Mastering The Xero Chart Of Accounts: A Complete Information

By admin / June 9, 2024 / No Comments / 2025

Mastering the Xero Chart of Accounts: A Complete Information

Associated Articles: Mastering the Xero Chart of Accounts: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Mastering the Xero Chart of Accounts: A Complete Information. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Mastering the Xero Chart of Accounts: A Complete Information

The chart of accounts is the spine of any accounting system, and Xero is not any exception. A well-structured chart of accounts is essential for correct monetary reporting, environment friendly bookkeeping, and knowledgeable decision-making. This complete information delves into the intricacies of making, managing, and optimizing your Xero chart of accounts, guaranteeing you are outfitted to harness its full potential.

Understanding the Xero Chart of Accounts:

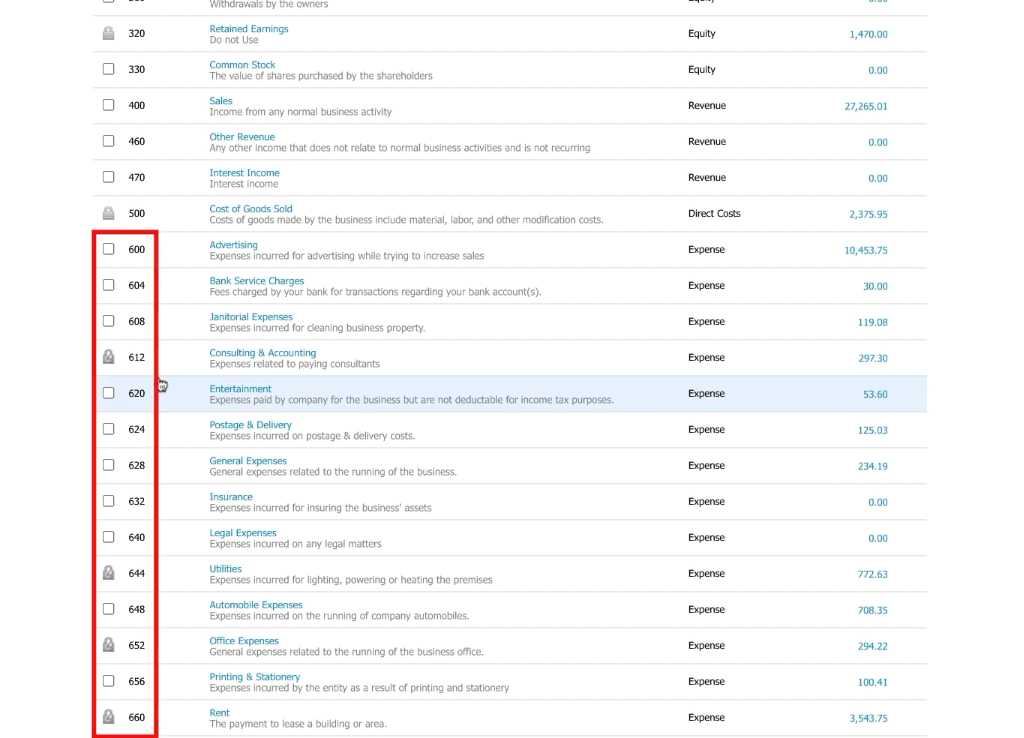

In Xero, the chart of accounts is a listing of all of the accounts used to document your corporation’s monetary transactions. Every account represents a particular class of economic exercise, akin to belongings, liabilities, fairness, income, and bills. These accounts are organized hierarchically, permitting for detailed monitoring and reporting. The construction you select immediately impacts the standard and usefulness of your monetary statements. A poorly designed chart of accounts can result in inaccurate reporting, making it obscure your corporation’s monetary well being.

Key Account Varieties in Xero:

Xero makes use of a standardized chart of accounts construction primarily based on usually accepted accounting ideas (GAAP). Understanding the totally different account varieties is prime to efficient chart of accounts administration:

-

Property: These signify what your corporation owns. Examples embody:

- Present Property: Money, accounts receivable, stock, pay as you go bills. These are anticipated to be transformed to money inside a 12 months.

- Non-Present Property: Property, plant, and gear (PP&E), long-term investments. These have a lifespan exceeding one 12 months.

-

Liabilities: These signify what your corporation owes to others. Examples embody:

- Present Liabilities: Accounts payable, salaries payable, short-term loans. These are due inside a 12 months.

- Non-Present Liabilities: Lengthy-term loans, mortgages. These are due past one 12 months.

-

Fairness: This represents the proprietor’s stake within the enterprise. For sole proprietorships and partnerships, this is likely to be a single fairness account. For firms, it contains retained earnings, contributed capital, and different fairness accounts.

-

Income: This represents revenue generated from your corporation operations. Examples embody gross sales income, service income, curiosity revenue. Completely different income streams ought to ideally have separate accounts for detailed evaluation.

-

Bills: This represents prices incurred in operating your corporation. Examples embody:

- Price of Items Offered (COGS): The direct prices related to producing items bought.

- Working Bills: Hire, salaries, utilities, advertising and marketing, and many others. These are bills associated to the day-to-day operating of the enterprise.

Organising your Xero Chart of Accounts:

Organising your chart of accounts in Xero is a vital first step. Whereas Xero supplies a default chart of accounts, tailoring it to your particular enterprise wants is important. Here is a step-by-step information:

-

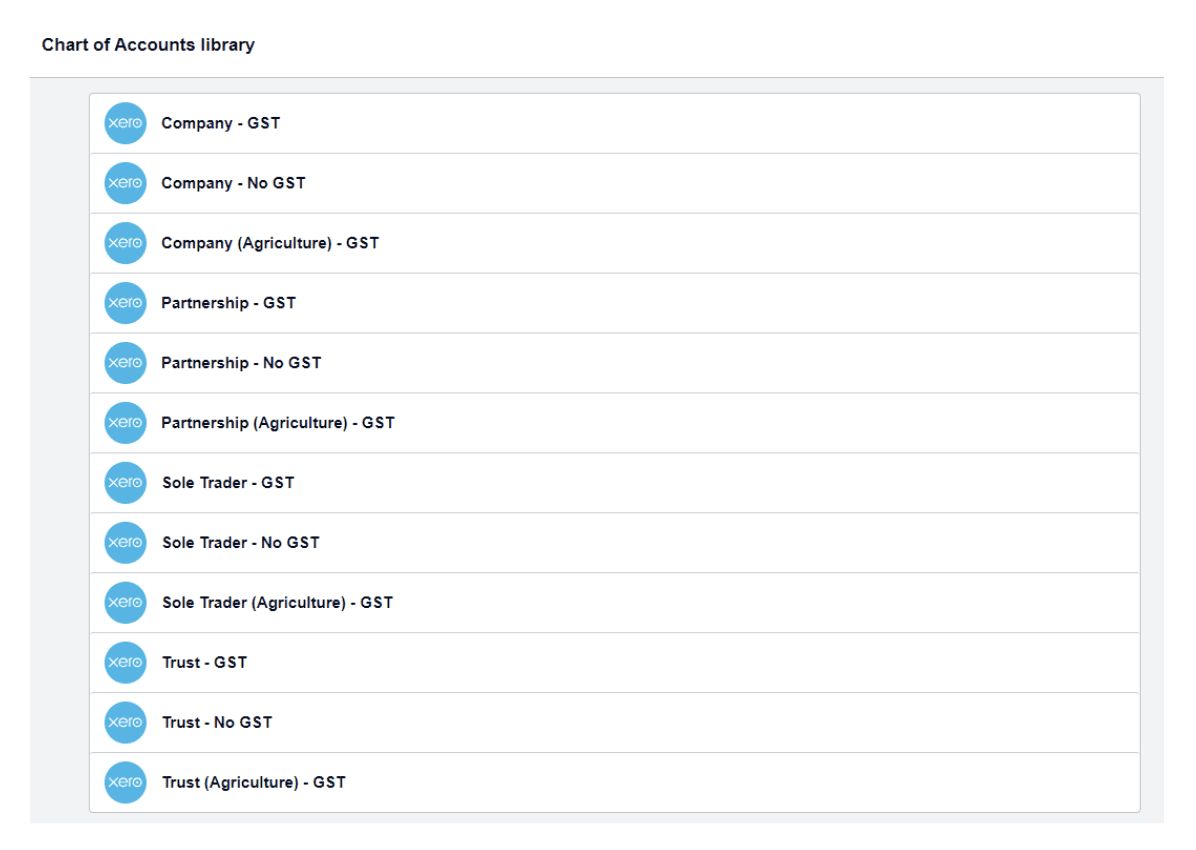

Select the best chart of accounts template: Xero presents industry-specific templates that present a place to begin. Deciding on essentially the most related template can save vital effort and time.

-

Customise your chart of accounts: As soon as you have chosen a template, evaluation and modify it to mirror your corporation’s distinctive construction and wishes. Add, rename, or delete accounts as needed. Think about the extent of element required to your reporting wants. Too many accounts may be cumbersome, whereas too few can restrict your analytical capabilities.

-

Use significant account names: Select clear and concise account names that precisely mirror the character of the transaction. Constant naming conventions are very important for sustaining organizational readability.

-

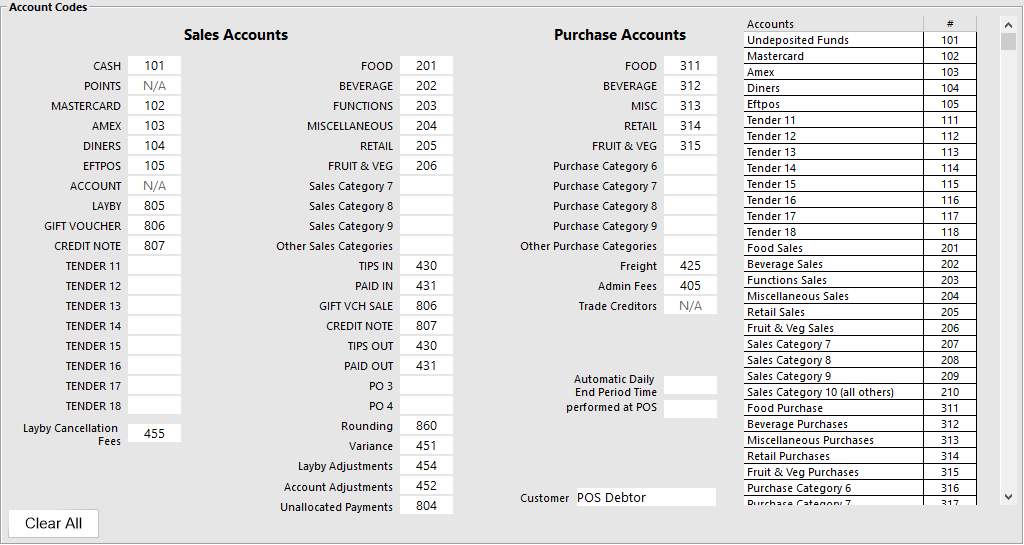

Assign account numbers: Xero mechanically assigns account numbers, however you may customise them for higher group and reporting. A well-structured numbering system can enhance the effectivity of your bookkeeping course of.

-

Outline monitoring classes: Monitoring classes mean you can phase your monetary information additional, enabling extra detailed evaluation. For instance, you may observe bills by venture, division, or shopper.

-

Repeatedly evaluation and replace: Your corporation will evolve over time, so it is essential to often evaluation and replace your chart of accounts to mirror these modifications. Including new accounts for brand new services or products, or eradicating out of date accounts, ensures your monetary information stays correct and related.

Finest Practices for Chart of Accounts Administration:

-

Hold it easy: Keep away from extreme complexity. A streamlined chart of accounts is less complicated to handle and preserve.

-

Use a constant naming conference: This enhances readability and improves information accuracy.

-

Repeatedly reconcile your accounts: This ensures your financial institution statements and Xero information are aligned.

-

Make the most of monitoring classes successfully: This permits for deeper monetary evaluation and reporting.

-

Doc your chart of accounts: Keep a document of your account construction and its rationale. That is priceless for future reference and for onboarding new workers.

-

Think about using an expert: For those who’re uncertain about establishing your chart of accounts, think about consulting with an accountant or bookkeeper. They will present skilled steerage and guarantee your chart of accounts aligns with finest practices and regulatory necessities.

Superior Chart of Accounts Options in Xero:

Xero presents a number of superior options to reinforce your chart of accounts administration:

-

Account Teams: These mean you can group accounts for reporting functions, offering a summarized view of your monetary information.

-

Customized Fields: Add customized fields to accounts to seize extra data, akin to venture codes or division identifiers.

-

Automated Reporting: Xero’s reporting options leverage your chart of accounts construction to generate varied monetary statements, together with revenue and loss statements, steadiness sheets, and money circulation statements. These reviews are important for monitoring your corporation’s monetary efficiency.

-

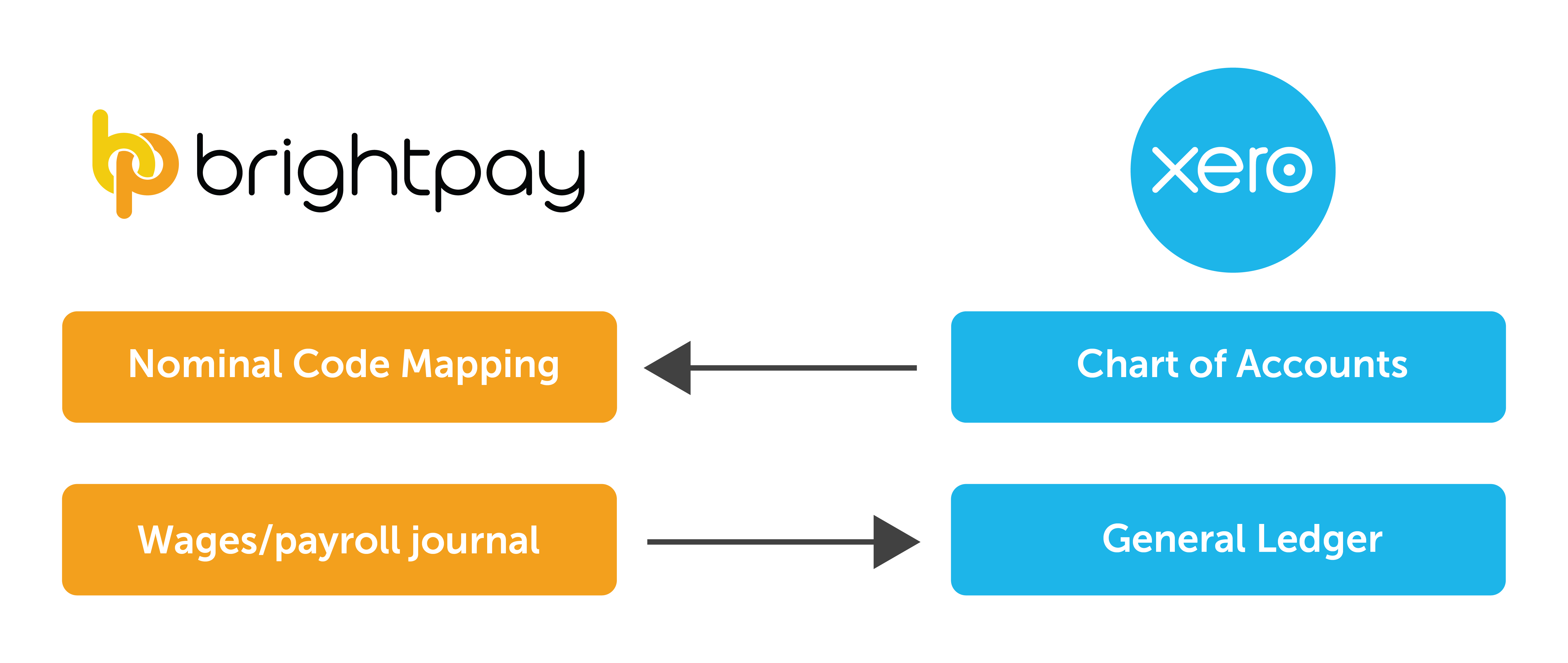

Integration with different software program: Xero integrates with varied third-party functions, additional enhancing the performance of your chart of accounts. This integration can streamline your workflow and enhance information accuracy.

Troubleshooting Widespread Chart of Accounts Points:

-

Inconsistent account naming: This will result in errors in reporting and evaluation. Set up and preserve a constant naming conference.

-

Inadequate account element: Lack of enough element can hinder your means to investigate your monetary information successfully. Guarantee you could have sufficient accounts to seize the mandatory data.

-

Duplicate accounts: This will trigger confusion and inaccuracies in your monetary information. Repeatedly evaluation your chart of accounts to determine and eradicate duplicates.

-

Out of date accounts: Outdated accounts litter your chart of accounts and might hinder your reporting. Repeatedly evaluation and take away out of date accounts.

Conclusion:

The Xero chart of accounts is a important part of your corporation’s monetary administration system. By understanding the totally different account varieties, implementing finest practices, and leveraging Xero’s superior options, you may create a strong and environment friendly chart of accounts that helps correct monetary reporting, knowledgeable decision-making, and the general success of your corporation. Do not forget that a well-structured chart of accounts isn’t a one-time setup; it requires ongoing upkeep and adaptation to maintain tempo with your corporation’s evolution. Investing the effort and time to optimize your chart of accounts will yield vital returns by way of improved monetary readability and management.

Closure

Thus, we hope this text has offered priceless insights into Mastering the Xero Chart of Accounts: A Complete Information. We admire your consideration to our article. See you in our subsequent article!