Navigating The International Markets: A Complete Information To Foreign exchange Time Zones And Buying and selling Methods

By admin / July 27, 2024 / No Comments / 2025

Navigating the International Markets: A Complete Information to Foreign exchange Time Zones and Buying and selling Methods

Associated Articles: Navigating the International Markets: A Complete Information to Foreign exchange Time Zones and Buying and selling Methods

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Navigating the International Markets: A Complete Information to Foreign exchange Time Zones and Buying and selling Methods. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Navigating the International Markets: A Complete Information to Foreign exchange Time Zones and Buying and selling Methods

The overseas change (foreign exchange) market, a colossal decentralized community working 24 hours a day, 5 days per week, presents each immense alternatives and important challenges. One of the vital essential elements of efficiently navigating this dynamic panorama is knowing the interaction of time zones. A foreign exchange time zone chart shouldn’t be merely a geographical illustration; it is a roadmap to optimizing buying and selling methods, managing danger, and finally, maximizing income. This text will delve deep into the intricacies of foreign exchange time zones, exploring their impression on market liquidity, volatility, and the general buying and selling expertise.

Understanding the International Foreign exchange Market’s Construction

The foreign exchange market does not have a central location. As a substitute, it is a community of banks, monetary establishments, companies, and particular person merchants linked electronically. This world nature dictates that buying and selling exercise flows throughout completely different time zones, creating distinct durations of excessive and low liquidity and volatility. Understanding these cycles is paramount for efficient buying and selling.

The most important buying and selling facilities, every working inside their respective time zones, are:

- Sydney (GMT+10): The primary main market to open, setting the tone for the day’s buying and selling. The Australian greenback (AUD) is closely traded throughout this era.

- Tokyo (GMT+9): Following Sydney, Tokyo’s opening sees important buying and selling exercise, notably involving the Japanese yen (JPY). The overlap with Sydney gives a interval of heightened liquidity.

- London (GMT+1): Typically thought of the center of the foreign exchange market, London’s opening marks a surge in buying and selling quantity and liquidity. The British pound (GBP) and the Euro (EUR) are closely traded. The overlap with Tokyo and Sydney gives important depth to the market.

- New York (GMT-5): The most important buying and selling heart by quantity, New York’s opening overlaps with London, making a interval of peak liquidity and volatility. The US greenback (USD) dominates buying and selling throughout this era.

- Different Facilities: Whereas these 4 are the main gamers, different facilities like Singapore, Hong Kong, and Zurich additionally contribute to the general market dynamics.

The Significance of a Foreign exchange Time Zone Chart

A foreign exchange time zone chart visually represents the opening and shutting instances of those main buying and selling facilities. That is essential for a number of causes:

-

Figuring out Durations of Excessive Liquidity: Overlaps between buying and selling facilities, such because the London/New York overlap, signify durations of excessive liquidity. That is usually most well-liked by merchants because it permits for simpler execution of trades with tighter spreads (the distinction between the bid and ask worth).

-

Recognizing Durations of Excessive Volatility: Whereas excessive liquidity is fascinating, overlaps can even result in elevated volatility. Information releases and financial knowledge bulletins impacting completely different currencies throughout these overlap durations may cause dramatic worth swings.

-

Optimizing Buying and selling Methods: Understanding the time zones permits merchants to tailor their methods to particular market situations. As an example, a scalper would possibly deal with the high-liquidity durations throughout overlaps, whereas a swing dealer would possibly favor the quieter durations when worth motion is much less erratic.

-

Managing Threat: Consciousness of time zone variations helps in managing danger. Merchants can keep away from buying and selling in periods of low liquidity, the place slippage (the distinction between the anticipated worth and the precise execution worth) and wider spreads are extra widespread.

-

Information and Financial Calendar Concerns: A foreign exchange time zone chart helps in correlating information releases and financial knowledge bulletins with particular buying and selling facilities. Figuring out when a major occasion will impression a specific market helps merchants anticipate potential worth actions and modify their positions accordingly.

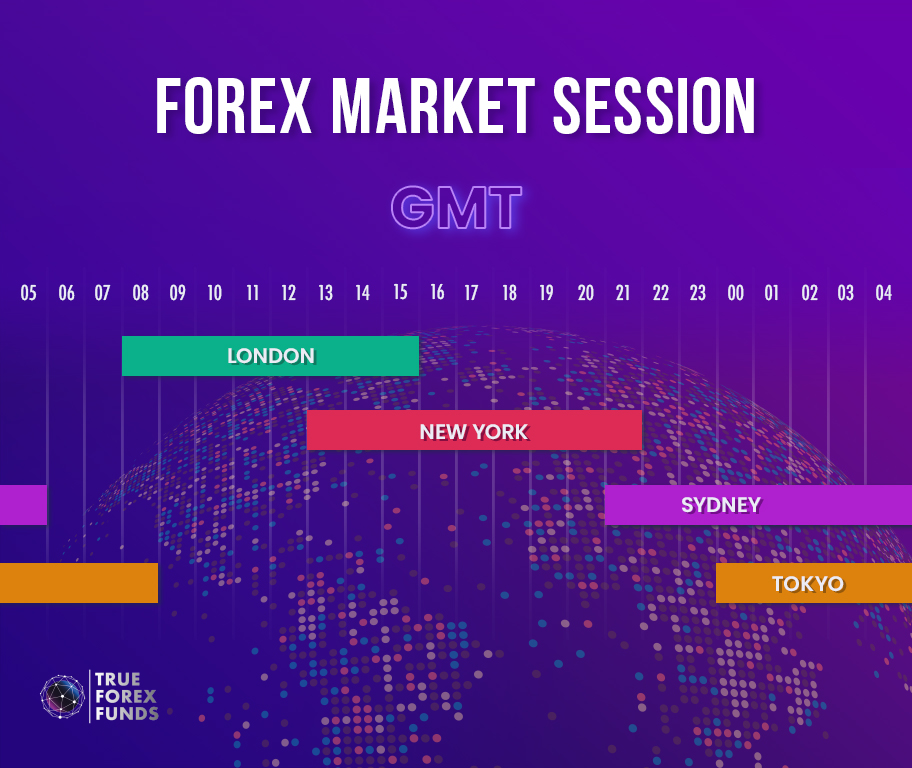

A Pattern Foreign exchange Time Zone Chart (Illustrative):

Whereas the precise instances might fluctuate barely relying on Daylight Saving Time (DST), a simplified chart would possibly seem like this:

| Time Zone | Location | Opening Time (GMT) | Closing Time (GMT) | Overlaps With |

|---|---|---|---|---|

| GMT+10 | Sydney | 10:00 | 17:00 | Tokyo |

| GMT+9 | Tokyo | 11:00 | 18:00 | Sydney, London |

| GMT+1 | London | 13:00 | 22:00 | Tokyo, New York |

| GMT-5 | New York | 18:00 | 01:00 (Subsequent Day) | London |

Buying and selling Methods and Time Zone Concerns:

Completely different buying and selling methods profit from particular time zone concerns:

-

Scalping: Scalpers thrive on excessive liquidity and speedy worth actions. They usually deal with the overlaps between London and New York, aiming for small income from quite a few trades.

-

Day Buying and selling: Day merchants sometimes maintain positions for just a few hours or much less. They may deal with the opening and shutting durations of main buying and selling facilities, capitalizing on volatility and liquidity modifications.

-

Swing Buying and selling: Swing merchants maintain positions for a number of days or even weeks. They may leverage the quieter durations outdoors of main overlaps, aiming for bigger worth swings.

-

Place Buying and selling: Place merchants maintain positions for prolonged durations, usually weeks or months. They deal with long-term traits and are much less involved with short-term fluctuations associated to particular time zone overlaps.

Challenges and Concerns:

-

Daylight Saving Time (DST): DST modifications can shift market opening and shutting instances, requiring changes to buying and selling schedules and techniques.

-

Holidays: Market closures attributable to holidays in numerous international locations can impression liquidity and buying and selling alternatives.

-

Geopolitical Occasions: Unexpected geopolitical occasions can considerably impression market situations no matter time zone.

-

Information and Information Releases: The impression of financial information and knowledge releases can fluctuate relying on the time zone and the forex pairs concerned.

Conclusion:

A foreign exchange time zone chart is a useful instrument for any foreign exchange dealer, no matter their expertise degree or most well-liked buying and selling type. Understanding the movement of buying and selling exercise throughout completely different time zones permits merchants to optimize their methods, handle danger successfully, and finally, enhance their probabilities of success on this dynamic and complicated market. By fastidiously contemplating the implications of time zones, merchants can navigate the worldwide foreign exchange panorama with higher confidence and precision. Keep in mind to all the time keep up to date on the newest market situations, information releases, and financial knowledge to additional improve your buying and selling selections. Whereas a foreign exchange time zone chart gives a framework for understanding market dynamics, steady studying and adaptation stay essential for long-term success in foreign currency trading.

Closure

Thus, we hope this text has supplied worthwhile insights into Navigating the International Markets: A Complete Information to Foreign exchange Time Zones and Buying and selling Methods. We hope you discover this text informative and helpful. See you in our subsequent article!