Mastering TradingView: A Complete Information To Charting And Evaluation

By admin / September 21, 2024 / No Comments / 2025

Mastering TradingView: A Complete Information to Charting and Evaluation

Associated Articles: Mastering TradingView: A Complete Information to Charting and Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Mastering TradingView: A Complete Information to Charting and Evaluation. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Mastering TradingView: A Complete Information to Charting and Evaluation

TradingView has quickly turn out to be the go-to platform for tens of millions of merchants and buyers worldwide. Its intuitive interface, highly effective charting instruments, and vibrant neighborhood make it a useful useful resource for technical evaluation, elementary analysis, and social buying and selling. This text delves deep into the capabilities of TradingView, exploring its charting options, analytical instruments, and techniques for efficient use.

I. Navigating the TradingView Interface:

Upon logging in, you are greeted with a clear and customizable workspace. The core elements embody:

-

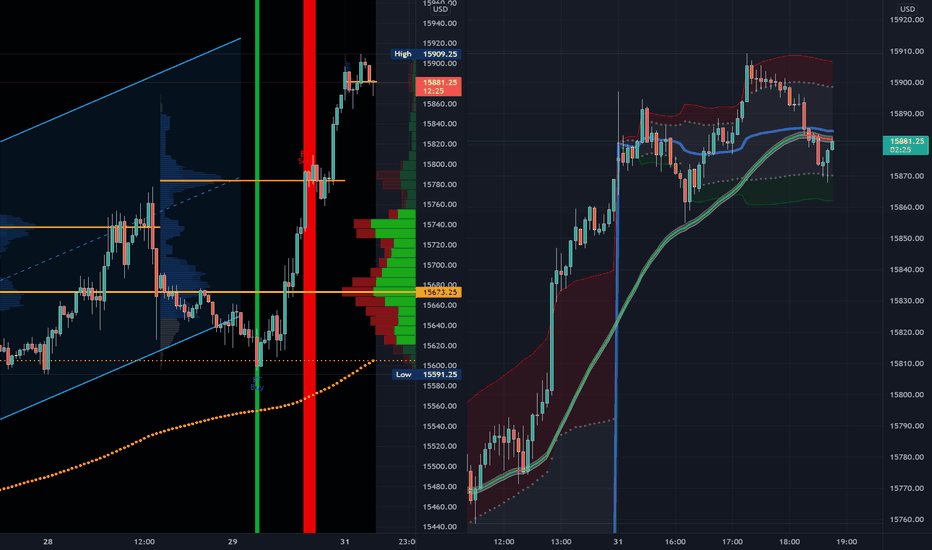

Chart Space: That is the central hub, displaying worth charts in varied types (candlestick, bar, line, Heikin-Ashi, and so forth.). You’ll be able to zoom out and in, pan throughout timeframes, and add quite a few indicators and drawing instruments.

-

Indicator Panel: Positioned on the left, this panel homes an enormous library of technical indicators, starting from easy shifting averages (SMA) and relative energy index (RSI) to extra complicated algorithms just like the Ichimoku Cloud and MACD. You’ll be able to search, filter, and add indicators on to your chart with ease.

-

Drawing Instruments: Present in the identical panel as indicators, these instruments can help you add varied shapes, strains, Fibonacci retracements, Gann followers, and different geometrical formations to your charts, enhancing visible evaluation and figuring out potential assist/resistance ranges, trendlines, and patterns.

-

Pine Editor: This highly effective characteristic permits skilled customers to create their very own customized indicators and techniques utilizing Pine Script, a proprietary scripting language. This opens up a world of potentialities for customized evaluation.

-

Concepts Part: TradingView boasts a vibrant neighborhood the place customers share their buying and selling concepts, analyses, and techniques. This part is a treasure trove of insights, permitting you to study from others and achieve completely different views on market actions.

-

Watchlists: Manage your favourite property into customized watchlists for fast entry and monitoring of worth motion.

II. Chart Varieties and Timeframes:

TradingView presents a big selection of chart sorts, every offering a singular perspective on worth knowledge:

-

Candlestick Charts: The preferred selection, displaying open, excessive, low, and shut costs for a given interval. The physique and wicks reveal worthwhile details about purchaser and vendor strain.

-

Bar Charts: Just like candlestick charts, however characterize worth knowledge with vertical bars as an alternative of candles.

-

Line Charts: Present solely the closing worth for every interval, offering a simplified view of worth tendencies.

-

Heikin-Ashi Charts: A smoothing method that filters out noise and makes tendencies simpler to determine.

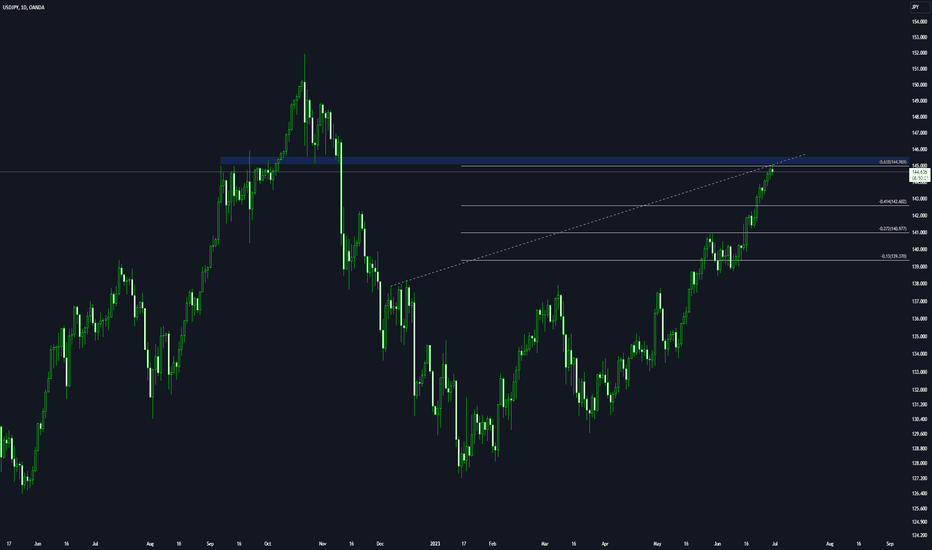

The timeframe choice is essential for various analytical approaches:

-

Brief-Time period Timeframes (1-minute, 5-minute, 15-minute): Best for scalping and day buying and selling, specializing in intraday worth fluctuations.

-

Intermediate Timeframes (30-minute, 1-hour, 4-hour): Appropriate for swing buying and selling, figuring out shorter-term tendencies inside a bigger context.

-

Lengthy-Time period Timeframes (Day by day, Weekly, Month-to-month): Used for place buying and selling and elementary evaluation, specializing in long-term worth actions and general market tendencies.

III. Technical Indicators: Unveiling Market Insights:

TradingView’s in depth library of technical indicators is a strong device for figuring out tendencies, assist/resistance ranges, momentum, and potential reversal factors. Listed below are a few of the mostly used indicators:

-

Transferring Averages (SMA, EMA): Clean out worth fluctuations and determine tendencies. Crossovers between completely different shifting averages usually sign purchase or promote indicators.

-

Relative Energy Index (RSI): Measures the magnitude of current worth modifications to guage overbought and oversold circumstances.

-

Transferring Common Convergence Divergence (MACD): Identifies momentum modifications and potential pattern reversals by way of the convergence and divergence of two shifting averages.

-

Bollinger Bands: Present worth volatility and potential reversal factors based mostly on commonplace deviations from a shifting common.

-

Stochastic Oscillator: Measures the momentum of worth modifications and identifies overbought and oversold circumstances.

-

Ichimoku Cloud: A complete indicator that gives data on assist, resistance, momentum, and pattern route.

IV. Drawing Instruments: Visualizing Market Constructions:

TradingView’s drawing instruments are important for visualizing worth patterns, figuring out assist and resistance ranges, and drawing trendlines. Key instruments embody:

-

Trendlines: Join important highs or lows to determine the general route of a pattern.

-

Help and Resistance Ranges: Horizontal strains drawn at important worth ranges the place worth has beforehand bounced or damaged by way of.

-

Fibonacci Retracements and Extensions: Based mostly on the Fibonacci sequence, these instruments determine potential assist and resistance ranges throughout retracements and extensions of a pattern.

-

Gann Followers: Angular strains based mostly on Gann’s theories, figuring out potential assist and resistance ranges.

-

Rectangles, Channels, and different shapes: Used to spotlight worth patterns and potential breakouts.

V. Using TradingView for Totally different Buying and selling Kinds:

TradingView caters to numerous buying and selling types:

-

Scalping: Brief-term buying and selling methods utilizing very quick timeframes and specializing in small worth actions. TradingView’s quick chart loading and real-time knowledge are essential right here.

-

Day Buying and selling: Holding positions for a single buying and selling day, requiring shut monitoring of worth motion and utilizing indicators to determine intraday alternatives.

-

Swing Buying and selling: Holding positions for a number of days or perhaps weeks, capitalizing on short-term worth swings inside a bigger pattern. Intermediate timeframes and indicators are key.

-

Place Buying and selling: Holding positions for months and even years, specializing in long-term tendencies and elementary evaluation. Lengthy-term timeframes and elementary knowledge are important.

VI. Past Charting: Neighborhood and Schooling:

TradingView’s energy lies not solely in its technical capabilities but additionally in its vibrant neighborhood and academic sources:

-

Concepts Part: Discover the concepts and analyses of different merchants, gaining insights and studying from their experiences.

-

Pine Script: Develop your individual customized indicators and techniques utilizing this highly effective scripting language.

-

Webinars and Tutorials: Entry a wealth of academic sources to enhance your buying and selling expertise.

-

Alerts: Arrange customized alerts to inform you of serious worth actions or indicator crossovers.

VII. Methods for Efficient Use of TradingView:

-

Begin Easy: Start with fundamental chart sorts and indicators earlier than exploring extra complicated instruments.

-

Backtesting: Take a look at your buying and selling methods utilizing historic knowledge to guage their effectiveness earlier than risking actual capital. TradingView presents backtesting capabilities for some methods.

-

Threat Administration: At all times implement correct threat administration strategies to guard your capital.

-

Diversify Your Evaluation: Do not rely solely on technical evaluation; incorporate elementary evaluation and information occasions into your decision-making course of.

-

Steady Studying: The monetary markets are always evolving, so steady studying is important for fulfillment.

VIII. Conclusion:

TradingView is a strong and versatile platform that empowers merchants and buyers of all ranges. By mastering its options, from fundamental charting to superior technical evaluation and neighborhood engagement, you possibly can considerably improve your buying and selling capabilities and enhance your probabilities of success. Do not forget that whereas TradingView offers invaluable instruments, profitable buying and selling requires self-discipline, threat administration, and steady studying. The platform is a strong device, but it surely’s solely pretty much as good because the person’s understanding and software of its options.

Closure

Thus, we hope this text has supplied worthwhile insights into Mastering TradingView: A Complete Information to Charting and Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!