Mastering The QuickBooks Chart Of Accounts: A Complete Information

By admin / October 11, 2024 / No Comments / 2025

Mastering the QuickBooks Chart of Accounts: A Complete Information

Associated Articles: Mastering the QuickBooks Chart of Accounts: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Mastering the QuickBooks Chart of Accounts: A Complete Information. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Mastering the QuickBooks Chart of Accounts: A Complete Information

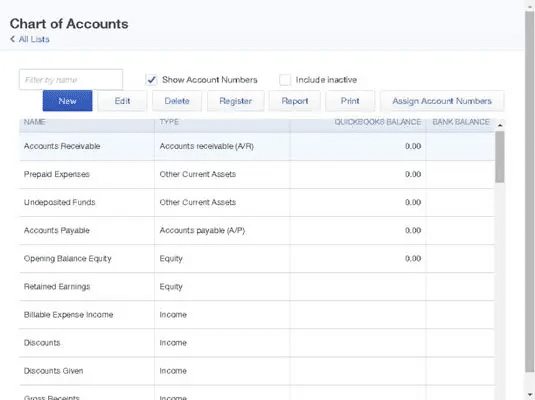

The Chart of Accounts in QuickBooks is the spine of your monetary record-keeping. It is a meticulously organized checklist of all of your firm’s accounts, performing as a central repository for each transaction. Understanding and meticulously managing your Chart of Accounts is essential for correct monetary reporting, streamlined bookkeeping, and knowledgeable enterprise choices. This complete information will delve into the intricacies of the QuickBooks Chart of Accounts, masking its construction, account varieties, finest practices for setup and upkeep, and the implications of poor chart of accounts administration.

Understanding the Construction and Function

The QuickBooks Chart of Accounts is a hierarchical system, categorizing your monetary actions into distinct accounts. Every account tracks a particular sort of economic exercise, resembling property, liabilities, fairness, income, and bills. This structured strategy ensures that each transaction is correctly categorised, facilitating correct monetary reporting and evaluation.

The construction usually follows a standardized accounting framework, usually mirroring the rules of typically accepted accounting rules (GAAP) or different related accounting requirements. This consistency ensures that your monetary statements are dependable and corresponding to trade benchmarks.

Key Account Varieties within the QuickBooks Chart of Accounts:

The Chart of Accounts includes a number of key account varieties, every serving a particular objective:

-

Property: These symbolize what your organization owns. Examples embody:

- Present Property: Money, Accounts Receivable (cash owed to you), Stock, Pay as you go Bills.

- Fastened Property: Property, Plant, and Tools (PP&E), Automobiles, Furnishings & Fixtures. These are usually depreciated over time.

- Different Property: Investments, Intangible Property (patents, copyrights).

-

Liabilities: These symbolize what your organization owes to others. Examples embody:

- Present Liabilities: Accounts Payable (cash you owe to suppliers), Brief-term Loans, Salaries Payable.

- Lengthy-term Liabilities: Lengthy-term Loans, Mortgages, Bonds Payable.

-

Fairness: This represents the house owners’ stake within the firm. For sole proprietorships and partnerships, that is usually the proprietor’s capital account. For companies, it contains retained earnings and contributed capital.

-

Income: This represents revenue generated from what you are promoting operations. Examples embody:

- Gross sales Income

- Service Income

- Curiosity Revenue

- Rental Revenue

-

Bills: These symbolize the prices incurred in working what you are promoting. Examples embody:

- Price of Items Offered (COGS)

- Salaries Expense

- Lease Expense

- Utilities Expense

- Advertising Expense

- Depreciation Expense

Organising your QuickBooks Chart of Accounts:

Organising your Chart of Accounts appropriately from the outset is essential. A poorly designed chart can result in inaccurate reporting and make monetary evaluation a nightmare. Listed below are some key concerns:

-

Select the Proper Chart of Accounts Template: QuickBooks presents varied templates catering to completely different enterprise varieties. Choose the one that almost all intently aligns together with your trade and enterprise construction. You possibly can all the time customise it later.

-

Use a Constant Chart of Accounts: Keep consistency in your account naming conventions. Keep away from utilizing imprecise or ambiguous account names. For instance, as a substitute of "Bills," use particular names like "Lease Expense," "Utilities Expense," and "Advertising Expense."

-

Section Accounts for Detailed Reporting: Think about segmenting your accounts for extra granular reporting. For instance, you might need separate accounts for various product traces or service varieties inside your income accounts.

-

Often Evaluation and Replace: Your corporation evolves, and so ought to your Chart of Accounts. Often evaluate your account construction to make sure it precisely displays your present operations. Add new accounts as wanted and remove out of date ones.

-

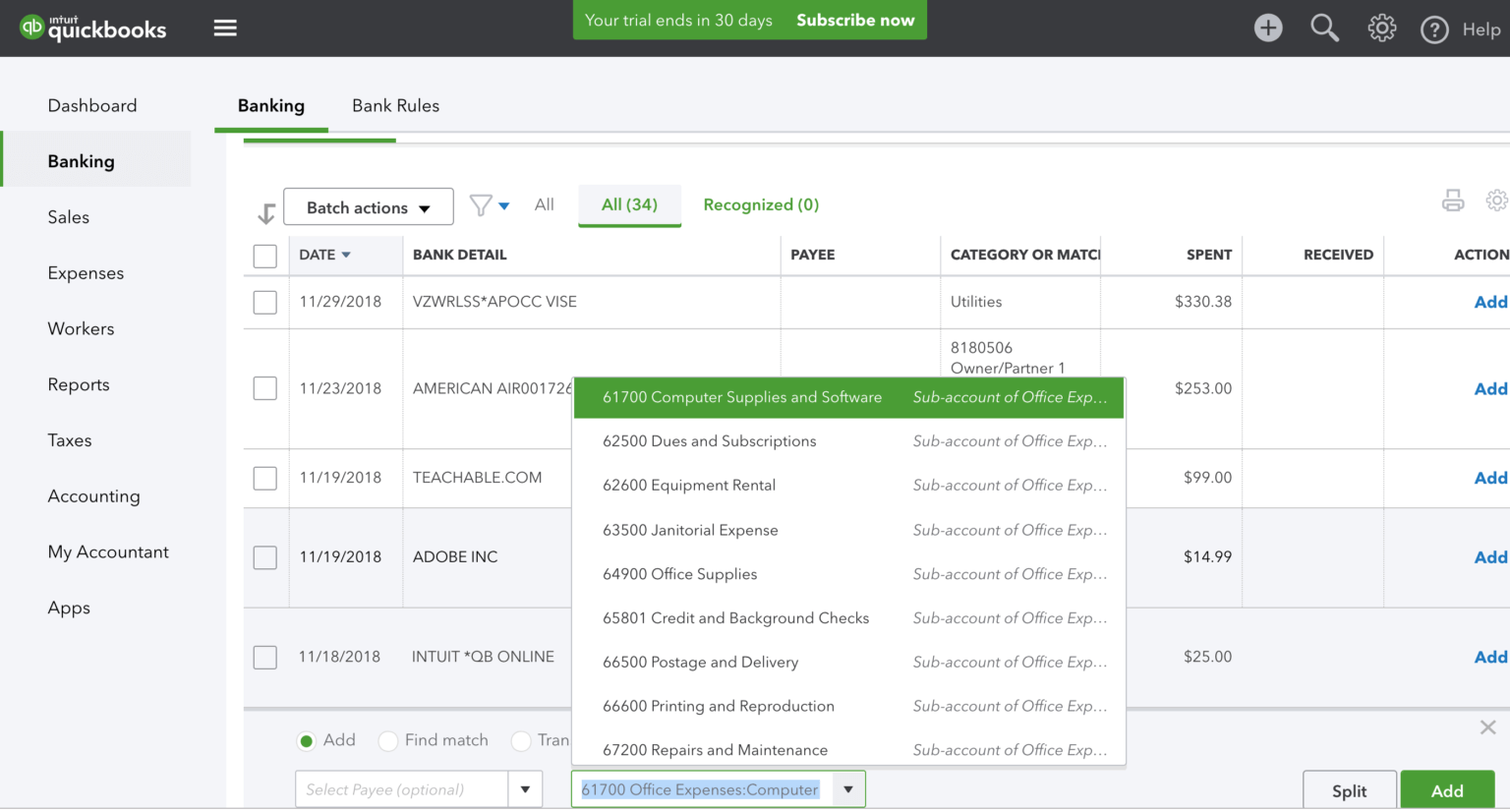

Use QuickBooks’ Constructed-in Options: Leverage QuickBooks’ options to streamline the method. The software program offers instruments to categorize accounts, assign account numbers, and generate stories based mostly in your account construction.

Greatest Practices for Chart of Accounts Administration:

-

Numbering System: Implement a logical numbering system on your accounts. This facilitates group and simplifies looking. A typical strategy is to make use of a hierarchical construction, with bigger numbers representing sub-accounts.

-

Account Descriptions: Present clear and concise descriptions for every account. This ensures that everybody in your group understands the aim of every account.

-

Common Reconciliation: Often reconcile your financial institution statements together with your QuickBooks information to make sure accuracy. This course of helps determine discrepancies and preserve the integrity of your monetary data.

-

Information Backup: Often again up your QuickBooks information to guard in opposition to information loss. That is essential for sustaining the integrity of your Chart of Accounts and your monetary data.

-

Coaching for Staff: Be certain that all workers concerned in monetary transactions are correctly skilled on using the Chart of Accounts. This minimizes errors and ensures consistency in information entry.

Penalties of Poor Chart of Accounts Administration:

Ignoring the significance of a well-structured and maintained Chart of Accounts can have vital penalties:

-

Inaccurate Monetary Statements: A poorly designed Chart of Accounts can result in inaccurate monetary statements, hindering your means to make knowledgeable enterprise choices.

-

Problem in Monitoring Bills: With no correct categorization system, monitoring bills turns into difficult, making it tough to determine areas for value discount.

-

Compliance Points: Inaccurate monetary data can result in compliance points with tax authorities and different regulatory our bodies.

-

Time-Consuming Reconciliation: A poorly organized Chart of Accounts could make the reconciliation course of time-consuming and irritating.

-

Restricted Insights: With no well-structured Chart of Accounts, you will lack the granular information wanted to achieve significant insights into what you are promoting efficiency.

Conclusion:

The QuickBooks Chart of Accounts is a elementary ingredient of your monetary administration system. A well-designed and meticulously maintained Chart of Accounts is important for correct monetary reporting, environment friendly bookkeeping, and knowledgeable decision-making. By adhering to finest practices and recurrently reviewing your account construction, you’ll be able to be sure that your Chart of Accounts stays a worthwhile asset to what you are promoting, supporting development and profitability. Investing the effort and time upfront to determine a sturdy Chart of Accounts will yield vital returns when it comes to improved monetary accuracy, streamlined operations, and enhanced enterprise insights. Keep in mind, a well-organized Chart of Accounts isn’t just a listing of accounts; it is the inspiration of your monetary well being.

Closure

Thus, we hope this text has supplied worthwhile insights into Mastering the QuickBooks Chart of Accounts: A Complete Information. We admire your consideration to our article. See you in our subsequent article!