The Chart Of Accounts: The Spine Of Monetary Reporting

By admin / June 3, 2024 / No Comments / 2025

The Chart of Accounts: The Spine of Monetary Reporting

Associated Articles: The Chart of Accounts: The Spine of Monetary Reporting

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to The Chart of Accounts: The Spine of Monetary Reporting. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

The Chart of Accounts: The Spine of Monetary Reporting

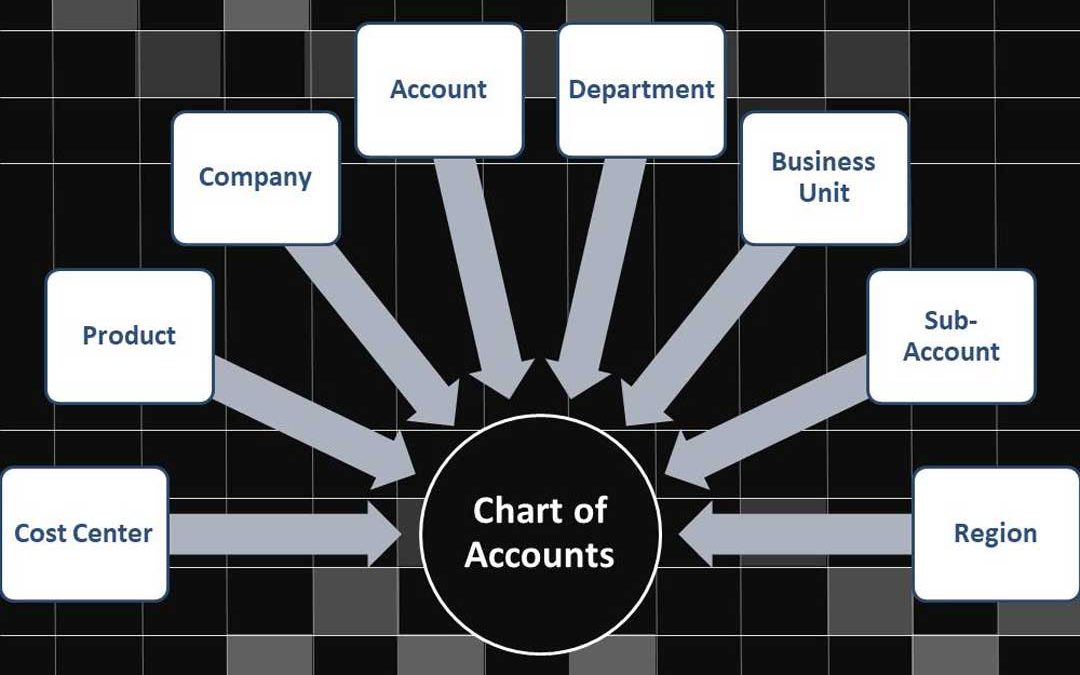

The chart of accounts (COA) is the bedrock of any group’s monetary reporting system. It is a structured checklist of all of the accounts utilized by a enterprise to document its monetary transactions. Consider it as an in depth, organized index of each single monetary ingredient inside an organization. With no well-designed and meticulously maintained chart of accounts, correct monetary reporting turns into an insurmountable problem, resulting in flawed decision-making and potential authorized points. This text delves into the intricacies of the chart of accounts, exploring its objective, construction, design issues, and significance in sustaining correct monetary information.

What’s a Chart of Accounts?

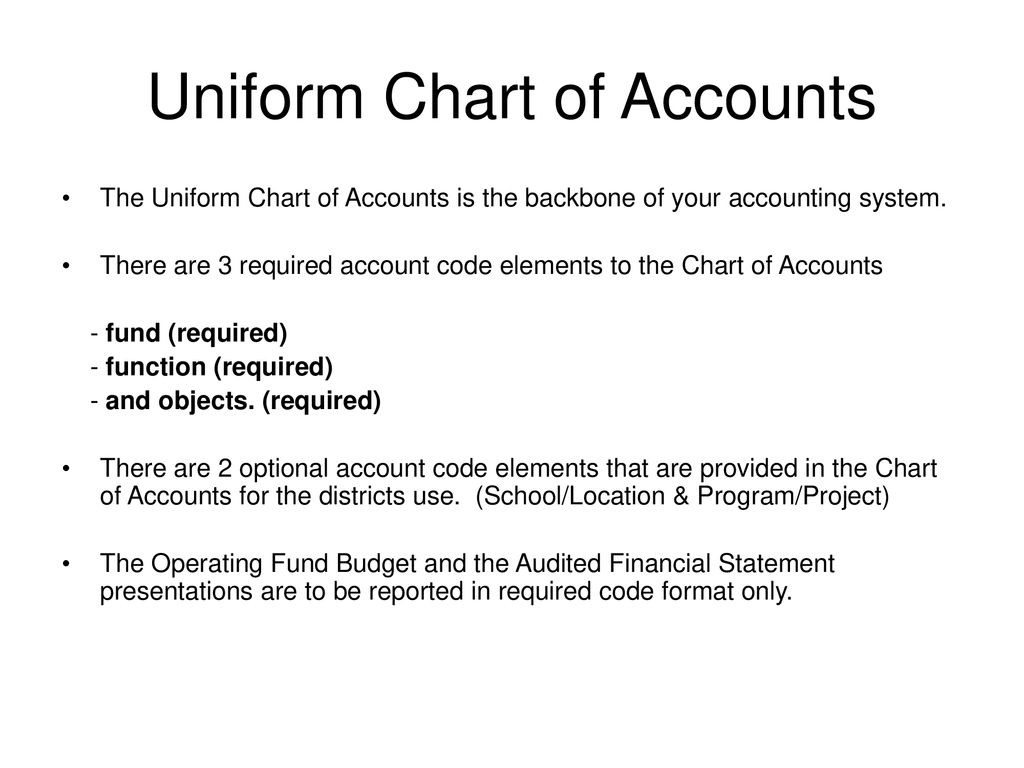

A chart of accounts is a complete itemizing of all of the accounts a enterprise makes use of to categorise and document its monetary transactions. These accounts are organized in a hierarchical construction, usually following a standardized numbering system, permitting for straightforward identification and retrieval of economic knowledge. Every account represents a particular side of the corporate’s monetary exercise, akin to belongings, liabilities, fairness, revenues, and bills. Transactions are recorded in these accounts utilizing double-entry bookkeeping, guaranteeing that the accounting equation (Belongings = Liabilities + Fairness) all the time stays balanced.

The particular accounts included in a chart of accounts will range relying on the character and measurement of the enterprise. A small sole proprietorship might need a comparatively easy chart of accounts, whereas a big multinational company would require a way more complicated and detailed one. Nonetheless, the basic ideas stay the identical: group, consistency, and adherence to typically accepted accounting ideas (GAAP) or Worldwide Monetary Reporting Requirements (IFRS).

The Construction of a Chart of Accounts:

A typical chart of accounts follows a hierarchical construction, typically utilizing a numerical coding system to categorize accounts. This method permits for straightforward identification and retrieval of knowledge. A typical construction contains:

-

Belongings: These are assets owned by the corporate that present future financial advantages. Examples embody money, accounts receivable, stock, property, plant, and gear (PP&E). Belongings are additional categorized into present belongings (simply transformed to money inside a 12 months) and non-current belongings (long-term belongings).

-

Liabilities: These are obligations or money owed owed by the corporate to others. Examples embody accounts payable, salaries payable, loans payable, and deferred income. Like belongings, liabilities are categorized into present liabilities (due inside a 12 months) and non-current liabilities (long-term obligations).

-

Fairness: This represents the proprietor’s stake within the firm. For sole proprietorships and partnerships, this is likely to be a easy proprietor’s fairness account. For companies, it contains retained earnings, widespread inventory, and different contributed capital.

-

Revenues: These are inflows of assets ensuing from the corporate’s working actions. Examples embody gross sales income, service income, curiosity income, and rental income.

-

Bills: These are outflows of assets incurred within the means of producing income. Examples embody value of products offered (COGS), salaries expense, hire expense, utilities expense, and promoting expense.

Inside every of those main classes, accounts are additional subdivided to supply a extra granular degree of element. For instance, beneath the "Bills" class, an organization might need separate accounts for "Salaries Expense – Gross sales," "Salaries Expense – Administration," and "Salaries Expense – Manufacturing." This degree of element permits for higher monitoring of prices and identification of areas for potential enchancment.

Designing a Chart of Accounts:

Designing an efficient chart of accounts requires cautious planning and consideration. A number of components ought to be taken into consideration:

-

Trade: The particular accounts wanted will range relying on the trade. A producing firm will want accounts for uncooked supplies, work-in-process, and completed items, whereas a service-based firm could not.

-

Firm Measurement: Bigger firms usually require extra detailed and complicated charts of accounts than smaller companies.

-

Accounting Software program: The chosen accounting software program will typically dictate the construction and format of the chart of accounts. It is essential to pick out software program that may accommodate the corporate’s particular wants.

-

Future Development: The chart of accounts ought to be designed to accommodate future development and growth. It ought to be versatile sufficient to adapt to adjustments within the enterprise.

-

Compliance: The chart of accounts should adjust to related accounting requirements (GAAP or IFRS) and tax laws.

A well-designed chart of accounts ought to be:

- Complete: It ought to embody all accounts essential to document all monetary transactions.

- Constant: It ought to use a constant numbering system and terminology.

- Person-friendly: It ought to be straightforward to grasp and use by all personnel concerned in monetary reporting.

- Versatile: It ought to be adaptable to adjustments within the enterprise.

Significance of a Properly-Maintained Chart of Accounts:

A well-maintained chart of accounts is vital for a number of causes:

-

Correct Monetary Reporting: A correctly designed COA ensures that each one transactions are recorded within the right accounts, resulting in correct and dependable monetary statements. That is important for making knowledgeable enterprise selections and attracting traders.

-

Improved Monetary Evaluation: An in depth COA permits for in-depth evaluation of economic efficiency. Managers can observe key metrics, determine traits, and pinpoint areas for enchancment.

-

Enhanced Budgeting and Forecasting: A well-structured COA facilitates the event of correct budgets and monetary forecasts.

-

Streamlined Auditing: A well-organized COA simplifies the auditing course of, making it simpler for auditors to confirm the accuracy of economic information.

-

Regulatory Compliance: A correctly maintained COA ensures compliance with all related accounting requirements and tax laws, minimizing the chance of penalties and authorized points.

-

Higher Resolution Making: Correct monetary info derived from a correctly maintained COA permits for higher knowledgeable selections relating to investments, growth, value management, and general enterprise technique.

Sustaining the Chart of Accounts:

The chart of accounts will not be a static doc. Because the enterprise grows and adjustments, the COA could have to be up to date and modified. Common evaluations ought to be performed to make sure that it stays related and correct. This contains:

- Including new accounts: Because the enterprise expands into new areas, new accounts could have to be added to replicate the adjustments in its operations.

- Deleting out of date accounts: Accounts which are not related ought to be eliminated to keep away from confusion and keep the integrity of the monetary information.

- Modifying current accounts: Current accounts could have to be modified to replicate adjustments in accounting requirements or enterprise practices.

In conclusion, the chart of accounts is a basic part of any group’s monetary system. A well-designed, meticulously maintained COA is important for correct monetary reporting, efficient monetary evaluation, and knowledgeable decision-making. Investing time and assets in creating and sustaining a sturdy chart of accounts is a vital step in guaranteeing the long-term monetary well being and success of any enterprise. Neglecting this very important side can result in important issues down the road, impacting every thing from correct monetary statements to regulatory compliance and in the end, the corporate’s backside line.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has supplied worthwhile insights into The Chart of Accounts: The Spine of Monetary Reporting. We hope you discover this text informative and helpful. See you in our subsequent article!