High 20 Chart Patterns: A Complete Information For Merchants

By admin / October 5, 2024 / No Comments / 2025

High 20 Chart Patterns: A Complete Information for Merchants

Associated Articles: High 20 Chart Patterns: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to High 20 Chart Patterns: A Complete Information for Merchants. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

High 20 Chart Patterns: A Complete Information for Merchants

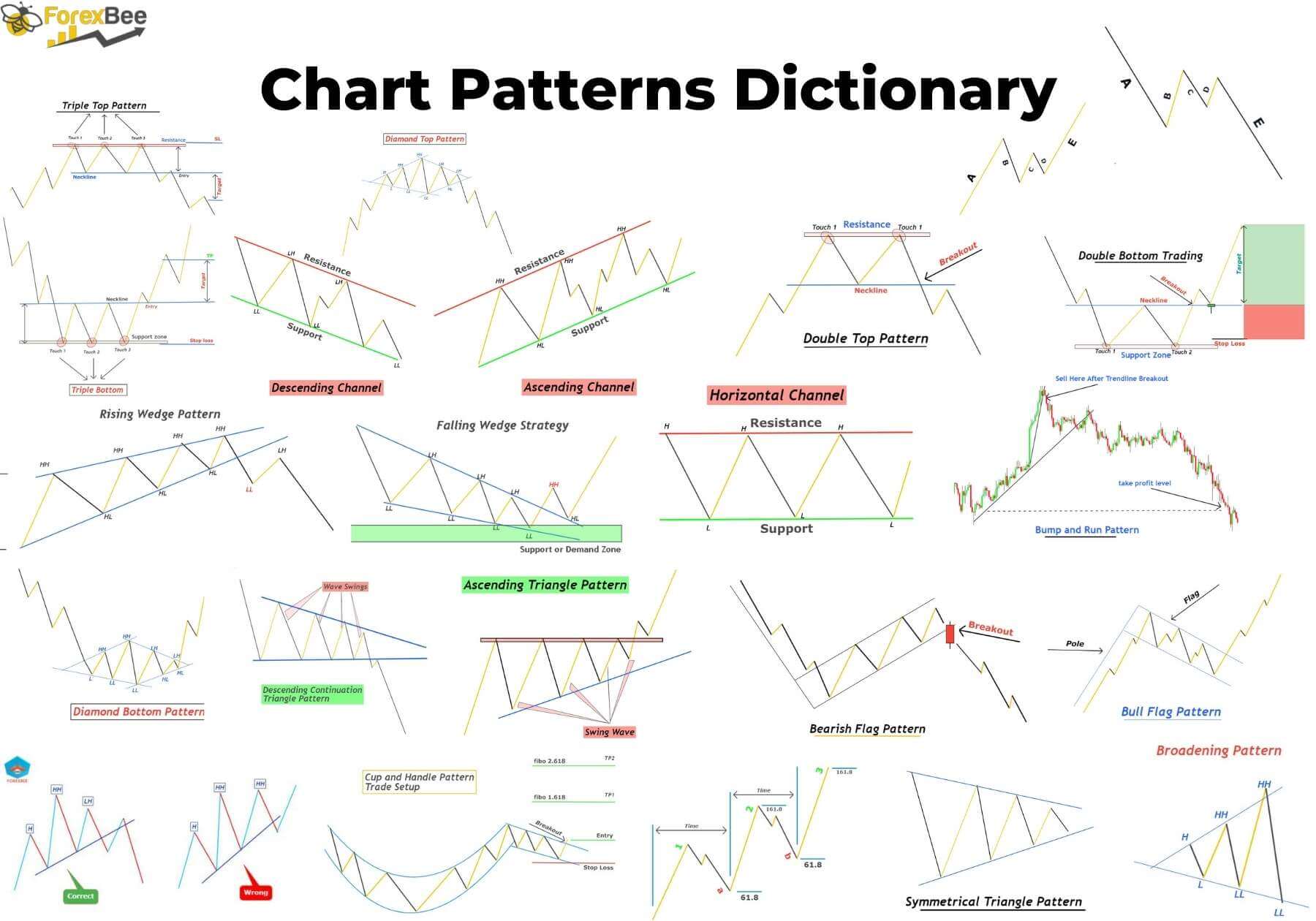

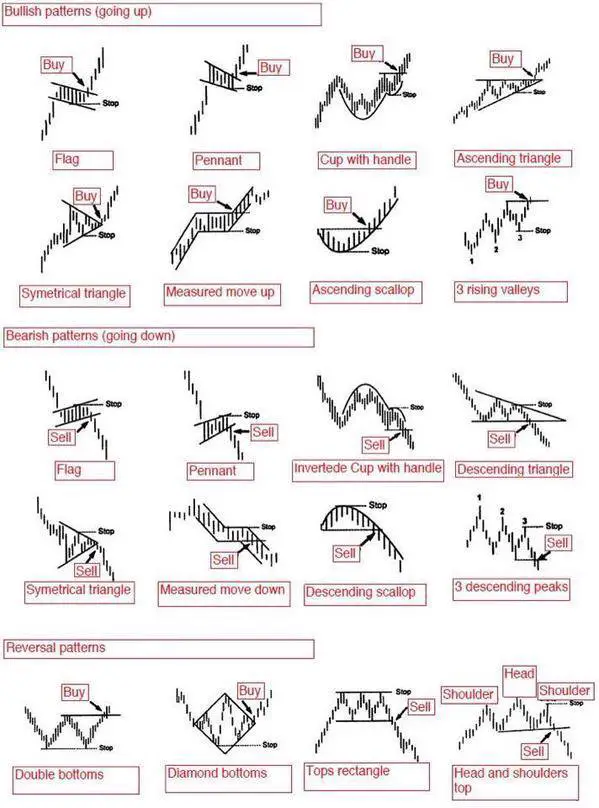

Chart patterns are visible representations of value motion that may provide insights into potential future value actions. Skilled merchants make the most of these patterns to determine potential entry and exit factors, handle danger, and improve their buying and selling methods. Whereas no sample ensures success, understanding and accurately figuring out these patterns considerably improves buying and selling chances. This text explores 20 of the most typical and dependable chart patterns, categorizing them for readability and offering a concise description of every.

I. Reversal Patterns (Suggesting a possible change in pattern course):

-

Head and Shoulders: This basic reversal sample consists of three peaks, with the center peak (the top) being the very best. A neckline connects the troughs between the peaks. A break beneath the neckline confirms the bearish reversal.

-

Inverse Head and Shoulders: The mirror picture of the Head and Shoulders sample, indicating a possible bullish reversal. A break above the neckline confirms the upward pattern.

-

Double High: Two consecutive value peaks at roughly the identical stage, adopted by a decline. A break beneath the assist stage (connecting the 2 troughs) confirms the bearish reversal.

-

Double Backside: The alternative of the Double High, exhibiting two consecutive value bottoms at roughly the identical stage, adopted by an increase. A break above the resistance stage (connecting the 2 peaks) confirms the bullish reversal.

-

Triple High/Backside: Just like Double Tops/Bottoms, however with three peaks/bottoms as a substitute of two. The affirmation is similar – a break beneath/above the respective assist/resistance stage.

-

Rounding High: A gradual curve within the value motion, forming a rounded peak. This sample signifies a weakening of the uptrend and a possible reversal to the draw back.

-

Rounding Backside: The alternative of the Rounding High, forming a gradual upward curve from a trough. This implies a strengthening of the downtrend and a possible bullish reversal.

II. Continuation Patterns (Suggesting a pause within the present pattern earlier than it resumes):

-

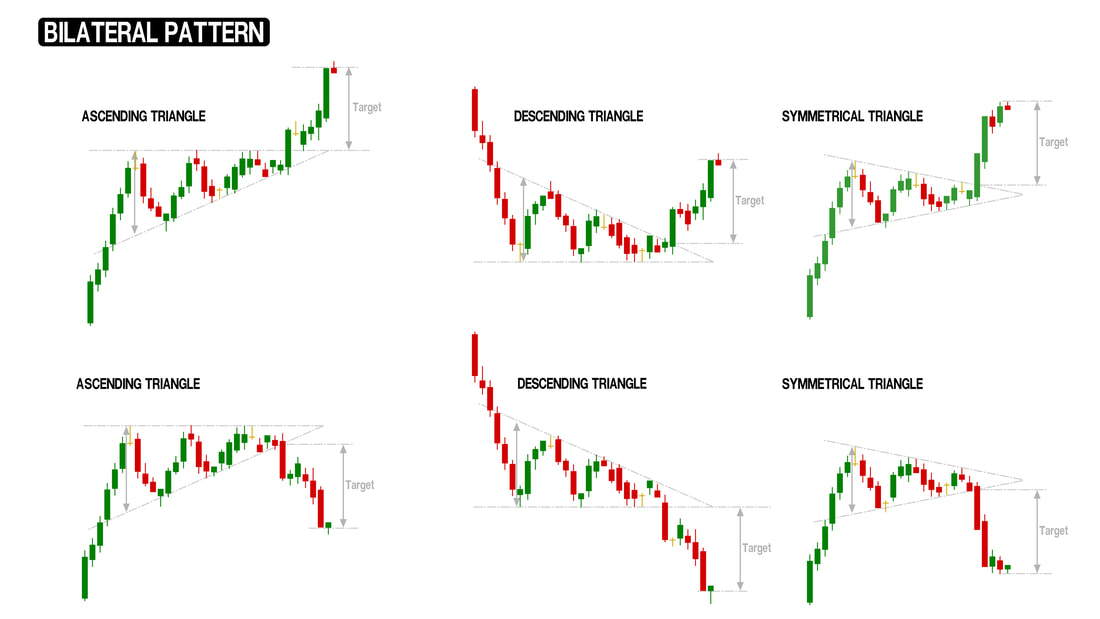

Triangles: These patterns are characterised by converging trendlines. There are a number of varieties:

- Symmetrical Triangle: Equal upward and downward slopes, suggesting a continuation of the prevailing pattern after a breakout.

- Ascending Triangle: Horizontal resistance line and an upward sloping assist line, indicating a bullish continuation.

- Descending Triangle: Horizontal assist line and a downward sloping resistance line, indicating a bearish continuation.

-

Rectangles: Worth motion oscillates between two horizontal traces (resistance and assist), suggesting a interval of consolidation earlier than a continuation of the prevailing pattern. A breakout above the resistance confirms an uptrend continuation, whereas a breakout beneath the assist confirms a downtrend continuation.

-

Flags: A brief, parallel channel inside a robust pattern, representing a short lived pause earlier than the pattern resumes. Breakouts from flags normally comply with the course of the principle pattern.

-

Pennants: Just like flags, however the sample is extra symmetrical, resembling a pennant. Breakouts affirm the principle pattern.

III. Different Necessary Chart Patterns:

-

Wedges: These patterns are characterised by converging trendlines, just like triangles, however the slopes should not essentially equal. Ascending wedges are bearish, whereas descending wedges are bullish. The interpretation relies on the general pattern.

-

Broadening Formations (Wedges): These formations are the alternative of triangles, with diverging trendlines. They point out a rise in volatility and infrequently precede a pointy transfer within the course of the breakout.

-

Diamond: A diamond sample is a mix of a broadening formation adopted by a narrowing formation. It normally alerts a pattern reversal.

-

Cup and Deal with: This bullish continuation sample resembles a cup with a small deal with. The "deal with" is a brief interval of consolidation. A breakout above the deal with’s resistance confirms the continuation of the uptrend.

-

Saucer: A saucer sample is a U-shaped reversal sample, indicating a bullish reversal on the backside of a downtrend.

IV. Candlestick Patterns (Patterns fashioned by particular person candlesticks):

-

Engulfing Sample: A bullish engulfing sample happens when a big inexperienced candle utterly engulfs the earlier pink candle, suggesting a possible bullish reversal. A bearish engulfing sample is the alternative.

-

Hammer/Inverted Hammer: The hammer is a bullish reversal candlestick sample with a small physique and an extended decrease shadow. The inverted hammer is a bearish reversal candlestick sample with a small physique and an extended higher shadow.

V. Mixture Patterns:

-

Island Reversal: This highly effective reversal sample entails a spot separating two candles, creating an "island" impact. It alerts a major shift in momentum.

-

Three-Line Strike: This sample consists of three consecutive candles with progressively decrease highs and decrease lows, indicating a bearish reversal. The same sample with increased highs and better lows signifies a bullish reversal.

Conclusion:

Chart patterns present helpful insights into market sentiment and potential value actions. Nonetheless, it is essential to keep in mind that they don’t seem to be foolproof predictors. Profitable implementation requires a mix of sample recognition, technical evaluation, elementary evaluation, danger administration, and affirmation from different indicators. At all times use stop-loss orders to guard your capital and contemplate the broader market context earlier than making buying and selling choices based mostly solely on chart patterns. Moreover, follow and expertise are key to mastering the artwork of chart sample recognition and using them successfully in your buying and selling technique. Take into account backtesting your methods utilizing historic knowledge to refine your method and enhance your win fee. Steady studying and adaptation are important for achievement within the dynamic world of buying and selling.

Closure

Thus, we hope this text has offered helpful insights into High 20 Chart Patterns: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!