Mastering The Artwork Of Charting In TradingView: A Complete Information

By admin / October 19, 2024 / No Comments / 2025

Mastering the Artwork of Charting in TradingView: A Complete Information

Associated Articles: Mastering the Artwork of Charting in TradingView: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Mastering the Artwork of Charting in TradingView: A Complete Information. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Mastering the Artwork of Charting in TradingView: A Complete Information

TradingView has turn into a ubiquitous platform for merchants of all ranges, providing a wealth of instruments and options to research markets and execute trades. On the coronary heart of this platform lies its highly effective charting engine, an important software for visualizing worth motion, figuring out patterns, and making knowledgeable buying and selling selections. This text delves into the intricacies of charting in TradingView, exploring its core functionalities, superior strategies, and finest practices for maximizing its potential.

Understanding the TradingView Charting Interface:

Step one to mastering TradingView charting is familiarizing your self with its interface. Whereas initially daunting, the structure is intuitive when you grasp the core components:

-

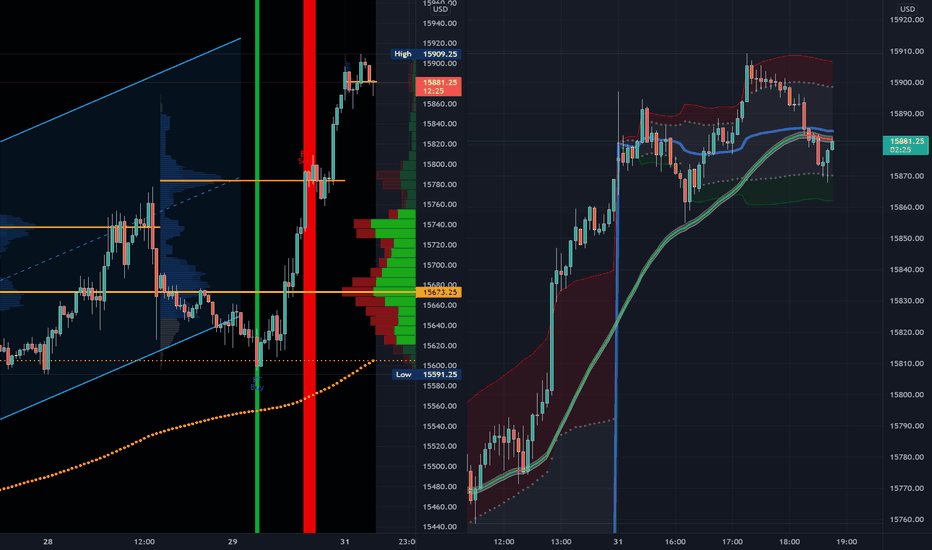

Chart Kind: TradingView presents varied chart varieties, every serving a singular function:

- Candlestick: The preferred alternative, displaying open, excessive, low, and shut costs for a given interval. Wonderful for figuring out candlestick patterns.

- Bar: Just like candlestick, however represents worth knowledge with vertical bars.

- Line: Connects closing costs, simplifying worth developments and highlighting total route.

- Heikin Ashi: A smoothed candlestick chart, lowering noise and highlighting developments.

- Space: Fills the realm between the value and the zero line, helpful for visualizing quantity or different indicators.

-

Timeframes: Selecting the suitable timeframe is paramount. From intraday (1-minute, 5-minute, hourly) to every day, weekly, and month-to-month charts, every timeframe reveals totally different features of worth habits. Analyzing a number of timeframes concurrently (e.g., a 5-minute chart alongside a every day chart) is a standard technique for confirming developments and figuring out potential entries and exits.

-

Drawing Instruments: TradingView boasts a complete suite of drawing instruments, permitting customers to annotate charts and determine key ranges:

- Trendlines: Join important swing highs and lows to determine the general development.

- Fibonacci Retracements: Based mostly on the Fibonacci sequence, these instruments assist determine potential assist and resistance ranges throughout retracements.

- Horizontal Strains: Mark assist and resistance ranges, essential for figuring out potential entry and exit factors.

- Fibonacci Extensions: Mission potential worth targets based mostly on Fibonacci ratios.

- Gann Strains: Based mostly on Gann’s theories, these traces assist determine potential assist and resistance ranges and worth targets.

- Rectangles, Channels, and different shapes: Spotlight worth consolidation areas, breakouts, and patterns.

-

Indicators: TradingView offers entry to an unlimited library of technical indicators, including one other layer of study to your charts. These indicators vary from easy transferring averages (SMAs) and relative power index (RSI) to extra advanced indicators just like the MACD and Bollinger Bands. Deciding on the appropriate indicators is determined by your buying and selling fashion and technique.

Superior Charting Strategies:

Past the fundamental functionalities, mastering superior charting strategies considerably enhances your analytical capabilities:

-

A number of Timeframe Evaluation: As talked about earlier, evaluating totally different timeframes offers a holistic view of the market. Figuring out a development on a every day chart and confirming it with a shorter timeframe (e.g., 4-hour or 1-hour) considerably reduces the danger of false indicators.

-

Combining Indicators: Utilizing a number of indicators in conjunction can present a extra complete evaluation than counting on a single indicator. As an example, combining RSI with MACD might help verify overbought or oversold circumstances and determine potential development reversals.

-

Sample Recognition: Studying to determine chart patterns like head and shoulders, double tops/bottoms, triangles, and flags is essential for predicting potential worth actions. These patterns typically precede important worth adjustments.

-

Help and Resistance Ranges: Figuring out key assist and resistance ranges is prime to profitable buying and selling. These ranges characterize worth areas the place shopping for or promoting strain is powerful, resulting in potential worth reversals or breakouts.

-

Quantity Evaluation: Integrating quantity evaluation with worth motion offers beneficial insights. Excessive quantity confirms worth actions, whereas low quantity suggests weak momentum.

-

Customizing your Chart: TradingView permits intensive customization. Adjusting colours, fonts, and indicator settings to fit your private preferences improves readability and enhances your buying and selling expertise. Creating customized layouts for various markets or buying and selling kinds is extremely helpful.

Greatest Practices for Efficient Charting:

-

Maintain it Easy: Keep away from cluttering your charts with too many indicators or drawing instruments. Give attention to just a few key indicators and instruments that align along with your buying and selling technique.

-

Context is Key: At all times think about the broader market context when analyzing charts. Information occasions, financial knowledge, and geopolitical components can considerably affect worth actions.

-

Backtesting: Earlier than implementing any buying and selling technique, backtest it on historic knowledge. TradingView permits backtesting utilizing its technique tester, serving to you consider the efficiency of your technique earlier than risking actual capital.

-

Danger Administration: By no means commerce and not using a correct danger administration plan. Outline your stop-loss and take-profit ranges earlier than coming into a commerce to restrict potential losses and shield your capital.

-

Steady Studying: The world of buying and selling is continually evolving. Keep up to date with the most recent market developments, technical evaluation strategies, and TradingView options to reinforce your charting abilities.

-

Paper Buying and selling: Observe your charting and buying and selling methods utilizing a paper buying and selling account earlier than risking actual cash. This lets you acquire expertise and refine your strategy with out monetary penalties.

Past the Fundamentals: Exploring Superior TradingView Options:

TradingView presents quite a few superior options that additional improve charting capabilities:

-

Pine Script: This highly effective scripting language permits customers to create customized indicators, methods, and drawing instruments. This opens up a world of prospects for tailoring your charting expertise to your particular wants.

-

Alerting System: Arrange alerts based mostly on worth actions, indicator indicators, or different circumstances. This lets you obtain notifications when particular buying and selling alternatives come up, even if you’re not actively monitoring the charts.

-

Group Options: TradingView boasts a vibrant neighborhood of merchants who share concepts, methods, and scripts. Leveraging this neighborhood can present beneficial insights and studying alternatives.

-

Integration with Brokers: TradingView integrates with many brokers, permitting you to execute trades immediately from the platform. This streamlines your workflow and improves effectivity.

Conclusion:

Mastering charting in TradingView is a journey, not a vacation spot. By understanding the core functionalities, exploring superior strategies, and following finest practices, you possibly can unlock the platform’s full potential and considerably enhance your buying and selling efficiency. Do not forget that constant follow, steady studying, and disciplined danger administration are essential for achievement in buying and selling. The instruments offered by TradingView are highly effective, however their effectiveness hinges on the person’s skill to interpret the knowledge and apply it strategically. Embrace the training course of, experiment with totally different strategies, and refine your strategy over time to turn into a more adept and profitable dealer.

Closure

Thus, we hope this text has offered beneficial insights into Mastering the Artwork of Charting in TradingView: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!