the other.

-

Breakout Technique: Establish assist and resistance ranges. Purchase when the worth breaks above a resistance stage (breakout) and promote when the worth breaks beneath a assist stage (breakdown). Use stop-loss orders beneath the assist (for lengthy positions) or above the resistance (for brief positions).

-

Channel Buying and selling Technique: Establish value channels (parallel trendlines). Purchase when the worth bounces off the decrease trendline and promote when it bounces off the higher trendline.

Half 4: Superior Methods and Concerns

-

Quantity Evaluation: Take note of buying and selling quantity. Excessive quantity confirms value actions, whereas low quantity suggests weak value motion.

-

Order Ebook Evaluation (if accessible): Some brokers supply entry to order ebook knowledge, which may present insights into market depth and potential value actions.

-

Information and Occasions: Keep up to date on information and occasions that might influence the Nifty Financial institution index. Main financial bulletins, adjustments in financial coverage, and information associated to particular person banks can considerably have an effect on the index’s value.

-

Sentiment Evaluation: Monitor market sentiment by social media, information articles, and different sources. Excessive bullish or bearish sentiment can point out potential market reversals.

-

Place Sizing: Decide the suitable place dimension for every commerce primarily based in your threat tolerance and capital. By no means over-leverage.

Half 5: Transitioning from Paper Buying and selling to Stay Buying and selling

As soon as you have persistently achieved worthwhile leads to your paper buying and selling, you’ll be able to regularly transition to reside buying and selling. Nonetheless, keep in mind that reside buying and selling entails actual monetary threat. Begin with a small quantity of capital and proceed to refine your technique primarily based in your reside buying and selling expertise. By no means commerce with cash you can not afford to lose.

Conclusion:

Paper buying and selling the Nifty Financial institution index on TradingView affords a strong instrument for studying and refining your buying and selling abilities. By mastering the platform’s options, creating a strong buying and selling technique, and diligently managing threat, you’ll be able to considerably enhance your probabilities of success once you ultimately transition to reside buying and selling. Keep in mind that constant observe, steady studying, and disciplined threat administration are key to long-term success within the dynamic world of monetary markets. All the time keep in mind that buying and selling entails vital threat, and losses are a risk. By no means make investments greater than you’ll be able to afford to lose.

Closure

Thus, we hope this text has supplied helpful insights into Mastering Nifty Financial institution Paper Buying and selling on TradingView: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!