Mastering The QuickBooks Chart Of Accounts: A Complete Information

By admin / August 31, 2024 / No Comments / 2025

Mastering the QuickBooks Chart of Accounts: A Complete Information

Associated Articles: Mastering the QuickBooks Chart of Accounts: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Mastering the QuickBooks Chart of Accounts: A Complete Information. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Mastering the QuickBooks Chart of Accounts: A Complete Information

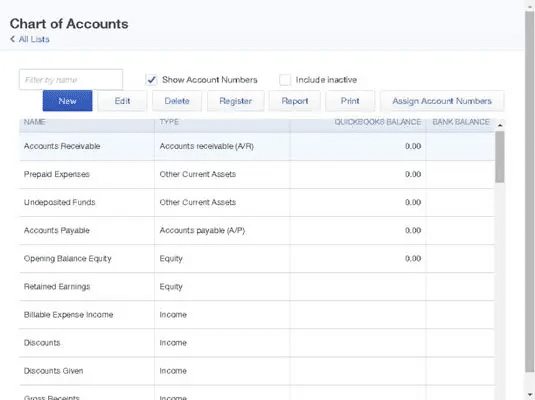

The Chart of Accounts in QuickBooks is the spine of your monetary system. It is a meticulously organized listing of all of your firm’s accounts, performing as a central repository for recording each monetary transaction. Understanding and correctly organising your Chart of Accounts is essential for correct monetary reporting, environment friendly bookkeeping, and knowledgeable enterprise selections. This text delves deep into the intricacies of the QuickBooks Chart of Accounts, protecting its goal, construction, account varieties, finest practices, and troubleshooting widespread points.

What’s a Chart of Accounts?

Merely put, a Chart of Accounts (COA) is a categorized listing of all of the accounts utilized by a enterprise to report its monetary transactions. Every account represents a particular side of the corporate’s monetary exercise, similar to property, liabilities, fairness, income, and bills. Consider it as an in depth monetary blueprint for your small business. Each transaction you report in QuickBooks is linked to a number of accounts in your COA, making certain that your monetary knowledge is precisely categorized and summarized.

The Construction of the QuickBooks Chart of Accounts:

QuickBooks provides a hierarchical construction on your COA, permitting for detailed categorization and reporting. This usually includes a system of account numbers, which may be personalized to a sure extent, although QuickBooks suggests an ordinary numbering system. The construction typically follows the accounting equation: Property = Liabilities + Fairness.

-

Property: These signify what your organization owns, together with money, accounts receivable (cash owed to you), stock, tools, and property. These accounts usually have numbers beginning with 1.

-

Liabilities: These signify what your organization owes to others, together with accounts payable (cash you owe to suppliers), loans payable, and accrued bills. These accounts usually have numbers beginning with 2.

-

Fairness: This represents the proprietor’s funding within the firm and the collected income or losses. This contains retained earnings, capital contributions, and withdrawals. These accounts usually have numbers beginning with 3.

-

Income: This represents the revenue generated from your small business actions, together with gross sales income, service income, and curiosity revenue. These accounts usually have numbers beginning with 4.

-

Bills: These signify the prices incurred in working your small business, together with price of products bought (COGS), salaries, lease, utilities, and promoting. These accounts usually have numbers beginning with 5 or 6.

Kinds of Accounts in QuickBooks:

QuickBooks provides a variety of account varieties, every designed to categorize particular monetary actions. Selecting the best account kind is essential for correct monetary reporting. Some widespread account varieties embrace:

-

Revenue Accounts: Used to report income from varied sources. Examples embrace Gross sales of Items, Service Income, Curiosity Revenue, and Rental Revenue.

-

Expense Accounts: Used to report prices incurred in working the enterprise. Examples embrace Price of Items Offered (COGS), Salaries Expense, Lease Expense, Utilities Expense, and Promoting Expense.

-

Asset Accounts: Used to trace what the corporate owns. Examples embrace Money, Accounts Receivable, Stock, Tools, and Buildings.

-

Legal responsibility Accounts: Used to trace what the corporate owes. Examples embrace Accounts Payable, Loans Payable, and Salaries Payable.

-

Fairness Accounts: Used to trace proprietor’s funding and retained earnings. Examples embrace Proprietor’s Fairness, Retained Earnings, and Drawings.

-

Different Accounts: QuickBooks additionally contains different account varieties similar to Financial institution Accounts, Credit score Card Accounts, and Undeposited Funds.

Finest Practices for Setting Up Your Chart of Accounts:

-

Plan Forward: Earlier than organising your COA, fastidiously contemplate your small business wants and the extent of element required for correct monetary reporting.

-

Use a Constant Chart of Accounts: Preserve consistency in your account naming and numbering conventions all through your accounting course of.

-

Preserve it Easy (Initially): Begin with a primary COA and add extra accounts as your small business grows and your reporting wants turn out to be extra advanced. Keep away from extreme element initially.

-

Use Descriptive Account Names: Select account names that clearly describe the character of the account. This enhances readability and understanding.

-

Commonly Evaluation and Replace: Periodically evaluate your COA to make sure it precisely displays your small business actions and stays related. Take away inactive accounts and add new ones as wanted.

-

Contemplate Business-Particular Accounts: Relying in your trade, it’s possible you’ll want particular accounts that aren’t included in an ordinary COA. For instance, a retail enterprise might have an account for "Gross sales Returns and Allowances."

-

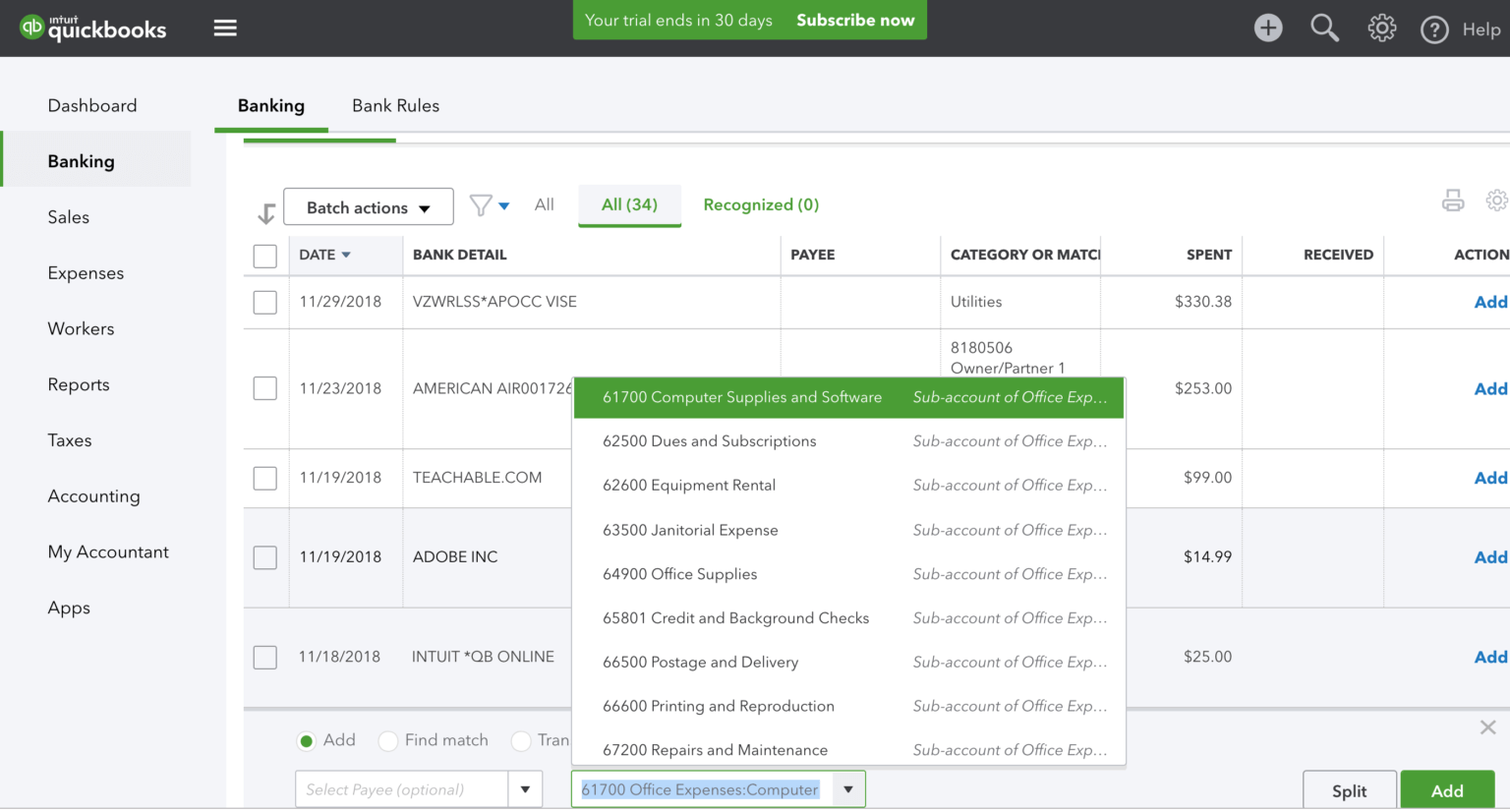

Make the most of Subaccounts: Make use of subaccounts to additional categorize your accounts and supply extra granular element inside important account classes. This improves reporting accuracy and permits for extra in-depth evaluation.

Troubleshooting Frequent Chart of Accounts Points:

-

Duplicate Accounts: Guarantee you do not create duplicate accounts. This may result in inaccurate monetary reporting. QuickBooks normally prevents this, however double-checking is essential.

-

Incorrect Account Sorts: Utilizing the unsuitable account kind can distort your monetary statements. Double-check the kind of every account earlier than saving it.

-

Inconsistent Naming Conventions: Preserve a constant naming conference on your accounts to enhance readability and reporting accuracy.

-

Lacking Accounts: Guarantee you may have all the mandatory accounts to trace your small business transactions. Omitting key accounts can result in incomplete monetary reporting.

-

Inactive Accounts: Commonly evaluate your COA to establish and take away inactive accounts, conserving your chart organized and environment friendly.

Importing and Exporting Chart of Accounts:

QuickBooks permits for importing and exporting your Chart of Accounts. That is helpful when migrating to a brand new QuickBooks model, organising a brand new firm file based mostly on an present one, or sharing your COA with different accountants or companies. The method usually includes utilizing a CSV file. All the time again up your knowledge earlier than importing or exporting your COA.

Conclusion:

The QuickBooks Chart of Accounts is a elementary element of your accounting system. A well-structured and meticulously maintained COA is important for correct monetary reporting, efficient enterprise administration, and knowledgeable decision-making. By understanding the totally different account varieties, finest practices, and potential troubleshooting points, you possibly can leverage the facility of your QuickBooks COA to optimize your monetary administration and obtain better success in your small business endeavors. Do not forget that the important thing to a profitable COA is cautious planning, constant upkeep, and common evaluate to make sure it stays a real reflection of your organization’s monetary actuality. Do not hesitate to hunt skilled recommendation in case you are not sure about any side of organising or managing your Chart of Accounts. A well-structured COA is an funding within the long-term well being and prosperity of your small business.

Closure

Thus, we hope this text has supplied useful insights into Mastering the QuickBooks Chart of Accounts: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!