The Rollercoaster Trip: Charting Japan’s Historic GDP Progress

By admin / August 17, 2024 / No Comments / 2025

The Rollercoaster Trip: Charting Japan’s Historic GDP Progress

Associated Articles: The Rollercoaster Trip: Charting Japan’s Historic GDP Progress

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to The Rollercoaster Trip: Charting Japan’s Historic GDP Progress. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

The Rollercoaster Trip: Charting Japan’s Historic GDP Progress

Japan’s post-war financial miracle is a legendary story of fast progress and industrial prowess. From the ashes of World Battle II, the nation rose to change into the world’s second-largest economic system, a feat achieved by way of a potent cocktail of presidency intervention, technological innovation, and a extremely disciplined workforce. Nonetheless, the narrative is much from a easy upward trajectory. Understanding Japan’s historic GDP progress requires acknowledging each its extraordinary achievements and the persistent challenges which have formed its financial panorama for the previous seven many years. This text will delve into an in depth evaluation of Japan’s GDP progress chart, exploring its key intervals, underlying components, and the continuing implications for the worldwide economic system.

The Submit-Battle Increase (Fifties-Nineteen Seventies): The Miracle Years

The speedy post-war interval noticed Japan grappling with widespread destruction and financial instability. Nonetheless, the implementation of the Dodge Plan in 1949, a sequence of financial reforms spearheaded by Joseph Dodge, laid the inspiration for exceptional progress. This plan centered on fiscal self-discipline, financial stability, and the liberalization of commerce. The Korean Battle (1950-1953) supplied an sudden increase to the Japanese economic system, making a surge in demand for manufactured items.

The Fifties and Nineteen Sixties witnessed an unprecedented interval of sustained excessive progress, sometimes called the "Japanese financial miracle." Annual GDP progress charges constantly exceeded 10% for prolonged intervals. This exceptional enlargement was pushed by a number of key components:

- Authorities-led industrial coverage: The Japanese authorities performed a vital position in guiding industrial improvement, prioritizing strategic sectors like electronics, cars, and shipbuilding. Focused subsidies, tax breaks, and protectionist measures fostered the expansion of those industries.

- Export-oriented progress: Japan leveraged its aggressive benefit in manufacturing to change into a world export powerhouse. The give attention to high-quality, low-cost merchandise fueled export-led progress.

- Excessive financial savings and funding charges: A excessive nationwide financial savings fee supplied ample capital for funding in infrastructure and new applied sciences. This contributed considerably to productiveness beneficial properties.

- Technological innovation: Japanese corporations invested closely in analysis and improvement, resulting in breakthroughs in numerous industries. The event of lean manufacturing methods, such because the Toyota Manufacturing System, additional enhanced effectivity and competitiveness.

- A extremely expert and disciplined workforce: A devoted and well-educated workforce was instrumental in driving productiveness and high quality. The robust emphasis on training and lifelong studying contributed to a talented labor pool.

The GDP progress chart throughout this era exhibits a near-vertical ascent, reflecting the exceptional financial transformation. Nonetheless, this period of fast progress was not with out its challenges. Earnings inequality began to widen, and environmental considerations started to emerge as industrialization accelerated.

The Slowdown and the Misplaced Decade (Nineteen Seventies-Nineteen Nineties): Navigating Headwinds

The oil crises of the Nineteen Seventies marked a turning level. The sharp enhance in oil costs triggered a world recession, considerably impacting Japan’s export-oriented economic system. Progress charges slowed significantly, though Japan nonetheless managed to take care of constructive progress, albeit at a a lot slower tempo.

The Nineteen Nineties witnessed the "Misplaced Decade," a interval of extended financial stagnation characterised by deflation, banking crises, and a major decline in asset costs. The bursting of the asset bubble within the early Nineteen Nineties uncovered weaknesses within the Japanese monetary system, resulting in a chronic interval of low progress and excessive ranges of non-performing loans. The federal government’s response, whereas well-intentioned, was usually sluggish and ineffective, exacerbating the financial stoop. The GDP progress chart throughout this era exhibits a flatlining trajectory, a stark distinction to the earlier many years of fast enlargement.

A number of components contributed to the Misplaced Decade:

- The bursting of the asset bubble: The collapse of the asset bubble led to a pointy decline in funding and client spending.

- Deflation: Deflation discouraged funding and consumption, as customers delayed purchases anticipating additional value declines.

- Banking sector issues: The excessive stage of non-performing loans crippled the banking system’s potential to lend, hindering financial exercise.

- Structural rigidities: The Japanese economic system confronted growing structural rigidities, together with rigid labor markets and resistance to deregulation.

The twenty first Century: A Interval of Stagnation and Gradual Restoration

The early 2000s noticed a gradual restoration, however progress remained sluggish. The worldwide monetary disaster of 2008 dealt one other blow to the Japanese economic system, additional dampening progress prospects. Whereas Japan averted the worst of the disaster, its export-oriented economic system was considerably impacted by the worldwide slowdown.

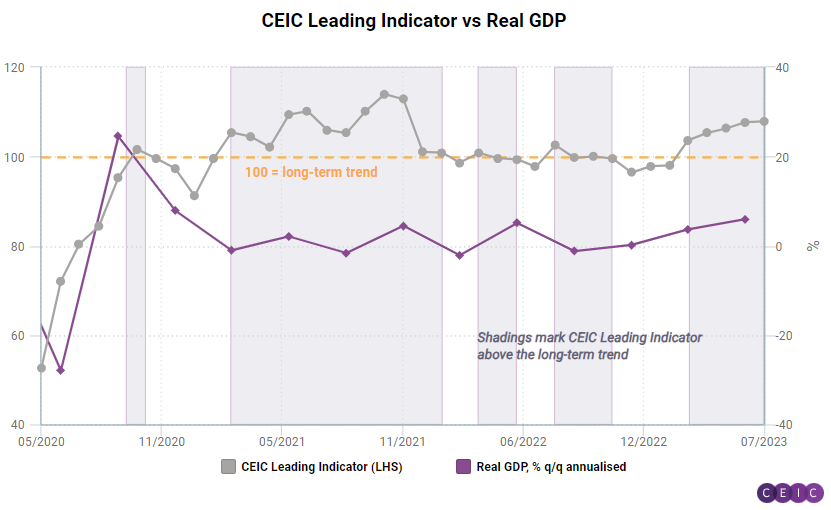

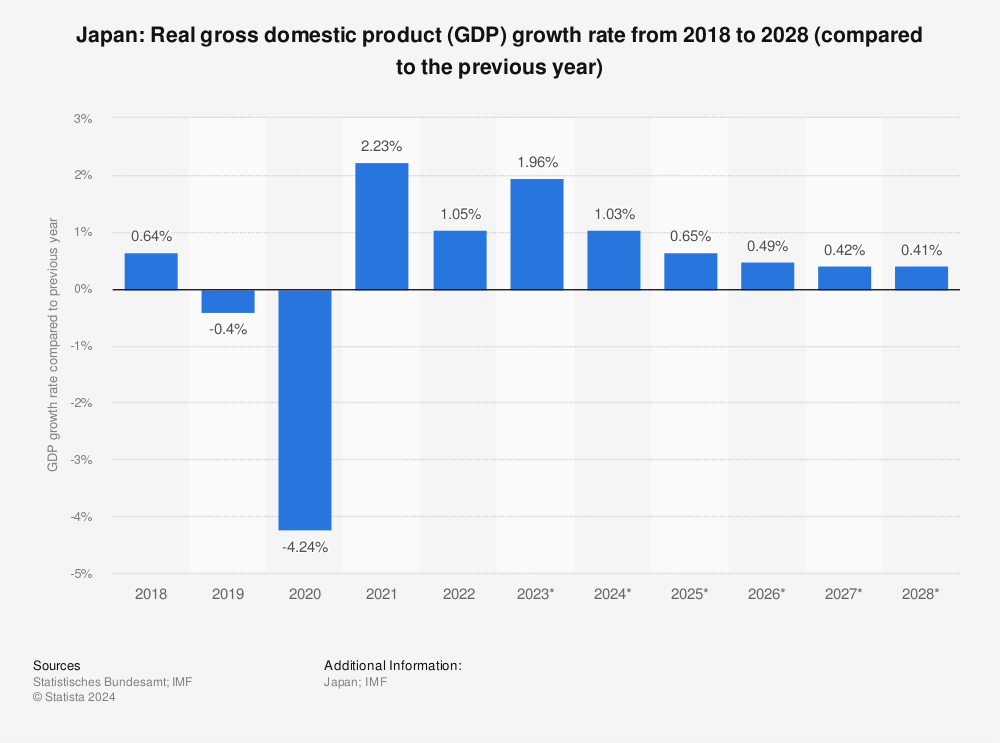

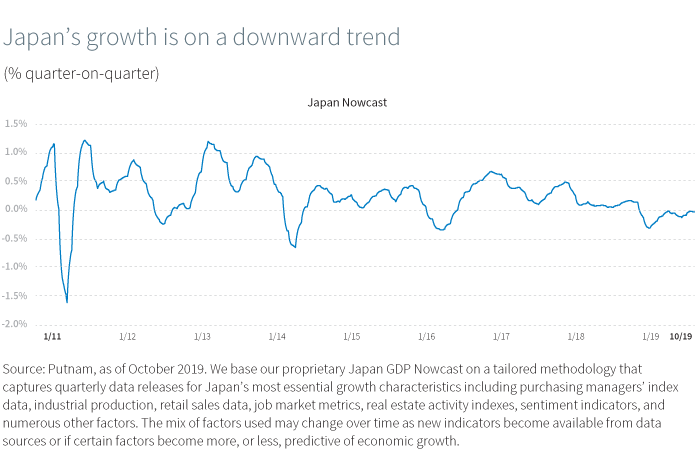

The GDP progress chart of the twenty first century reveals a sample of fluctuating progress, with intervals of modest enlargement interspersed with intervals of stagnation. A number of components have contributed to this sample:

- Growing old inhabitants: Japan faces a quickly growing old inhabitants and declining delivery fee, resulting in a shrinking workforce and lowered home demand.

- Technological challenges: Whereas Japan stays a technological chief in sure areas, it has confronted challenges in adapting to fast technological modifications in different sectors.

- Authorities debt: Japan’s excessive stage of presidency debt poses a major fiscal constraint.

- International financial uncertainties: The worldwide financial panorama stays unsure, impacting Japan’s export-oriented economic system.

Current Traits and Future Prospects

Lately, Japan has carried out numerous financial reforms geared toward boosting progress, together with Abenomics, a sequence of insurance policies launched underneath Prime Minister Shinzo Abe. These insurance policies centered on financial easing, fiscal stimulus, and structural reforms. Whereas Abenomics achieved some success in weakening the yen and stimulating inflation, it finally did not generate sustained, strong progress.

The COVID-19 pandemic additional hampered Japan’s financial restoration, highlighting the vulnerability of its export-dependent economic system. Nonetheless, the following restoration has been comparatively robust, aided by authorities assist measures and pent-up demand.

Wanting forward, Japan faces important challenges in reaching sustainable financial progress. Addressing the growing old inhabitants, fostering innovation, and implementing additional structural reforms are essential for long-term prosperity. The success of those efforts will considerably form the long run trajectory of Japan’s GDP progress chart. The trail forward stays unsure, however a cautious examination of its historic efficiency provides priceless classes for navigating the complexities of the worldwide economic system. The "miracle" years could also be behind it, however Japan’s financial resilience and capability for innovation stay important components in its future prospects. The following chapter in Japan’s financial story is but to be written, however its previous offers a wealthy and sophisticated narrative to tell the long run.

Closure

Thus, we hope this text has supplied priceless insights into The Rollercoaster Trip: Charting Japan’s Historic GDP Progress. We hope you discover this text informative and useful. See you in our subsequent article!