Navigating The Labyrinth: A Complete Information To Accounts Payable Course of Flowcharts

By admin / July 22, 2024 / No Comments / 2025

Navigating the Labyrinth: A Complete Information to Accounts Payable Course of Flowcharts

Associated Articles: Navigating the Labyrinth: A Complete Information to Accounts Payable Course of Flowcharts

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Navigating the Labyrinth: A Complete Information to Accounts Payable Course of Flowcharts. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Navigating the Labyrinth: A Complete Information to Accounts Payable Course of Flowcharts

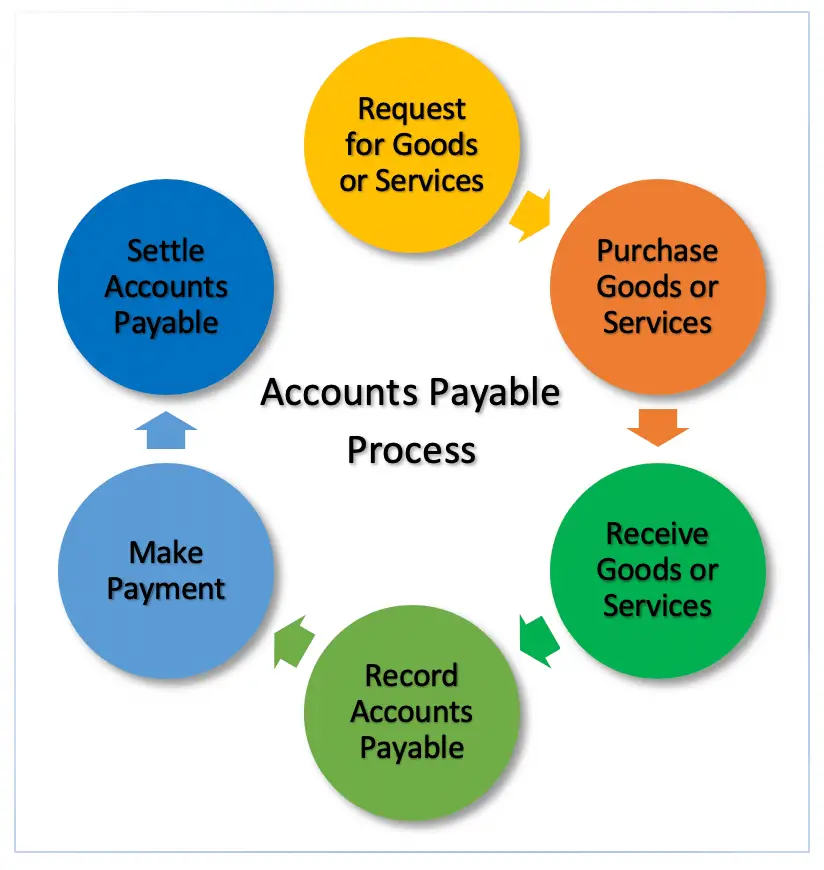

The accounts payable (AP) division is the spine of any group’s monetary well being. Chargeable for processing and paying invoices from distributors, a well-oiled AP machine ensures well timed funds, maintains robust vendor relationships, and prevents pricey errors. Central to optimizing this important course of is using a meticulously designed accounts payable course of flowchart. This text delves deep into the intricacies of AP flowcharts, exploring their varied parts, advantages, and the way they are often tailor-made to totally different enterprise sizes and constructions.

Understanding the Significance of Accounts Payable Course of Flowcharts

A flowchart, in its easiest kind, is a visible illustration of a course of. Within the context of AP, it gives a transparent, step-by-step information to how invoices are obtained, processed, accepted, and in the end paid. This visible readability provides a number of important benefits:

- Improved Effectivity: By outlining every step explicitly, flowcharts determine bottlenecks and redundancies, streamlining the method and decreasing processing time.

- Enhanced Accuracy: A well-defined flowchart minimizes the probabilities of human error by offering clear directions and eliminating ambiguity.

- Elevated Transparency: All stakeholders, from AP clerks to senior administration, can simply perceive the method, fostering higher communication and collaboration.

- Higher Management and Oversight: Flowcharts facilitate higher monitoring of the AP course of, enabling early detection of potential issues and guaranteeing compliance with inner insurance policies and exterior laws.

- Simplified Coaching: New staff can shortly grasp the AP course of by referring to the flowchart, decreasing coaching time and bettering onboarding effectivity.

- Facilitates Automation: Flowcharts are instrumental in figuring out areas the place automation will be applied, resulting in important value financial savings and elevated productiveness.

Elements of a Complete Accounts Payable Course of Flowchart

A typical AP flowchart encompasses a number of key phases, although the particular steps and their order could range relying on the group’s measurement, business, and inner controls. A complete flowchart usually consists of:

-

Bill Receipt: This preliminary stage particulars how invoices are obtained – whether or not electronically (by means of e-mail, EDI, or portals), through mail, or by means of different means. The flowchart ought to specify the dealing with of various bill codecs and the preliminary information entry course of.

-

Bill Verification and Validation: This significant step includes checking the bill for accuracy and completeness. This consists of verifying the seller data, bill quantity, portions, costs, and matching it in opposition to the acquisition order (PO) and receiving report (RR) – the three-way match. Discrepancies needs to be clearly recognized and routed for decision.

-

Bill Coding and Approval: As soon as verified, the bill is coded to the suitable common ledger accounts. The flowchart outlines the approval workflow, specifying who must approve invoices primarily based on their worth or different standards. This would possibly contain a number of ranges of approval, relying on the corporate’s inner management construction.

-

Knowledge Entry and Processing: This step includes getting into the bill information into the accounting system. The flowchart ought to element the system used and the particular information fields to be entered.

-

Cost Processing: After approval, the bill is prepared for cost. The flowchart outlines the cost technique (e.g., test, ACH, wire switch) and the method for producing cost recordsdata.

-

Cost Launch and Reconciliation: This stage includes releasing the funds and reconciling them with the financial institution statements. The flowchart ought to specify the reconciliation course of and the steps to be taken if discrepancies are recognized.

-

Vendor Communication and Dispute Decision: The flowchart ought to handle how distributors are contacted concerning cost standing, discrepancies, or disputes. It also needs to define the method for resolving any payment-related points.

-

Archiving and Report Preserving: Lastly, the flowchart ought to specify how invoices and supporting paperwork are archived and saved, guaranteeing compliance with record-keeping laws.

Variations in Accounts Payable Course of Flowcharts

The particular design of an AP flowchart will range primarily based on a number of components:

-

Group Measurement: Small companies may need easier flowcharts with fewer steps and fewer advanced approval processes. Bigger organizations, however, would require extra detailed flowcharts to handle the next quantity of invoices and extra intricate approval workflows.

-

Trade: Sure industries may need particular regulatory necessities or distinctive bill processing wants, impacting the flowchart design.

-

Expertise Used: The usage of AP automation software program considerably alters the flowchart, decreasing guide steps and streamlining the method. Flowcharts ought to replicate the particular functionalities of the chosen software program.

-

Inner Controls: The extent of inner controls applied will affect the flowchart, significantly concerning approvals, authorization, and segregation of duties.

Constructing an Efficient Accounts Payable Course of Flowchart

Creating a very efficient AP flowchart requires cautious planning and consideration. Listed here are some key steps:

-

Outline Scope: Clearly outline the boundaries of the method to be mapped.

-

Determine Key Steps: Break down the AP course of into particular person, sequential steps.

-

Decide Resolution Factors: Determine factors the place choices should be made (e.g., bill approval, dispute decision).

-

Use Standardized Symbols: Make use of normal flowchart symbols to signify various kinds of actions, choices, and information.

-

Collaborate with Stakeholders: Contain all related stakeholders within the flowchart creation course of to make sure accuracy and buy-in.

-

Frequently Evaluation and Replace: The AP course of, and subsequently the flowchart, needs to be reviewed and up to date periodically to replicate adjustments within the enterprise atmosphere, know-how, or inner insurance policies.

Conclusion:

A well-designed accounts payable course of flowchart is a useful device for any group. It enhances effectivity, accuracy, transparency, and management inside the AP division, in the end contributing to the general monetary well being of the enterprise. By understanding the important thing parts, variations, and greatest practices outlined on this article, organizations can develop and implement efficient AP flowcharts that optimize their bill processing and cost procedures, resulting in important enhancements in productiveness and value financial savings. Investing the effort and time to create and keep a strong AP flowchart is an funding within the long-term monetary well-being of the group. Do not forget that the flowchart is a dwelling doc that needs to be usually reviewed and up to date to replicate the ever-evolving wants of the enterprise.

Closure

Thus, we hope this text has offered priceless insights into Navigating the Labyrinth: A Complete Information to Accounts Payable Course of Flowcharts. We hope you discover this text informative and helpful. See you in our subsequent article!