The Final Information To Chart Patterns (PDF): Mastering Technical Evaluation For Knowledgeable Buying and selling

By admin / August 4, 2024 / No Comments / 2025

The Final Information to Chart Patterns (PDF): Mastering Technical Evaluation for Knowledgeable Buying and selling

Associated Articles: The Final Information to Chart Patterns (PDF): Mastering Technical Evaluation for Knowledgeable Buying and selling

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to The Final Information to Chart Patterns (PDF): Mastering Technical Evaluation for Knowledgeable Buying and selling. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

The Final Information to Chart Patterns (PDF): Mastering Technical Evaluation for Knowledgeable Buying and selling

Technical evaluation, a cornerstone of profitable buying and selling, depends closely on figuring out and deciphering chart patterns. These patterns, fashioned by value actions over time, provide precious insights into potential future value route, permitting merchants to anticipate market developments and make knowledgeable choices. This complete information delves into the world of chart patterns, offering an in depth understanding of their formation, interpretation, and sensible utility. Take into account this your final useful resource, downloadable as a PDF for handy reference (hyperlink to hypothetical PDF can be positioned right here).

I. Understanding Chart Patterns: The Basis

Chart patterns emerge from the interaction of provide and demand forces inside the market. They symbolize visually identifiable formations on value charts, reflecting the collective conduct of market contributors. Understanding these patterns requires persistence, observe, and a eager eye for element. Whereas no sample ensures future value actions, recognizing them considerably improves your odds of constructing worthwhile trades.

A. Kinds of Chart Patterns: Chart patterns are broadly categorized into two most important teams:

-

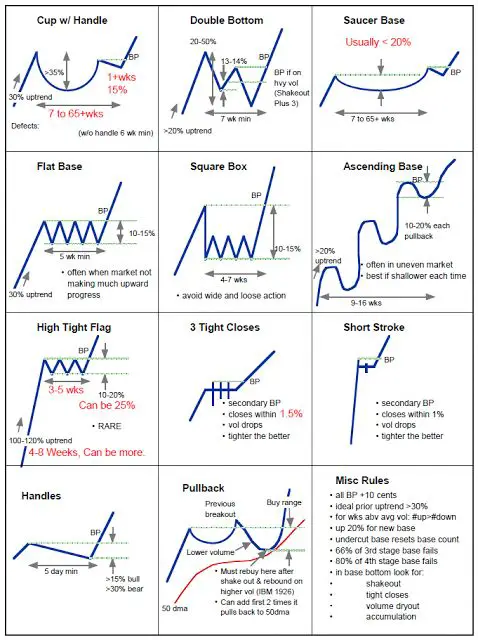

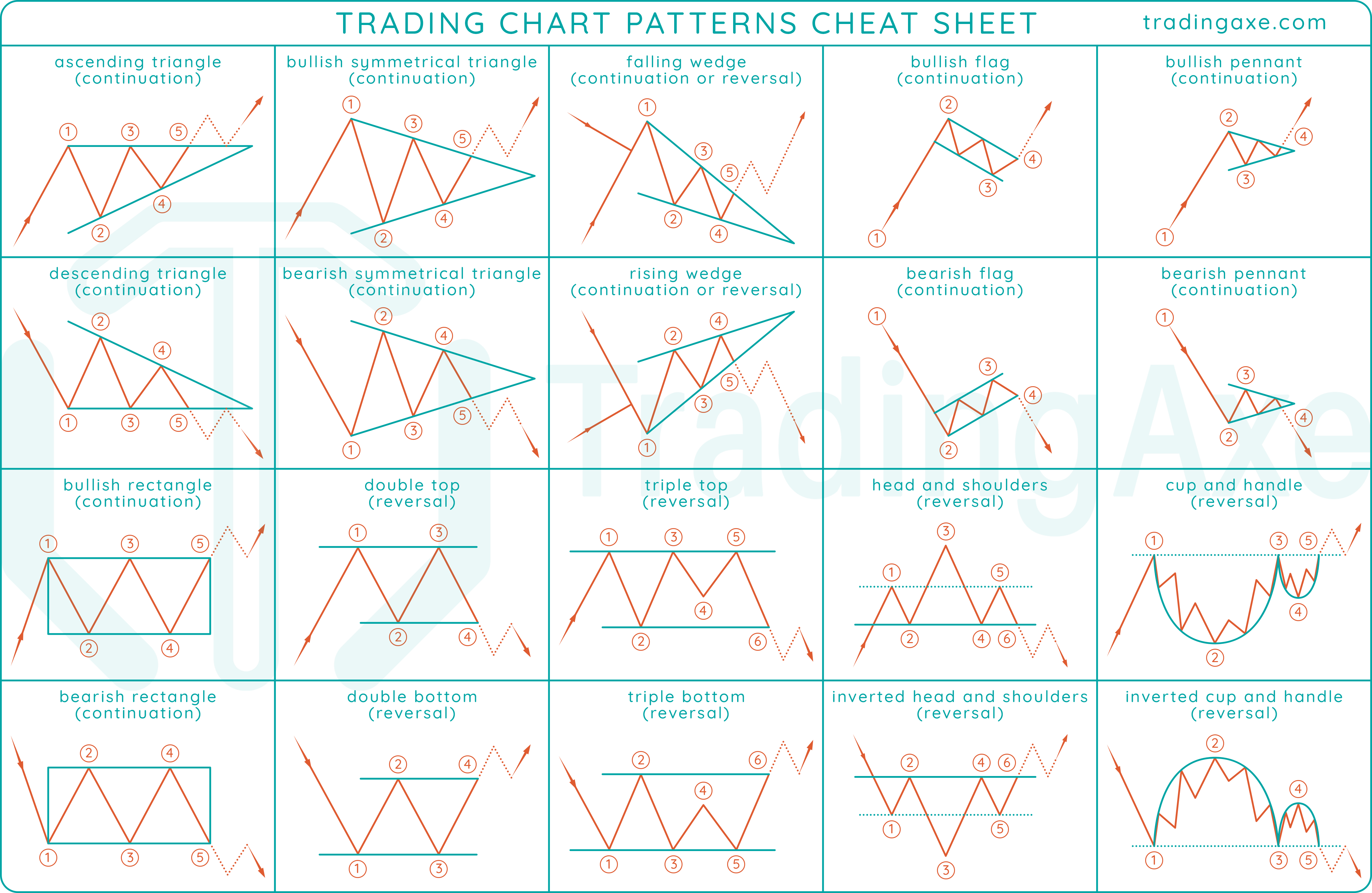

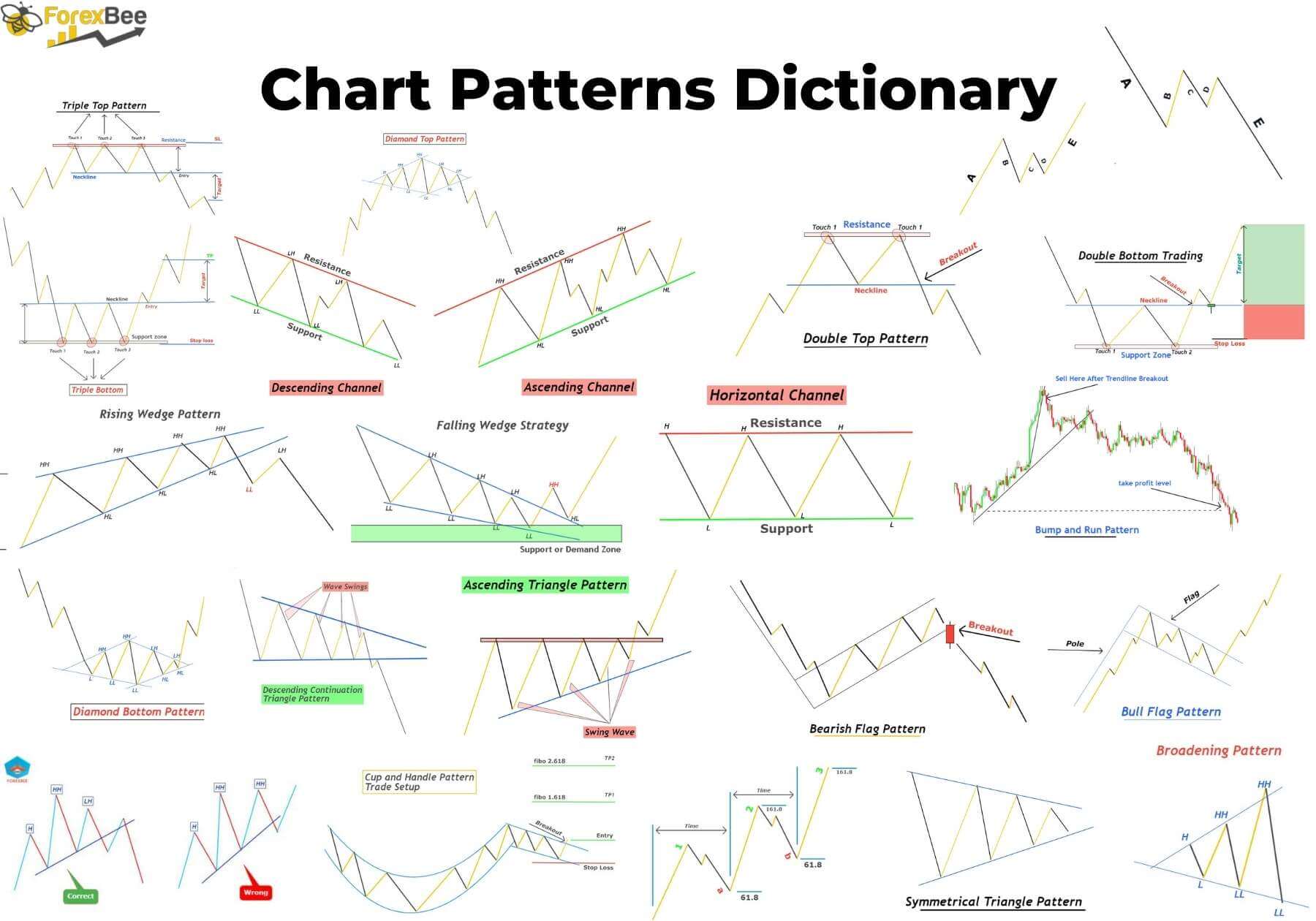

Continuation Patterns: These patterns recommend a brief pause in an current development earlier than its resumption. The development’s route stays unchanged after the sample’s completion. Examples embody:

- Triangles: Symmetrical, ascending, and descending triangles point out consolidation intervals. They sign a continuation of the previous development, with the breakout route usually mirroring the development’s preliminary route.

- Flags and Pennants: These patterns resemble small rectangles or triangles that kind throughout a powerful development. They symbolize a short-term pause earlier than the development resumes in its unique route.

- Rectangles: Horizontal consolidations indicating a interval of indecision. Breakouts above or under the rectangle’s boundaries affirm the development’s continuation.

-

Reversal Patterns: These patterns sign a possible change within the prevailing development. They recommend a shift from an uptrend to a downtrend or vice versa. Examples embody:

- Head and Shoulders: A traditional reversal sample characterised by three peaks, with the center peak (the "head") being the best. A neckline connects the troughs on both facet of the pinnacle. A break under the neckline confirms a bearish reversal.

- Inverse Head and Shoulders: The mirror picture of the pinnacle and shoulders sample, signaling a bullish reversal. A break above the neckline confirms the upward development.

- Double Tops and Double Bottoms: These patterns present two comparable value peaks (double high) or troughs (double backside), indicating potential development reversals. A break under the double high or above the double backside confirms the reversal.

- Triple Tops and Triple Bottoms: Much like double tops and bottoms, however with three peaks or troughs, suggesting stronger reversal indicators.

B. Key Parts of Chart Sample Evaluation:

- Assist and Resistance Ranges: These are essential for figuring out potential breakout factors. Assist is a value degree the place shopping for stress outweighs promoting stress, stopping additional value declines. Resistance is the alternative, the place promoting stress dominates, hindering additional value will increase.

- Quantity: Analyzing quantity alongside value actions is important. Excessive quantity throughout a breakout confirms the sample’s validity, whereas low quantity suggests weak conviction and potential false breakouts.

- Affirmation: All the time search affirmation from different technical indicators or elementary evaluation earlier than getting into a commerce primarily based on a chart sample. This reduces the danger of false indicators.

- Timeframe: Chart patterns can seem on varied timeframes (each day, weekly, month-to-month). The timeframe chosen influences the sample’s significance and potential period.

II. Detailed Evaluation of Particular Chart Patterns

Let’s delve deeper into a number of the most prevalent chart patterns:

A. Triangles:

- Symmetrical Triangle: A consolidation sample the place each assist and resistance converge. Breakouts above or under the converging traces sign the development’s continuation.

- Ascending Triangle: Resistance stays horizontal, whereas assist progressively rises. This sample is bullish, indicating a possible upward breakout.

- Descending Triangle: Assist stays horizontal, whereas resistance progressively falls. This sample is bearish, suggesting a possible downward breakout.

B. Flags and Pennants:

- Flags: These patterns resemble rectangular or barely slanted formations throughout a powerful development. They symbolize a brief pause, adopted by a resumption of the unique development.

- Pennants: Much like flags however with converging trendlines, forming a triangle form. In addition they point out a short-term pause earlier than the development’s continuation.

C. Head and Shoulders:

- Head and Shoulders: A bearish reversal sample. The left shoulder, head, and proper shoulder symbolize successively decrease highs, adopted by a break under the neckline, confirming the bearish reversal.

- Inverse Head and Shoulders: A bullish reversal sample, the mirror picture of the pinnacle and shoulders sample. Greater lows kind the shoulders and head, with a breakout above the neckline confirming a bullish reversal.

D. Double and Triple Tops/Bottoms:

- Double Tops/Bottoms: Two comparable value peaks or troughs point out a possible development reversal. A break under a double high or above a double backside confirms the reversal.

- Triple Tops/Bottoms: Much like double tops/bottoms, however with three peaks or troughs, signifying a stronger reversal sign.

III. Sensible Utility and Threat Administration

Figuring out chart patterns is barely half the battle. Profitable buying and selling requires a strong danger administration technique and disciplined execution.

A. Figuring out Entry and Exit Factors:

- Breakout Technique: Enter lengthy positions after a bullish breakout above resistance in continuation or reversal patterns. Enter brief positions after a bearish breakout under assist.

- Cease-Loss Orders: All the time place stop-loss orders to restrict potential losses. These orders routinely promote your place if the value falls under a predetermined degree.

- Take-Revenue Orders: Set take-profit orders to safe income as soon as your goal value is reached. This helps lock in features and stop revenue erosion.

B. Threat Administration Strategies:

- Place Sizing: By no means danger greater than a small share of your buying and selling capital on any single commerce.

- Diversification: Unfold your investments throughout completely different belongings and buying and selling methods to scale back total danger.

- Backtesting: Take a look at your buying and selling methods on historic information earlier than implementing them with actual cash.

C. Combining Chart Patterns with Different Indicators:

Chart patterns are only when mixed with different technical indicators, comparable to transferring averages, RSI, MACD, and Bollinger Bands. This gives a extra complete view of the market and reduces the danger of false indicators.

IV. Conclusion:

Mastering chart patterns is a journey that requires dedication, observe, and steady studying. Whereas no sample ensures success, understanding and making use of these methods considerably enhances your potential to anticipate market actions and make knowledgeable buying and selling choices. Bear in mind to all the time prioritize danger administration and mix chart sample evaluation with different technical and elementary indicators for a holistic strategy to buying and selling. This information gives a stable basis; additional analysis and sensible expertise will refine your abilities and result in extra constant success within the dynamic world of economic markets. (Once more, hypothetical hyperlink to PDF can be right here).

Closure

Thus, we hope this text has offered precious insights into The Final Information to Chart Patterns (PDF): Mastering Technical Evaluation for Knowledgeable Buying and selling. We thanks for taking the time to learn this text. See you in our subsequent article!