Mastering Your Funds: A Complete Information To Chart Of Accounts In Excel (with Examples)

By admin / October 12, 2024 / No Comments / 2025

Mastering Your Funds: A Complete Information to Chart of Accounts in Excel (with Examples)

Associated Articles: Mastering Your Funds: A Complete Information to Chart of Accounts in Excel (with Examples)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Mastering Your Funds: A Complete Information to Chart of Accounts in Excel (with Examples). Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Mastering Your Funds: A Complete Information to Chart of Accounts in Excel (with Examples)

A Chart of Accounts (COA) is the spine of any sound monetary system. It is a structured listing of all of the accounts utilized by a enterprise to file its monetary transactions. Consider it as an in depth organizational map on your firm’s funds, making certain consistency and accuracy in recording and reporting. Whereas subtle accounting software program exists, understanding the ideas of a COA and tips on how to create one in Excel gives invaluable perception and management over your monetary information. This text will information you thru making a complete Chart of Accounts in Excel, providing sensible examples and greatest practices.

Why Excel for a Chart of Accounts?

Whereas devoted accounting software program gives automation and superior options, utilizing Excel for a COA gives a number of benefits, particularly for small companies or these beginning out:

- Accessibility and Familiarity: Most customers are comfy with Excel, making it straightforward to study and implement.

- Price-Effectiveness: Excel is available and would not require buying costly software program.

- Customization: You may have full management over the construction and content material of your COA, adapting it to your particular enterprise wants.

- Transparency: The info is instantly seen and simply understood by anybody acquainted with spreadsheets.

Construction of a Chart of Accounts

A well-structured COA follows a constant format, usually utilizing a numbering system to categorize accounts. This hierarchical construction permits for detailed monitoring and reporting. A standard method is a five-digit numbering system, permitting for detailed sub-accounts inside broader classes. This is a breakdown of a typical COA construction:

-

Property (10000-19999): These are sources owned by the enterprise, together with:

- Present Property (10000-10999): Property anticipated to be transformed to money inside one 12 months (e.g., money, accounts receivable, stock).

- Non-Present Property (11000-19999): Property with a lifespan exceeding one 12 months (e.g., property, plant, and tools (PP&E), intangible belongings).

-

Liabilities (20000-29999): These are obligations owed by the enterprise to others, together with:

- Present Liabilities (20000-20999): Obligations due inside one 12 months (e.g., accounts payable, salaries payable, short-term loans).

- Non-Present Liabilities (21000-29999): Obligations due past one 12 months (e.g., long-term loans, mortgages).

-

Fairness (30000-39999): This represents the proprietor’s funding within the enterprise and retained earnings. It consists of:

- Proprietor’s Fairness (30000-30999): The preliminary funding and subsequent contributions by the proprietor.

- Retained Earnings (31000-31999): Accrued income minus dividends.

-

Income (40000-49999): Earnings generated from the enterprise’s operations. Examples embrace:

- Gross sales Income (40000-40999): Earnings from the sale of products or companies.

- Different Income (41000-49999): Earnings from sources apart from core operations (e.g., curiosity earnings, rental earnings).

-

Bills (50000-59999): Prices incurred in producing income. Examples embrace:

- Price of Items Bought (COGS) (50000-50999): Direct prices related to producing items offered.

- Working Bills (51000-59999): Bills associated to operating the enterprise (e.g., lease, salaries, utilities).

Excel Implementation: A Sensible Instance

Let’s create a simplified Chart of Accounts in Excel. We’ll use a five-digit numbering system and embrace key columns:

| Account Quantity | Account Identify | Account Sort | Description |

|---|---|---|---|

| 10000 | Money | Asset | Money readily available and in financial institution accounts |

| 10100 | Accounts Receivable | Asset | Cash owed to the enterprise by clients |

| 11000 | Tools | Asset | Enterprise tools |

| 20000 | Accounts Payable | Legal responsibility | Cash owed by the enterprise to suppliers |

| 21000 | Loans Payable | Legal responsibility | Excellent mortgage balances |

| 30000 | Proprietor’s Fairness | Fairness | Proprietor’s preliminary funding |

| 40000 | Gross sales Income | Income | Income from gross sales of products or companies |

| 50000 | Price of Items Bought (COGS) | Expense | Direct prices of manufacturing items offered |

| 51000 | Hire Expense | Expense | Hire funds for enterprise premises |

| 52000 | Salaries Expense | Expense | Salaries paid to staff |

Increasing the Chart of Accounts:

This can be a primary instance. You may broaden it considerably to mirror the complexity of what you are promoting. As an example, you possibly can break down "Working Bills" into extra particular classes:

- 51000 – Hire Expense

- 51100 – Utilities Expense

- 51200 – Insurance coverage Expense

- 51300 – Advertising Expense

- 51400 – Workplace Provides Expense

Equally, you may create sub-accounts below "Gross sales Income" to trace gross sales by product line or buyer section. This degree of element permits for extra insightful monetary evaluation.

Including Performance in Excel:

Excel gives a number of options to reinforce your COA:

- Knowledge Validation: Use information validation to limit entries to particular values or ranges, making certain information consistency. For instance, you possibly can prohibit "Account Sort" to solely permit "Asset," "Legal responsibility," "Fairness," "Income," and "Expense."

- Formulation and Features: Use formulation to calculate balances, totals, and different key monetary metrics. For instance, you possibly can use SUMIF to calculate the full for every account sort.

- Pivot Tables: Create pivot tables to summarize and analyze your information in several methods. This lets you rapidly generate stories on numerous facets of your funds.

- Charts and Graphs: Visualize your monetary information utilizing charts and graphs to establish tendencies and patterns.

Greatest Practices for Your Excel Chart of Accounts:

- Consistency: Keep a constant numbering system and naming conference all through your COA.

- Readability: Use clear and concise account names which might be simply understood.

- Common Overview: Periodically evaluate and replace your COA to make sure it precisely displays what you are promoting actions. As what you are promoting grows and evolves, your COA ought to adapt accordingly.

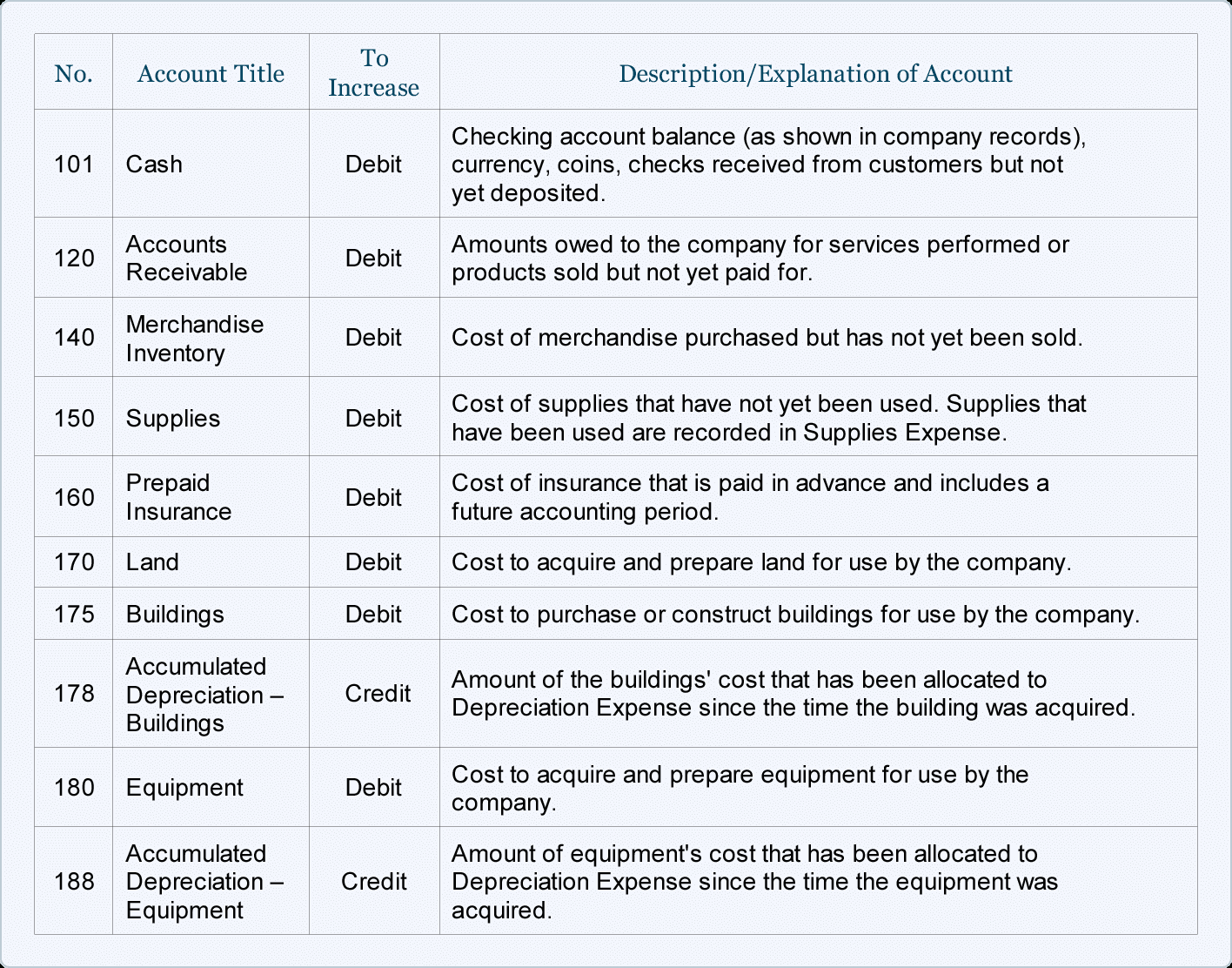

- Documentation: Doc your COA totally, together with descriptions of every account and its objective. That is essential for sustaining consistency and understanding.

- Backup: Repeatedly again up your Excel file to forestall information loss.

Conclusion:

A well-maintained Chart of Accounts is important for efficient monetary administration. Whereas devoted accounting software program gives superior options, utilizing Excel gives a sensible and accessible various, particularly for smaller companies. By following the rules and examples supplied on this article, you may create a sturdy and customised COA in Excel that may empower you to handle your funds effectively and successfully. Keep in mind to repeatedly evaluate and replace your COA to make sure it stays a real reflection of what you are promoting’s monetary well being. This detailed method, mixed with Excel’s performance, will lay a stable basis for correct monetary reporting and knowledgeable decision-making.

Closure

Thus, we hope this text has supplied precious insights into Mastering Your Funds: A Complete Information to Chart of Accounts in Excel (with Examples). We hope you discover this text informative and useful. See you in our subsequent article!