Navigating The UK Silver Market: A Complete Information To Stay Value Charts And Market Dynamics

By admin / June 13, 2024 / No Comments / 2025

Navigating the UK Silver Market: A Complete Information to Stay Value Charts and Market Dynamics

Associated Articles: Navigating the UK Silver Market: A Complete Information to Stay Value Charts and Market Dynamics

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Navigating the UK Silver Market: A Complete Information to Stay Value Charts and Market Dynamics. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Navigating the UK Silver Market: A Complete Information to Stay Value Charts and Market Dynamics

Silver, a lustrous valuable steel with a wealthy historical past, holds a big place within the world monetary markets. For UK traders, understanding the dwell silver worth chart and the elements influencing its fluctuations is essential for profitable buying and selling and funding methods. This text supplies a complete overview of the UK silver market, specializing in dwell worth charts, their interpretation, and the important thing financial and geopolitical occasions that form silver’s trajectory.

Understanding Stay Silver Value Charts within the UK

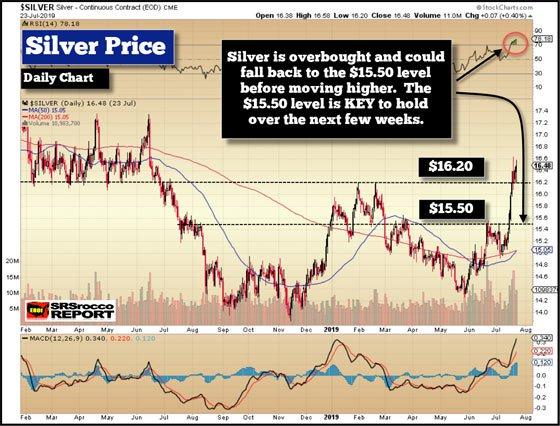

Stay silver worth charts, available on-line by means of varied monetary platforms, present a real-time visible illustration of the steel’s worth. These charts usually show the value in British kilos (GBP) per troy ounce, reflecting the present market worth. A number of chart sorts are generally used:

- Line Charts: These charts show the value over time, exhibiting the general development and worth actions. They are perfect for figuring out long-term tendencies and main worth swings.

- Candlestick Charts: These charts supply extra detailed info, exhibiting the opening, closing, excessive, and low costs for a particular interval (e.g., a day, hour, or minute). The candlestick’s physique signifies the value vary between the opening and shutting costs, whereas the wicks (higher and decrease shadows) characterize the excessive and low costs throughout that interval. Candlestick charts are favoured by technical analysts for figuring out patterns and predicting future worth actions.

- Bar Charts: Just like candlestick charts, bar charts show the excessive, low, open, and shut costs for a given interval. Nevertheless, they use vertical bars as a substitute of candlesticks.

Key Components of a Stay Silver Value Chart:

- Value Axis (Y-axis): Reveals the value of silver in GBP per troy ounce.

- Time Axis (X-axis): Shows the time interval, starting from minutes to years, relying on the chart’s timeframe.

- Shifting Averages: Traces plotted on the chart that clean out worth fluctuations, serving to to determine tendencies. Widespread shifting averages embrace 50-day, 100-day, and 200-day averages.

- Technical Indicators: Mathematical calculations utilized to cost information to generate indicators about potential worth actions. Examples embrace Relative Power Index (RSI), Shifting Common Convergence Divergence (MACD), and Bollinger Bands.

- Quantity: Signifies the quantity of silver traded throughout a particular interval. Excessive quantity typically accompanies important worth actions.

Components Influencing the UK Silver Value:

The worth of silver within the UK, like globally, is influenced by a fancy interaction of things:

-

Provide and Demand: The elemental driver of worth. Elevated industrial demand, notably from the electronics and photo voltaic vitality sectors, tends to push costs greater. Conversely, a surplus in provide can result in decrease costs. Mining manufacturing, recycling charges, and authorities insurance policies all play a task in figuring out provide.

-

US Greenback Power: Silver is priced in US {dollars} globally. A stronger greenback usually results in decrease silver costs for UK traders (as they should pay extra GBP to purchase the identical quantity of USD-denominated silver). Conversely, a weaker greenback often boosts silver costs in GBP phrases.

-

Inflation and Curiosity Charges: Inflation erodes the buying energy of cash, making valuable metals like silver a lovely hedge towards inflation. Rising rates of interest can, nevertheless, make holding non-interest-bearing belongings like silver much less interesting, probably placing downward stress on costs.

-

Industrial Demand: Silver’s industrial functions are a significant driver of its worth. Progress in sectors equivalent to electronics, photo voltaic vitality, and cars straight impacts silver demand. Technological developments and financial development in these sectors can considerably affect silver costs.

-

Funding Demand: Silver is taken into account a safe-haven asset, that means traders typically flock to it throughout occasions of financial uncertainty or geopolitical instability. Trade-traded funds (ETFs) backed by bodily silver additionally play a task in funding demand. Elevated investor curiosity can push costs greater.

-

Geopolitical Occasions: International political instability, commerce wars, and different geopolitical occasions can create uncertainty within the markets, driving traders in the direction of safe-haven belongings like silver, thus influencing its worth.

-

Hypothesis: The silver market is vulnerable to hypothesis, the place merchants guess on future worth actions. This will result in important worth volatility, each upwards and downwards.

Deciphering Stay Silver Value Charts: A Technical Evaluation Perspective

Technical evaluation entails finding out previous worth actions and patterns to foretell future worth tendencies. A number of methods can be utilized to interpret dwell silver worth charts:

- Development Identification: Figuring out the general route of the value (uptrend, downtrend, or sideways). This may be achieved by observing the slope of shifting averages or by drawing trendlines on the chart.

- Assist and Resistance Ranges: Figuring out worth ranges the place the value has traditionally struggled to interrupt by means of. Assist ranges characterize worth flooring, whereas resistance ranges characterize worth ceilings. Breaks above resistance or beneath help can sign important worth actions.

- Chart Patterns: Recognizing recurring patterns on the chart, equivalent to head and shoulders, double tops/bottoms, and triangles, which may present insights into potential future worth actions.

- Technical Indicators: Utilizing indicators like RSI, MACD, and Bollinger Bands to generate purchase or promote indicators. These indicators present further details about worth momentum, development power, and potential overbought or oversold situations.

Sensible Suggestions for Utilizing Stay Silver Value Charts within the UK:

- Select a Respected Dealer: Choose a regulated and respected dealer to entry dwell silver worth charts and commerce silver.

- Perceive Your Danger Tolerance: Silver costs might be risky, so it is essential to grasp your threat tolerance earlier than investing.

- Diversify Your Portfolio: Do not put all of your eggs in a single basket. Diversifying your investments throughout totally different asset courses can scale back total threat.

- Keep Knowledgeable: Sustain-to-date on financial information, geopolitical occasions, and trade tendencies that may influence silver costs.

- Use Cease-Loss Orders: Shield your investments by utilizing stop-loss orders to restrict potential losses.

- Contemplate Lengthy-Time period Investing: For long-term traders, specializing in the general development and elementary elements is extra essential than short-term worth fluctuations.

Conclusion:

The UK silver market provides each alternatives and challenges for traders. Understanding the dynamics of the market, deciphering dwell silver worth charts successfully, and staying knowledgeable about influencing elements are essential for navigating this complicated panorama. By combining technical evaluation with elementary information, UK traders could make knowledgeable selections and probably profit from investing on this valuable steel. Bear in mind to at all times conduct thorough analysis and search skilled monetary recommendation earlier than making any funding selections. The data supplied on this article is for academic functions solely and shouldn’t be thought-about monetary recommendation.

Closure

Thus, we hope this text has supplied invaluable insights into Navigating the UK Silver Market: A Complete Information to Stay Value Charts and Market Dynamics. We respect your consideration to our article. See you in our subsequent article!